Meet SafeBoda—the ride-hailing startup that just closed a Series B round co-led by GOJEK and Allianz X

SafeBoda was founded by a Ugandan and two Europeans in 2014. They recently closed a Series B funding round co-led by GOJEK's Go-Ventures and Allianz X.

Ugandan bike-hailing startup, SafeBoda has secured a Series B investment co-led by Allianz X and Go-Ventures. This was announced on Tuesday, May 7 by Allianz X.

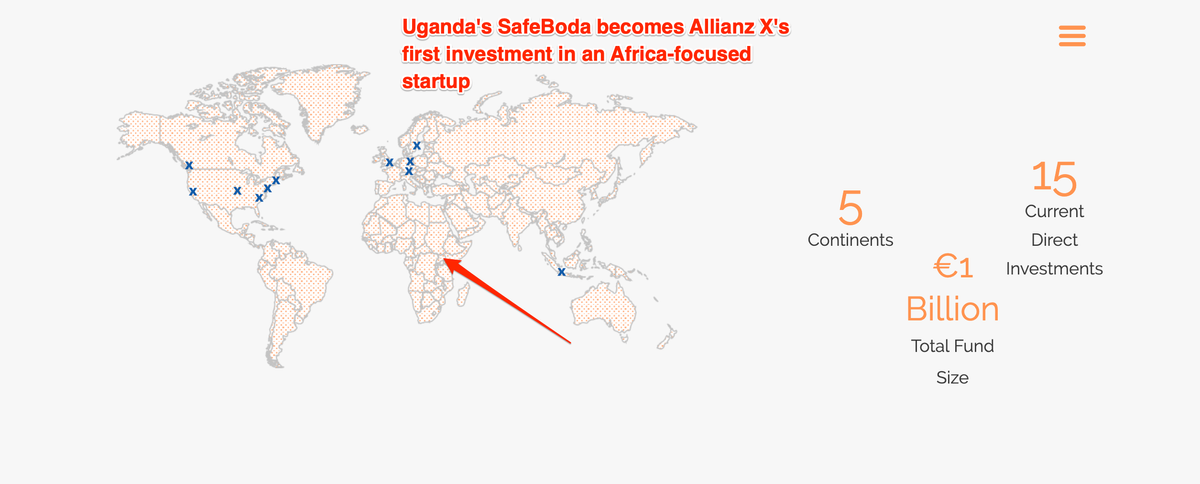

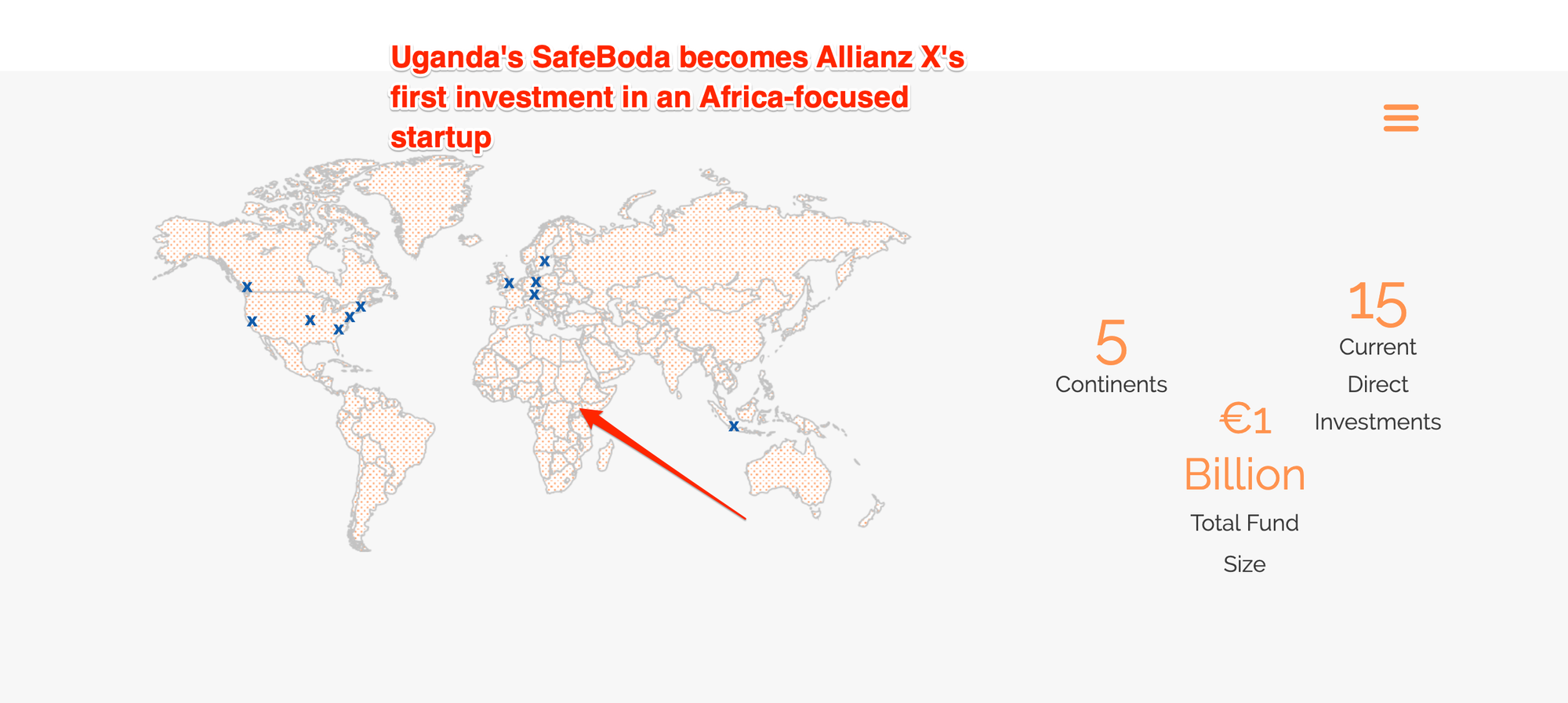

Allianz X is the digital investment unit of Germany's Allianz Group, and part of the group's Renewal Agenda while Go-Ventures is the venture capital arm of Indonesian startup—GOJEK, investing globally in early-stage ventures.

Allianz revenue of 130.6 billion euros places it firmly in the top 5 largest financial services companies in the world. Allianz X invest in digital growth companies that are part of their ecosystems related to insurance: Mobility, Connected Property, Connected Health, Wealth Management & Retirement, and Data Intelligence & Cybersecurity while also helping to drive innovation across Allianz operating entities.

In February 2019, Allianz stepped up the fund size of Allianz X to 1 billion euros ($1.12 billion), thanks to the digital investment's unit's track record of successful collaborations and contribution towards the Group’s overall digital transformation strategy. For instance, last year, Allianz X invested $35 million in 4-year-old Indonesia' super app, GOJEK valued at about $10 billion. Already, the parent company, Allianz has sealed a deal to offer insurance to GOJEK's driver partners.

Allianz X's investment into mobility and fintech firm, GOJEK marked their first Southeast Asian investment. Their investment in SafeBoda marks their first investment in Africa (or in an Africa-focused firm). SafeBoda is similar to GOJEK in that it is also a mobility and fintech firm (see photo 3).

On the other hand, GOJEK is the cornerstone investor in Go-Ventures (GV), the other VC firm that led SafeBoda's Series B raise. GV is reportedly putting together a $180 million fund with participation from external investors. Interestingly, GOJEK's main rival in Indonesia, Grab also has a VC arm—Grab Ventures. However, unlike GV, Grab is the sole investor of Grab Ventures, making investments off its balance sheet.

"SafeBoda is a promising start-up with substantial growth potential, including the development of relevant financial services and insurance products. We look forward to our strategic collaboration and to being part of SafeBoda’s success story", says Coenraad Vrolijk, CEO of Allianz Africa.

Commenting on the raise, Alastair Sussock, Co-CEO and Co-Founder of SafeBoda said, “SafeBoda is excited to have Allianz X join our investor group, particularly as we deepen our platform and add a number of important FinTech services for both SafeBoda drivers and passengers. We are confident that collaborating with Allianz will enable us to grow the business and impact the wider community across East and West Africa”.

Although, SafeBoda doesn't reveal its funding numbers, it's estimated that its Series A round was $1.1 million. So, this round could be anywhere between a $8–25 million raise, where $25 million was the average Series B raised in the US in 2018.

Get to know SafeBoda

SafeBoda (registered as "Guinness Transporters Ltd.") is a 5-year-old startup co-founded by an Ugandan bike-taxi driver, Rapa Thomson Ricky and two European economists—Alastair Sussock and Maxime Dieudonne who had experience working in the region.

They started in Kampala, Uganda where the boda boda sector is rumoured to be the second largest employer after agriculture with about 100,000 bikes operating in the city's central. Last year July, they completed an expansion to Kenya, whose boda boda sector made $2.17 billion in revenue in 2017.

Last week Sunday, benjamindada.com broke the news of their expansion into Nigeria even as we announced their appointed Country Head, Babajide Duroshola, a former Andela staff.

SafeBoda places a premium on safety for two-wheel transportation. Rightfully so because across East Africa where Boda Boda is prevalent, many road accidents and trauma cases are caused by them. In Kenya, motorcycle crash victims made up about 11% of the total number (11,062) of road accident victims between Jan 1 – Dec 28, 2017, according to Kenya's National Transport and Safety Authority (NTSA). In Uganda, "Road Traffic Crashes (RTCs) were the leading cause of trauma and bodabodas were involved in 41% of all trauma patients", a study published in 2010 revealed.

Poor road safety practices such as speeding, reckless driving and non-adherence to the use of protective gear like helmets has contributed to the Boda boda accidents.

"Our aim is to improve the industry for both drivers and passengers by increasing the number of safe trips taken per day and by making travel around cities convenient and stress-free", says a statement on their website.

Co-founder Alastair told CNN that people in Uganda don't wear helmets because they do not have one, so SafeBoda provides helmets for all their drivers and riders. In addition, a three-week-long driver training is provided in partnership with the Ugandan Red Cross that covers road safety and bike maintenance.

Despite stiff competition in East Africa with Uber, Taxify Kenya and other local players (e.g Uganda's Dial Jack and Kenya's Savvy Riders), the company has been able to sign-up 1,500+ boda drivers in less than a year of expansion to Kenya. As an aside, it has taken Nigeria's MAX nearly four years to sign-up "1000+ drivers completing nearly 1 million rides", MAX co-founder, Adetayo Bamiduro told Benjamindada.com.

SafeBoda is different from many motorcycle-taxis but similar to Uber and Taxify

Today, in Africa what we know as bike-hailing startups are typically asset financing companies who rent out or lease these high-powered bikes to drivers who have to pay back periodically. Take for instance, Easy Mobility. According to a TechPoint report, Easy Mobility requires drivers to remit ₦3,000 ($8.3) daily and keep whatever is left as their profit. Whether the average driver is able to afford it is a discussion for another day, but what this means is that riders are priced inefficiently.

In an age where companies are trying to leverage emerging technologies to drive personalisation even down to pricing (ask InsureTech startups), such approach by Easy Mobility cannot be said to be innovative neither do they deserve the much-coveted name of bike-hailing startup. TechPoint has since fixed its headline to reflect how a startup like Easy Mobility is not a "motorcycle-on-demand startup".

"March 22—The headline, which originally referred to EasyMobility as a “motorcycle-on-demand startup” looking to give other entrants a run for their money has been reviewed to accurately depict the model that it operates on", reads the update on their site.

On the other hand, SafeBoda is similar to Uber because instead of charging on the production asset (the two-wheel automobiles) they charge for the platform. So, drivers pay a fee per trip gotten through the SafeBoda app.

But how does SafeBoda navigates the collections problems faced by many cash-based economies? Because just like GOkada, riders can still manually flag down a motorcycle.

More than a bike-hailing startup also a fintech

SafeBodas are at the forefront of a #cashless revolution. Going from earning cashless to fuelling your bike 🏍️ #cashless is changing their mindset around a dependency on cash. Can't wait to share our learnings and scaling this across different customer segments and markets. pic.twitter.com/so6IQeifyU

— Kamanzi Jr. (@Nickle_las) May 10, 2019

Like GOJEK, SafeBoda has built itself to be more than just a transport company, they are also a financial services company. SafeBoda's Nigeria Country Head, Babajide Duroshola tells Benjamindada.com that "collections is one of the biggest challenges with ride-hailing startups, SafeBoda fixes that as it mandates both drivers and riders to have a SafeBoda wallet". Thereby, making it easier for the company to debit the riders account and payout to the driver after taking out their cut.

Indeed, even Uber partnered with Paypal to build out a digital wallet for the ride-hailing startup. Digital wallets ease transactions as there are fewer hoops compared to traditional banks and the rules are largely defined by you—the wallet owner, enabling flexibility and quick responses to market changes.

"Also, SafeBoda gives loans to its drivers, thereby driving financial inclusion and boosting the economic activities", Babajide tells us.

By offering both transportational and financial services, SafeBoda's strategy to become a super app like GOJEK becomes clearer. This alignment also hints to why GOJEK dominant in Southeast Asia would invest in a similar company focused in Africa. SafeBoda can benefit from GOJEK's industry experience to power and scale up her operations.

While we might soon see SafeBoda offer insurance cover to its drivers leveraging Allianz's financial services capabilities.

In 2018, SafeBoda won AppsAfrica Award and co-founder Rapa Thompson Ricky was listed on Forbes 30 Most Promising Young Entrepreneurs In Africa for being instrumental in helping the region embrace technology through adoption of its SafeBoda app.