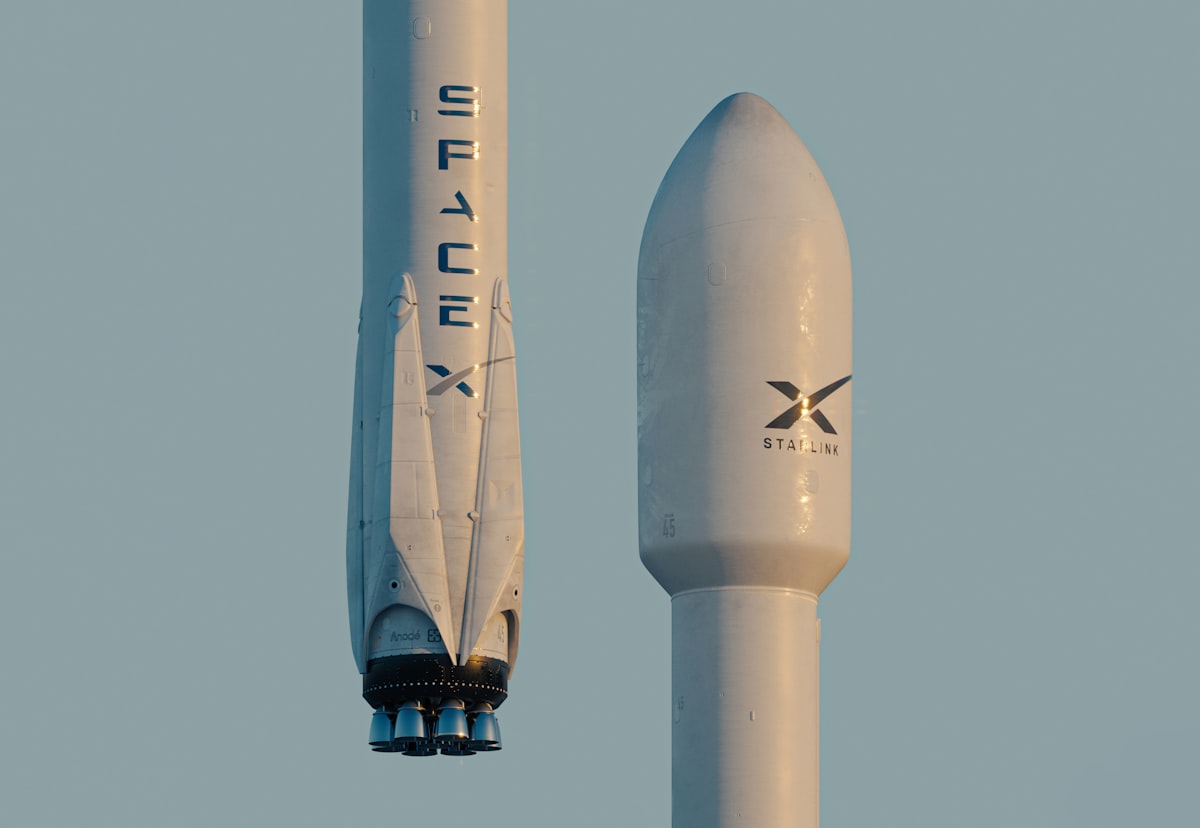

Taking the bait, Starlink gears to launch in South Africa

South Africa's telecoms regulator has discreetly granted "type approval" certificates to three local companies authorised by Starlink.

A week ago, the Independent Communications Authority of South Africa (Icasa), the country’s telecoms regulator, issued a notice in the Government Gazette about the operations of SpaceX’s Starlink service in the jurisdiction, describing them as illegal.

The broadband platform has had the toughest time in South Africa, having not formally applied for a license to align the unique demands from Icasa and [with] its actions elsewhere in Africa.

However, the market’s demand for high-speed, low-latency internet has been strong enough to keep the train moving. Having recorded more sales in SA than in any other market in the continent, Starlink seems to be finally moving in the right direction regulation-wise.

Icasa’s crackdown is but one part of its move to ensure Starlink complies with local ISP regulations. In less visible moves, the regulator has, on the other hand, been reportedly issuing type approval certificates to third-party sellers.

Since the service does not yet have an official presence, South African customers have been purchasing the kits via regional ISPs like IT Lec and StarSat Africa; they import from other countries where the service is legal.

Three local ecosystem players have now received Icasa’s approval: Paratus Telecommunications, Magic Space Dust, and Data X Lab, all of whom officials suggest are authorized to sell the service in the market.

Paratus is one of Starlink’s distribution partners in Africa; it has resold kits in Mozambique, Kenya, Rwanda, and Nigeria. Also, Paratus joined efforts with Space Dust to build the platform’s station gateways. Meanwhile, Data X Lab handles router applications for the SpaceX spinoff.

“So, now we have a link to say that Starlink is interested in South Africa, to the extent that they have bothered to get their core equipment type approved. They wouldn’t do that if they didn’t intend to enter the South African market,” Dominic Cull, regulatory advisor to the Internet Service Providers’ Association (Ispa) told TechCentral.

Recall that shortly after Icasa increased pressure on Starlink, its closest competitor in the satellite internet bubble, Eutelsat-owned OneWeb, announced that it would be hastening its launch in the market.

The handset-to-satellite comms technology is also in direct competition with efforts of local MNOs Vodacom and MTN, both of which are currently exploring the same while bearing the brunt of the country’s load shedding situation.

Starlink’s South African launch has been over-delayed. Pre-orders commenced at the start of 2021. At the time, it aimed to launch by 2022, but before the end of 2021, the launch was postponed to 2023 and changed indefinitely around December 2022.

As Africa’s largest IT market, South Africa was originally on the priority list for Starlink’s rollout.

However, due to these regulatory hurdles—part of which mandates the company to relinquish 30 percent of its equity to local historically disadvantaged groups—the market was deprioritised.

Currently, the service is legally available in seven other African countries and plans to replicate the efforts in 25 more by the end of 2024.