Is SafeBoda exit from Kenya a telltale sign for bike-hailing startups in Africa?

SafeBoda has paused operations in Nairobi, Kenya, effective from November 27, 2020. But is COVID-19 solely responsible for Safeboda pausing operations in Kenya as the company claims? What does SafeBoda's operational moratorium mean for bike-hailing startups in Africa?

SafeBoda has paused operations in Nairobi, Kenya, effective from November 27, 2020. The pan-African bike-hailing startup cites the aftermath of COVID-19 as the reason for leaving Kenya.

"While Nairobi is seeing some economic recovery from COVID-19, boda transportation has been hit hard. This has meant our business cannot sustainably operate in this environment and unfortunately the timeline for a full recovery is not certain", SafeBoda explained, adding that it will continue to grow in Uganda and Nigeria.

By saying it's pausing Ride and Send Services in Nairobi, Kenya, rather than shutting down, SafeBoda could make a comeback like Gokada that paused operations in Nigeria for about two weeks in August 2019.

And it could really be a goodbye to Kenya from SafeBoda. Nigerian fintech company OPay has paused its bike- and ride-hailing services ORide and OCar and logistics service OExpress across the country since July 2020. "This is largely due to the harsh business conditions which have affected many Nigerian companies, including ours, during this COVID-19 pandemic, the lockdown and government ban", OPay explained in a statement.

There is no sign of ORide, OCar and OExpress coming back. OPay's core payment and financial inclusion solutions have been booming. It processed a gross transaction value of $1.4 billion in October 2020 and plans to expand beyond Nigeria.

Tidbits

Bikes and bicycles are called boda-boda in Kenya and most of East African countries because they easily transport people and goods across borders. But bikes are called okadas in Nigeria and taxi-motos in most Francophone African countries. SafeBoda is registered as Guinness Transporters Ltd. It was co-founded by an Ugandan bike-taxi driver, Rapa Thomson Ricky, and two European economists Alastair Sussock and Maxime Dieudonne in 2015. SafeBoda has raised over $1.3 million. The amount raised in its last Series B funding round was not disclosed.

SafeBoda allowed customers to use the remaining balance in their wallet to take rides and send packages before November 27. A refund process was also put in place for unspent balance, which would reflect in customers' mobile money wallets (M-Pesa) between November 30 and December 4, 2020.

The attendant effects of the global pandemic have been the boon and bane of many businesses. For instance, e-commerce, e-learning, and over-the-top content platforms (except Quibi) have recorded unprecedented growth, while tourism and ride-hailing companies have struggled.

But is COVID-19 solely responsible for Safeboda pausing operations in Kenya as the company claims? What does SafeBoda's operational moratorium mean for bike-hailing startups in Africa?

Why SafeBoda left Kenya

In addition to COVID-19, fierce competition could also be what compelled SafeBoda to make the hard decision of discontinuing operations in Nairobi, Kenya. While it had a four-year head start in Kampala, Uganda where it first launched in 2015, Safeboda had to compete with Juu boda, Bolt boda and uberBODA in Kenya from the get-go.

Bolt (formerly Taxify) launched its bike-hailing service in Nairobi in March 2018. SafeBoda launched in the green city under the sun in June 2018. And Uber joined the bike-hailing race in November 2018. The Kenyan Boda Boda Safety Association had also rolled out its own bike-hailing app called Juu boda to connect its members to more customers in January 2018.

To curry favour from passengers, SafeBoda offered discounts and promos. It also provided drivers with access to accident and life assurance of up to KSh100,000 ($908), better earnings and savings through SafeBoda Sacco, and training at community hubs. But SafeBoda driver-partners were not satisfied.

"We started avoiding Safeboda even before COVID-19 and made sure it went down", Francis, a Safeboda driver, told me in a WhatsApp chat. "These Safeboda people were taking advantage of us and making customers happy".

He added that SafeBoda ran many promos and set lower prices to make customers happy. Yet the drivers, who own the bikes, maintain and refuel them, receive kidogo sana (peanuts).

Between January and March 2020, SafeBoda drivers were reportedly cancelling request to protest the low rates customers were enjoying at the expense of their profit margin. According to a driver, a trip that would normally cost between KSh 150—200 was slashed to KSh 80—100 on SafeBoda. And the same trip cost between KSh 190 and KSh 250 on uberBODA and Bolt Boda.

It should be noted that SafeBoda is not the only bike-hailing startup that give customers discount, uberBODA and Bolt Boda do the same.

It is also important to note that Kenya is really a market for cars. With the average boda-boda ride costing KSh 221 ($2), bike-hailing is more expensive than ride-hailing and Matatus (minivans and buses). Hence, people who can afford boda-boda would rather hail a ride or board Matatus.

In the midst of the restriction on movement to contain the coronavirus outbreak, SafeBoda added delivery service to its offering. In April 2020, SafeBoda Shop was launched in Kenya to enable the delivery of groceries. SafeBoda had also added food, delivery and payment options to its platform in December 2019.

Peter Wafula, who became SafeBoda's driver-partner in August 2019, said, "my take home has significantly reduced" since he mostly deliver items and food due to the restriction on movement. "I got my bike through loan and I pay KSh 500 ($5) daily whether I have worked or not", Peter said. Therefore, "I have to work to ensure that I meet the daily loan repayment" and "take care of my family".

In the food, groceries and items delivery vertical SafeBoda diversified into there are also deep pocket competitors such as Glovo and Sendy who had been operating in the space many months before SafeBoda.

Victua, a Kenyan tech entrepreneur, said, "SafeBoda riders were not only making offline trips, they also like exchanging contacts so they can become your regular driver who you can call at any time". He added that uberBODA is still a favourite.

Reports from Uganda suggest SafeBoda drivers in the country are unhappy with their earnings, too. In July 2019, SafeBoda altered its payment system and reduced the bonus drivers receive by 50%.

Allan Bangirana, CEO of Innovware — an Ugandan digital strategy and marketing consultancy firm, said if SafeBoda does not work on their policies, they may find themselves out of Uganda soon, too. As a SafeBoda user, Allan said, "I take time to ask the riders about their experiences and most of them refer to the same issues of lower rates given to users and the percentage cut off from each ride they do".

Hence, it makes sense for SafeBoda to pause operation in Kenya and focus on its strong markets Uganda and Nigeria. Similar difficult decision was made in launching SafeBoda in Ibadan, a city in southwestern Nigeria, rather than the commercial capital Lagos. And that decision is paying off — SafeBoda completed 100,000 rides between March when it was launched and June 2020.

The state of bike-hailing startups in Africa

SafeBoda is not the first bike-hailing startup to bite Kenyan dust. Maramoja and Sendy had shut down their boda-boda service in 2016 because of slow uptake. Rwandan SafeMotos, which rebranded as CanGO in September 2019, had ultimately shut down in January 2020, too.

Since 2015, bike-hailing startups have proliferated across Africa. According to TechSci Research, the two-wheeler market in Africa — which includes motorcycle and scooter — is projected to cross $9 billion by 2021. South Africa, Nigeria, and Tanzania are the largest African two-wheeler markets, followed by Kenya, Algeria, Uganda, Egypt, Morocco, Angola and Ethiopia.

The ubiquity of motorbikes makes the business model of bike-hailing startups tricky. As Osarumen quizzed in his seminal essay on motorbikes, "how do you get to scale in a market where online hailing alone isn't valuable enough to drive adoption?"

Hence, bike-hailing startups are all trying build a super app that provides not only enable transportation of people but also provide additional services like payment, e-commerce and delivery. With Opera-backed OPay out of the picture, SafeBoda still have a chance if it can double down on its growth in Uganda and Nigeria.

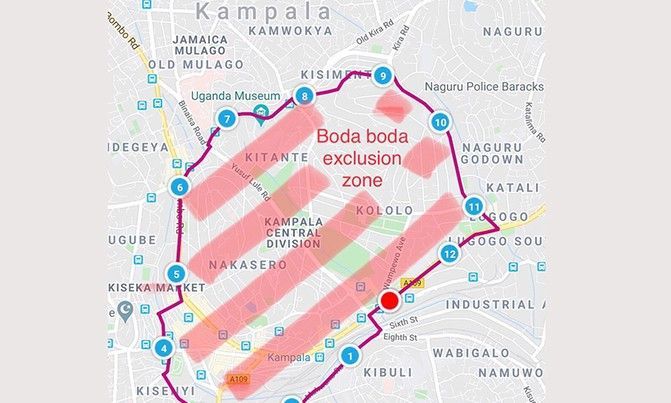

African governments have been bootlessly trying to regulate bike-hailing startups. In July 2020, Uganda announced the Boda Boda Free Zone which mostly prohibit bikes from operating in the capital city Kampala. It's similar to the Lagos State okada ban which took effect in February 2020. A year ago July 2019, Ethiopia had also enforced a ban on motorbikes in Addis Ababa.

Following the okada ban in Lagos in February 2020, Gokada had pivoted into delivery. And MAX.ng launched in Ibadan while refocusing on its delivery business in Lagos.

Notwithstanding the uncertain regulatory frameworks across the continent, more bike-hailing startups are still being launched. For instance, Ecobodaa which was founded in March 2020 plans to launch the first Kenyan electronic motorbike in 2021. Max.ng plans to roll out its electric bikes in Nigeria, too.

Whoever is able to successfully build the super app like Gojek and Grab will win the bike-hailing race in Africa. Because of their pan-African and super app play, Gozem and SafeBoda are well-positioned to win the bike-hailing race in Africa.