Nigerian fintech startup, Zilla is discontinuing its buy-now-pay-later (BNPL) service to focus on Zillawire, its newly launched cross-border payment.

As of Monday evening, when we visited RovingHeights' website, the option to buy through Zilla was no longer available. Until its closure, the startup provided shoppers in Nigeria with interest-free credit for purchasing gadgets and other household items. Users could begin with a 25% initial deposit and a repayment period of eight weeks.

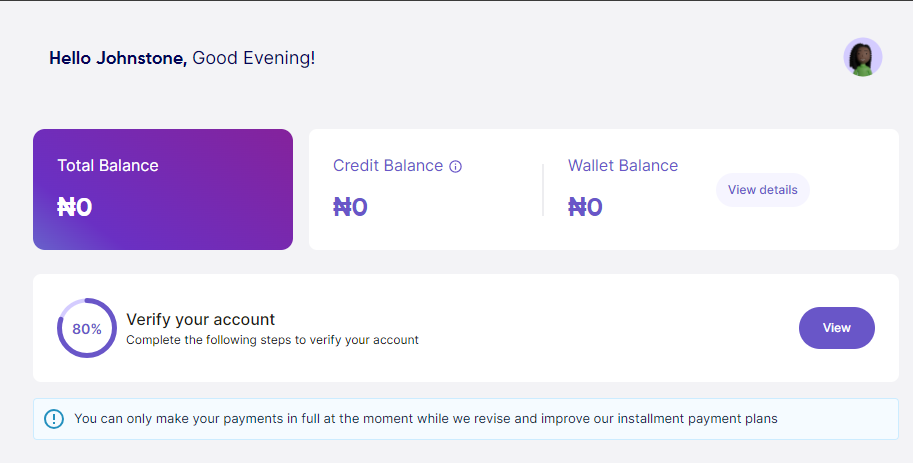

As of now, Zilla users are limited to making full payments for their purchases, as the startup plans to "revise and improve [...] instalment payment plans," as mentioned in a note on its website.

An employee at Zilla who spoke with TechCabal, where the shutdown was first reported said: "One of our biggest challenges has been that a lot of people don’t understand how credit works and think it is about owing people. Most customers would rather wait until they have the complete amount of money to pay than get one now and pay in instalments."

Zillawire, introduced in August last year, outperformed the buy-now-pay-later (BNPL) service, according to the report. The startup has about 30,000 shoppers.