Standard Chartered Nigeria launches a digital bank. Now what?

What does the launch of digital banks by legacy financial institutions mean for fintechs such as Kuda and Rubies Bank.

Standard Chartered Bank Nigeria—a subsidiary of London-headquartered Standard Chartered Bank Plc.—has announced the launch of its digital bank with zero charges.

The launch of the digital bank is in line with the multi-market digital strategy of Standard Chartered Bank in Africa. The digital strategy, which was commissioned last year, has enabled Standard Chartered to launch its digital bank in Uganda, Tanzania, Ghana, Kenya, Côte d’Ivoire, Botswana, Zambia and Zimbabwe.

With the digital banking service, new and current customers of Standard Chartered Bank Nigeria will enjoy zero charges on all interbank transfers, alert messages, ATM withdrawals, and free debit card delivery nationwide.

> [Digital banks: ALAT, Kuda, Rubies, Eyowo, V by VFD, and Sparkle compared. Which of them is the best?](https://www.benjamindada.com/best-digital-bank-alat-kuda-eyowo-vfd-sparkle//)This means Standard Chartered Bank customers in Nigeria will no longer have to worry about being charged ₦65 when they withdraw from non-Standard Chartered Bank automated teller machines (ATMs) and the ₦52 charged for interbank transfers. While this is good news for consumers, it smells like trouble for bankers and fintechs, whose major value proposition is free interbank transfers.

**Related:** [An explainer on CBN's ₦5 billion Financial Services Licence fee and more](https://www.benjamindada.com/5-billion-psb-psp-mfb/)Additionally, the updated mobile app of Standard Chartered Bank Nigeria, which is dubbed "SC Mobile 2.0" now allows customers to easily access their savings, current, fixed deposits, joint accounts and wealth management product, as well as generate a soft token for all transactions and perform funds transfer without adding beneficiaries.

Speaking to newsmen after the launch event, the Head of Retail Banking, David Idoru, said: "Our digital bank was developed with our clients in mind. We have incorporated innovative technology to allow them to execute all banking activities from a mobile device."

In just the amount of time it takes to make a cup of coffee, you can open a new account through the app and access up to 70 banking services. This is something we are very proud of and we look forward to continuously providing the best-in-class financial services to our clients."

According to the CEO of Standard Chartered Bank Nigeria, Lamin Manjang, the launch of the digital bank is a milestone in the Bank's digital trajectory, ThisDay reported.

We are pleased to launch our digital bank in Africa with the support of the Central Bank of Nigeria (CBN). This is a key milestone on our digital journey as a Bank and underlines our commitment to investing and growing in the market.

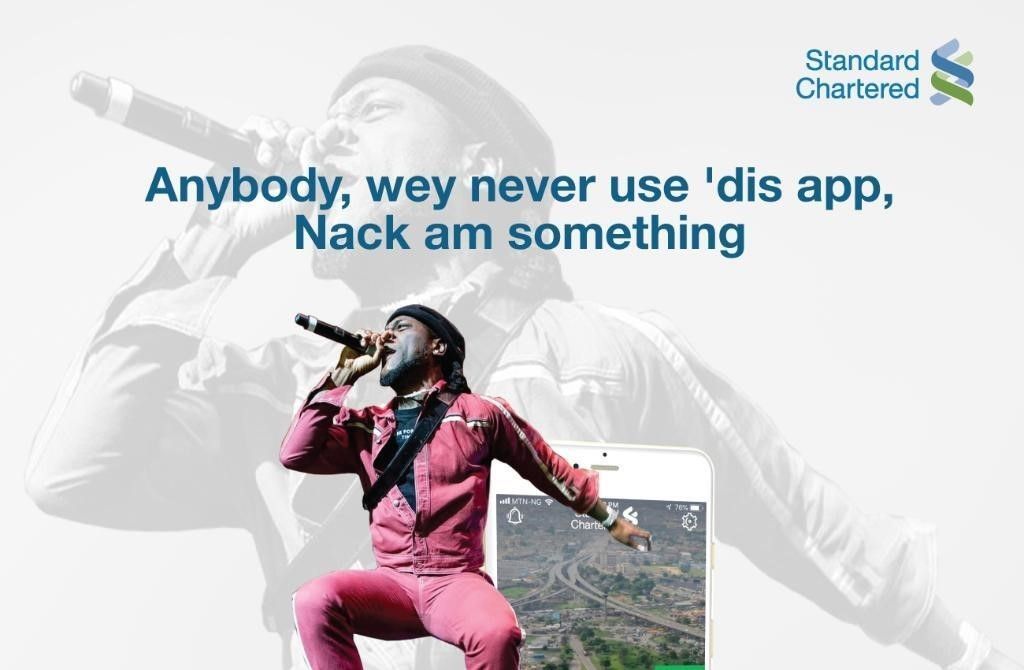

To promote its digital-only bank, Standard Chartered Bank has signed on the African Giant crooner, Damini Ogulu (AKA Burna Boy), as its digital bank ambassador.

Standard Chartered Bank Nigeria is not the first Nigerian bank to launch a digital-only bank. Wema Bank did it first with ALAT. Neither is it the first with zero bank charges; GTBank removed bank charges on its GTCRea8 Account product in October.

Since the launch of ALAT by Wema in May 2017, a plethora of fintechs have launched digital-only banks, such as Kuda and Rubies Bank. But the inefficiencies commercial banks are known for shine through their digital banking service. Hence, Kuda Bank and Rubies, continue to warm their way into people's heart with good customer service.

Guys pls, if u know anyone that uses @alat_ng or want to open, abeg I take my dead papa name beg una, take all ur savings away nd don't ever make any mistake of opening one, they are s fraud of a Bank cc @Gidi_Traffic @Naija_PR

— Shanu Oluwasegun (@ShanuOluwasegun) December 10, 2019

@segunoloketuyi @alat_ng it is now 72 hours without resolution. Just return my money. #EpicFail https://t.co/SPA7zi95qd

— Rahman Oloritun (@rahman_dexter) December 8, 2019

According to Daniel Adeyemi, a Financial Analyst and Operations Officer at Owo Consults, the digital offering of commercial banks could cost fintechs their customers. Daniel says: "I'd imagine that there is enough users to go round for both banks and fintechs, which will allow them to co-exist. But the margins are small for digital banks; so it's a low margin, large volume game".

Another possible outcome is for these banks to acquire the fintech (or their products).

Feranmi Ajetomobi, Head of Marketing and Communications at Cowrywise, believes Kuda and Rubies Bank stand a chance against the digital offering of commercial banks. He said, "Both of them will compete because before commercial banks get their digital offering right, fintechs would have built moats around themselves".

FREE debit and credit alerts

— Ìfẹ́olúwa Sópéjú (@ifeoluwasopeju) December 3, 2019

ZERO account or card maintenance fee

I also received another email today saying I can now enjoy 25 FREE monthly bank transfers, invariably saving me N1,312.5 every month.

The account opening process was seamless and the user experience smooth.

On how the launch of digital-only banks would affect bankers, it is pertinent to note the recent happening in South Africa's banking sector. In the first half of 2019, Standard Bank Group closed 91 branches as a result of increased uptake of its digital offerings and less use of its outlets. The decision cost 1,200 employees their jobs and culminated in the botched strike action of SASBO—South Africa's finance union—in September.

As more Africans go online, banks are incentivized to ramp up their digital offerings. For instance, the mobile app of the top banks in Nigeria, known as FUGAZ (FirstBank, UBA, GTB, Access and Zenith Bank), have more than one million downloads in Google's Play Store. Bankers should prepare to work with robots in the near future, rather than revolt against it.

According to Olaoluwa Daramola, Associate and Robotics Process Automation Developer at EY, Nigerian banks already use robots: software robots and programmable software robots. Olaoluwa said: "But for humanoids that can replace human tellers, I don't think that would become a thing [anytime soon] because labour is cheap and people will still need that human touch at [bank] branches".