Fewer than 5% of seeded African startups make it to Series A

105 companies raised seed funding in 2022. Only 5 have successfully raised their next rounds

In the last couple of years, African tech has seen much luck raising funds. Despite this unlikely, initial success, the journey from seed to Series A round classes is a daunting task for many startups.

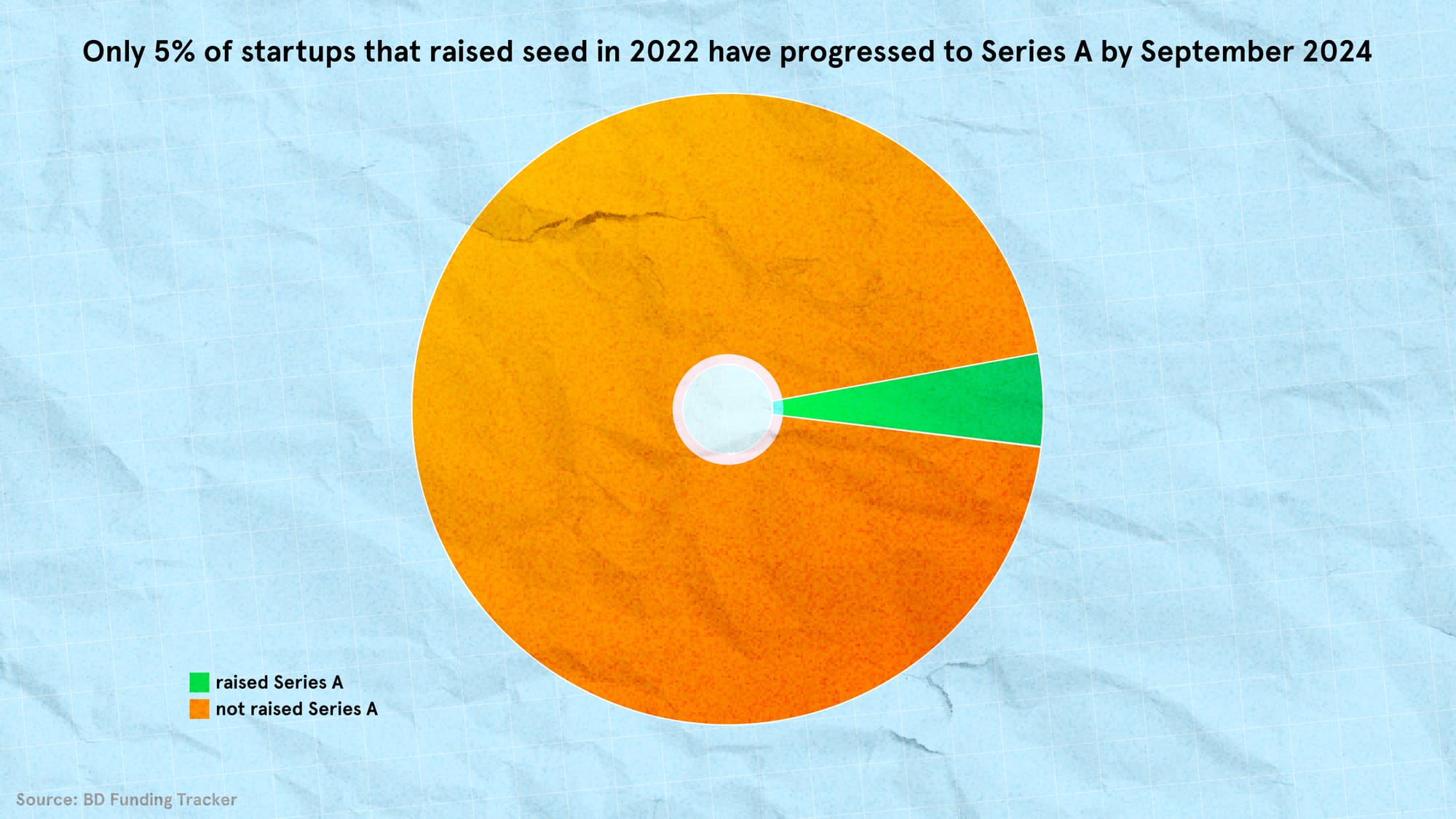

Data pulled from our funding tracker shows less than 5% of startups seeded in the last two years have managed to progress to Series A rounds. This reflects difficulty, with many startups either stalling or unlucky securing further investment.

For context, out of 105 startups that raised seed in 2022, only 5 have successfully secured Series A since then, a 4.76% turnout rate. The path from the former class to the latter typically spans 12 to 36 months, and 95.24% have not yet completed the lap.

A tough uphill course

This figure underscores the struggle to get enough numbers to advance. For those startups that fail to move, outcomes are often grim. They could run out of capital and shut down or go on a hiatus, and sometimes straightforwardly resort to dissolution.

“It isn't surprising to those who have been in the ecosystem for the last couple of years," says Uwem, Head of Investments at Launch Africa Ventures. “It's a tough landscape, and I've seen countless promising startups fizzle out, sometimes to no fault from founders”.

“We're still building the plane while flying it. Our startup ecosystems across the continent are still in the infant stages, and we are learning expensive lessons in real-time,” he tells Bendada.com.

Conversely, those failing to win over investors may go for a “fire sale”. In such cases, the acquisition is struck at a distress-level valuation. This marked-down outcome is far from the ideal exit virtually all founders envision, where sales are made at premium valuation bringing hefty returns.

Uwem believes “lack of clear exit strategies is also a hindrance.” Most African markets lack clear exit paths due to poor capital markets. Without the promise of IPOs—which will remain very few and far between—or big acquisitions, he says “many Series A investors see too much risk."

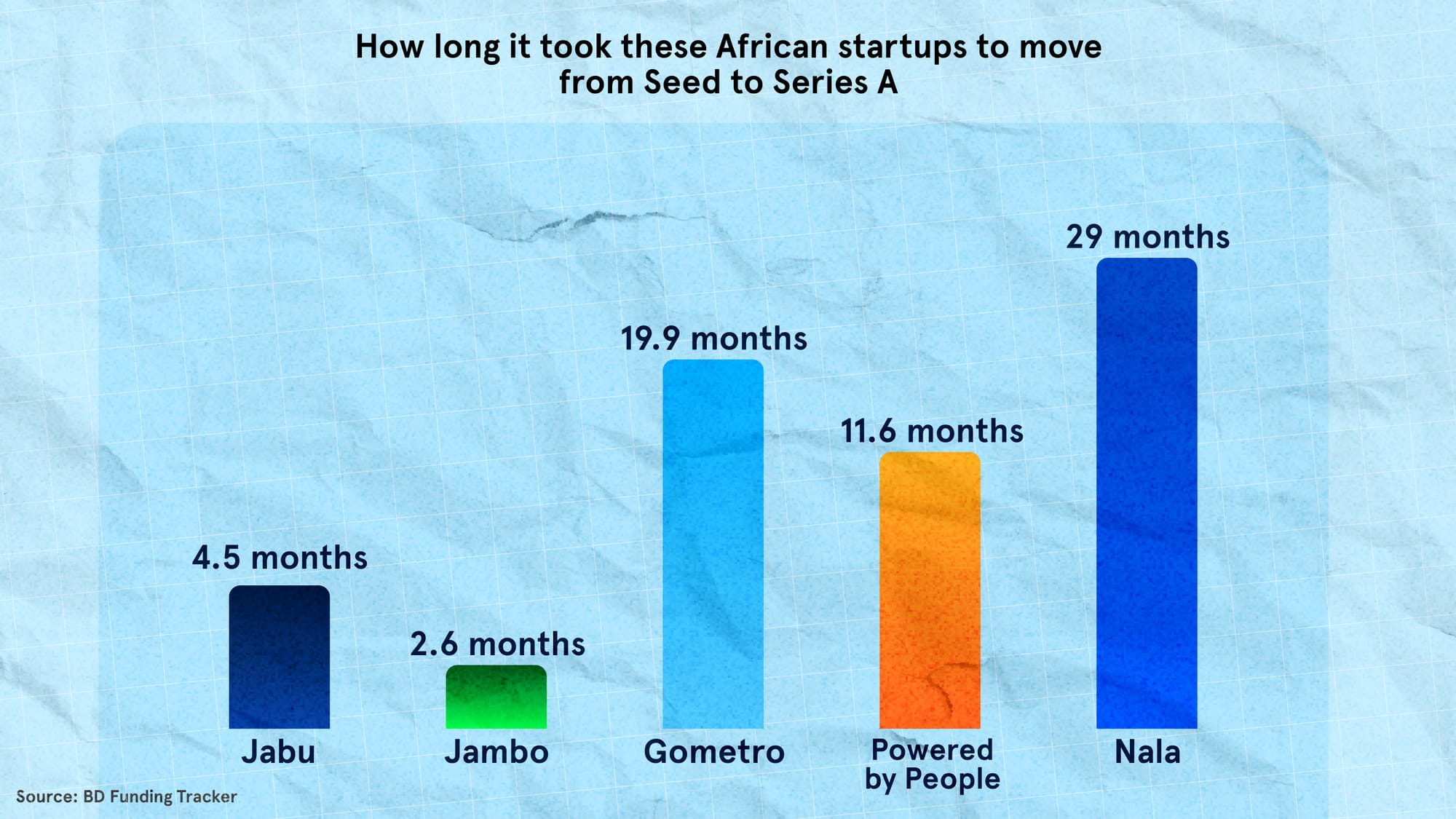

Jabu, Jambo, Powered by People, Nala, and GoMetro are part of the few startups that have moved on to raise a Series A round. They are generally in high-demand sectors like fintech, eCommerce, and logistics, where investors can find robust op metrics, proven business models, and clear market fits.

The climate, influenced by global economic pressures, has made transitioning more challenging. To reach VCs whose pursestrings have been often fastened of late, ventures would have to prove traction and scalability.

Survival of the fittest

As history has it, startups unable to pull in bets fail or remain in limbo, with an estimated 90% assumed likely to fail. But those raising regardless of the headwinds in the process prove value. Ultimately, attracting Series A sets them toward scaling and long-term sustainability.

In 2023, GoMetro and Powered by People were the only exceptions that raised Series A, a success rate of 1.90% for the year’s batch of startups seeded the previous year (2022). This 2024, it's just Egypt’s OneOrder and Tanzania’s Nala that have raised their next rounds, a less than 1% pull through.

A standout case is Jabu, a YC-backed Namibian B2B eCommerce retail startup, which, after getting seeded in January 2022 at $3.2 million, raised a Tiger Global-led Series A at $15 million in May the same year.

But that pales compared to the 3-month timeline (between February and May 2022) scored by Congo-based Web3 “super app for Africa” startup Jambo.

For this year, numbers are yet emerging. The most notable Series As in the ecosystem so far are Nala’s $40 million and OneOrder’s $16 million. Combined, they have 31.17% of the total. Interestingly, these two exceptions raised the largest single rounds in 2024.

Some—like Telda, NowNow, and Spleet—are yet to progress to Series A despite interesting business models, high-demand sectors, and substantial seed funding.

Zachariah George, Managing Partner at Launch Africa Ventures, which operates one of Africa’s most active pre-seed, seed, and Series A venture capital funds, points to startups having to spend a bomb raising capital due to the current weather.

Not forgetting that a startup typically hires a law firm to help with the offering, raising a proper series A round costs between $50,000 to $100,000, he says. Lots of startups don't have the resources, or more simply the money to pull through.

“The gap can be extensive. At some point, startups go for extensions. Only when they have 4-5 million in annual revenue, can they look at a Series A. As such, the gap can be 5 years, even 7. Some like Peach Payments 10 years,” George tells Bendada.com.

Investment amounts also show significant variation. For context, in 2022, the average Series A round was $15 million. In 2023, it declined slightly to $14.9 million. For 2024, it is currently at a $8.7 million average.

Successful raisers show promising growth trajectories but not all startups achieve the same outcomes, some facing hurdles or exit in ways not always considered clear successes.

Series As are scarce

Scarcity is another trend to consider. Series A funding has subsided, from $437.8 million in 2022 to $179.7 million in 2023—a 59% decrease. This trend continues into 2024 when only $69.7 million has been raised, 61.2% less than the sum from 2023. These suggest more conservation likely driven by said economic pressures.

While fintech and eCommerce remain dominant, the reduction in funding has left a gap that affects all and sundry. In 2022, the average Series A funding was $87 million, increasing slightly to $89 million in 2023, before dropping to $69 million in 2024.

“Series A investors, mostly non-African funds, are interested in multiple markets. If the firm is active only in smaller countries like Ghana, Uganda, or South Africa, they won’t invest,” Zachariah George explains. “Nigeria and Egypt are exceptions due to large populations; others are considered too small, even Kenya.”

“Plus, Series A valuations have come down,” he points out. "The lowest I saw during the good years was around $35 million. Now, it goes for $15-20 million pre-money. Startups should prioritize monetization to improve their chances. Focus more on traction and revenue rather than spending too much time building”.

Uwem, on his part, advocates for a broader, continental focus, and stresses the need for state support. "We need more continental thinking from day one. The African Continental Free Trade Area (AfCFTA) could be a goldmine for the right businesses. We also need regulators to fast-track implementation,” he says.

High-profile startup shutdowns happened during the timeline, although causes vary from cash shortages to internal conflicts. Co-founder conflict forced Pivo under, fraud issues met Dash with the same fate – both cases make a 1.9% shutdown rate for startups that raised seed in 2022.

Despite initial progress, many startups face real operational and financial challenges preventing them from securing additional capital and scaling. Fintech and digital services continue to attract investors, but overall, the gap widens.