Inside South Africa's Rapid Payments Programme for merchants and consumers

Rapid Payments Programme will create a simpler, safer, and cheaper instant payment environment for South African residents.

The South African Reserve Bank (SARB) is introducing Rapid Payments Programme (RPP) to create a simpler, safer, and cheaper instant payment environment for South African residents.

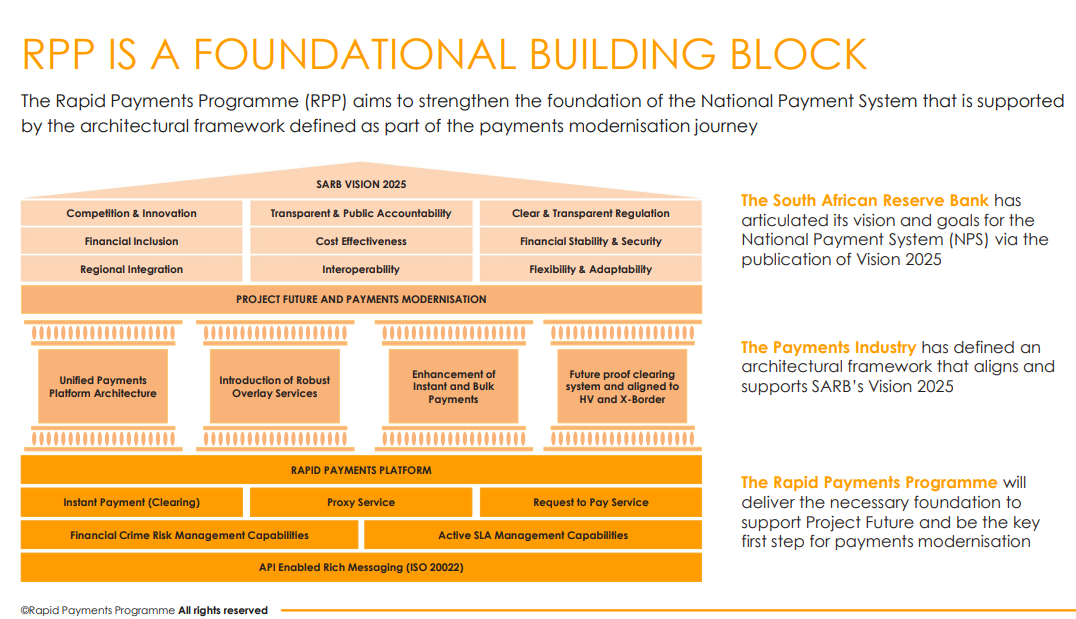

The programme is currently in its implementation stage and will be launched into pilot later this year. It forms part of the SARB’s 'vision 2025' plan as an industry-led payments modernisation initiative. "The highly anticipated modernisation of the country’s inter-banking payment system will not only boost financial inclusion but make it much easier, and cheaper, for consumers to pay both merchants and fellow consumers whilst boosting e-commerce sales," Andrew Springate, CEO of tech and financial gateway service provider PAYM8 said.

What is the Rapid Payments Programme?

In simple terms, Rapid Payments Programme [pdf] will enable the ability to make real-time payments using simple identifiers, like mobile numbers or e-mail addresses to make transacting almost instantaneous. Customers will soon not need a bank account number or a branch code to transfer money. In South Africa, current estimates suggest that 53% of all point of sale purchases are still made in cash, while in the informal economy a staggering 89% of transactions are cash-based.

Springate said that "not only is RPP good news for underbanked consumers who still rely on cash as their primary payment method, but it also modernises the industry by creating new and exciting opportunities for merchants, SMEs, and e-commerce players alike. Similar systems have been piloted and launched elsewhere across the globe with massive success. The benefits are numerous and include stimulating economies by replacing cash usage, and improving overall security all whilst providing a service as quick as cash."

How will RPP enable digital payments in South Africa?

"RPP has great potential for transforming digital payments in South Africa. In particular, by making use of modernised payment rails and message protocols it could create an environment where low-value, high-volume transactions can become faster and more cost-effective. This can both increase financial inclusion in the country and also increase the ability for fintechs to offer innovative products and services to a wider consumer base that was previously cash-based only," Neha Kumar, Head of Product Partnerships at Stitch told Benjamindada.com.

The total transaction value in South Africa's digital payments segment is projected to reach $14.34 billion in 2022. RPP provides a low-cost digital payment system for consumers. It has the potential to free South Africans from high transaction fees, waiting in long bank queues at month-end, and waiting days to receive payments. RPP will also make paying debt easier with opportunities for instant instalment payments and payment arrangements via a mobile phone number. The more options consumers have at their disposal, the healthier the entire payments ecosystem becomes for all players.

The aforementioned will bridge the major gaps among South Africa’s diverse population, including the rural and urban divide. Ensuring unbanked or underbanked consumers are financially included will increase competition amongst financial services providers which is critical for consumers who will for the first time enjoy affordable access to convenient payment mechanisms.

"There is also an opportunity for the regulatory bodies to bring fintechs closer to the payment rails with RPP - that would be truly transformative and enable South African fintechs and consumers to be a world leader," Kumar added.