Why OPay launched another mobility service

Venture-backed OPay adds ride-hailing service, OCar, to its offerings, as it continues strategic experimentation to strengthen its super app status.

OPay—Opera's attempt at building a super app in Nigeria—has announced the launch of another transportation service on its platform, dubbed OCar.

With the launch of OCar in beta phase, OPay now has three mobility services on its platform: ORide—its bike-hailing service—or OTrike, its three-wheel mobility service operational in Aba and Kano, and OBus—its fledgling public transport service.

Superficially, the launch of OCar signals a deviation from the mission of OPay's complimentary services, which is "to provide solutions the financially excluded and people in the informal sector can pay for." But holistically, OCar will strengthen the super app status of OPay. Since it is ridiculously priced at ₦200, both the rich and poor can afford it, at least for now.

The Day we've all been waiting for is finally here! 💃🏽

— ORide (@getoride) November 19, 2019

OCar has arrived! 🚘

Go anywhere with OCar in Lagos, Owerri, PH, Abuja, Benin, Kaduna, Abeokuta & Ibadan for just 200 Naira.

Now, you can enjoy safe, affordable & comfortable rides at the tap of a button. #GetOCar #RideOCar pic.twitter.com/8yue6jNTiD

Since our spotlight on Opera and Opay, OKash and OWealth have come out of beta phase. And as of press time, the services offered by OPay Digital Services Limited through its app are: bike-hailing service (ORide), food delivery service (OFood), microloans (OKash), investment (OWealth) in partnership with Blue Ridge Microfinance Bank, bus-hailing service (OBus) and ride-hailing service (OCar). Customers can also purchase airtime, data, electricity, and transfer money to their sports betting accounts through the mobile app. All these are in addition to its mobile money service built on its expansive network of agents.

Clearly, we are a hairbreadth close to OEverything and the coronation of OPay as Nigeria's super app.

Should Bolt and Uber be worried because of OCar?

If done right, OCar could give Bolt and Uber a run for their money. Currently, drivers on Uber and Bolt platforms are charged 25% and 20% commission per trip, respectively. Following ORide playbook, OCar would charge a lower commission to lure drivers onto its platforms and use promos to attract customers.

The challenge, however, will be to ensure OCar does not take on the bad reputation plaguing ORide. The cheap fares and frequent promos notwithstanding, ORide drivers are notorious for reckless driving. David, a frequent user of the bike-hailing service, told benjamindada.com, "It's like all the reckless 'okada' drivers joined ORide. I usually have to threaten and shout at the driver every time to have a smooth and sane ride, else ORide could become my cheap ticket to heaven."

The Poll and the Comments did not Lie. User feedback was accurate. All the Max bikes waited. Some Gokadas did. Some didn't.

— Gossy Ukanwoke (@gossyomega) November 12, 2019

The others, Lol

Similarly, there are reports alleging that ORide is exploiting the drivers on its platform as their reality is a far cry from the perfect picture of the monthly salary (₦200,000) and flexible working hours OPay advertised to them.

Whichever way it pans out though, customers would be the biggest winners. Just as the expansive growth of ORide caused Gokada and Max.ng to improve their services, Uber and Bolt would be prepared to outsmart OCar's aggressive growth strategies, thereby giving customers more value for their money. Except they connive to form a trust, which is not feasible at this stage.

The ride-hailing service is still in beta phase and, as such, may not be working optimally. I couldn't get OCar yesterday at Ojodu, Berger, because there were no rides around, but I was able to get a ride today.

Why another mobility service?

If you thought that with all the rumble in the ride-, bike- and tricycle-hailing space, there is no room for competition, OPay thinks you're wrong: like improvement, there's still a wiggle room for one more player.

In his seminal article on the rise of motorcycle taxis in Africa, Osarumen Osamuyi, a tech analyst and Entrepreneur-in-Residence at Africa's Talking, submitted that the playbook of bike-hailing startups on the continent is to:

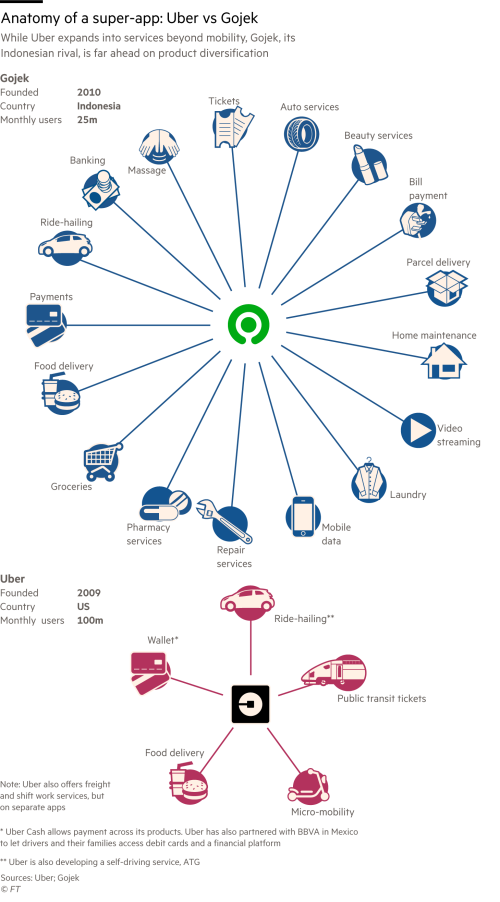

- Offer transportation as a service and grow as quickly as the market permits — just like Grab and Go-Jek in Southeast Asia

- Leverage scale to layer on adjacent services like identity, mobile payments, credit, micro-insurance, etc. — just like Grab and Go-Jek in Southeast Asia

- Extend services beyond core use case, expand into new verticals, and build ecosystems around your platform — just like Grab and Go-Jek in Southeast Asia

- 'Raise and burn cash'—$-$-$-$-$ — just like Grab and Go-Jek in Southeast Asia

In essence, the playbook is to rehash Grab and Go-Jek strategy. Unfortunately, according to the former CEO of Go-Jek, Nadiem Makarim, the Indonesia's ride-hailing company is close to achieving profitability in all verticals, except transportation.

Similarly, Grab—Singapore-based transportation network company—is looking to its food delivery business (GrabFood), bolstered by the acquisition of Uber Asia, to take it to the nirvana of profitability. After which, it will go public.

Although connecting drivers and riders with technology is really cool because transportation is an existential need of man, it is not as lucrative. As of today, because of fierce competition, there is only so high a percentage that can accrue to a platform before drivers ditch it and high fares is a deal breaker for passengers. The platform that will win on the long run is the one that is able to cut cost, own the largest share of the market, and rake in high revenues.

In the latest unaudited financial result of Opera, OPay is reported to have tripled its active mobile money agents to over 140,000 and doubled transaction volumes to exceed $10 million (₦3.6 billion) per day. Also, OKash recorded increased revenue compared to the second quarter of 2019, which is driven by 5 million loans worth more than $250 million (₦90.6 billion) disbursed.

Ordinarily, OPay should be doubling down on its microloans and investment services not mobility services which, according to Ridwan Olalere, Senior Director of Operations at OPay, is not profitable yet. Speaking at TC Mobility Townhall, Ridwan said: "We are more focused on growth now."

Indeed, growth and quick expansion could be the saving grace of mobility startups or their death knell.

It's all strategic experimentation

Not resting on its oars, OPay is bullish on expansion across different verticals and geographies.

According to Indiabasi Akpan, OPay's Country Manager, the fintech startup is constantly taking feedback from customers and innovating. He said: "I think the customers will decide where we go next. But one thing you can count on is that wherever we see opportunity, we will play."

OPay could be the last platform standing and the winner that takes it all.

From OTrek to OAir to ONigeria - We've heard it all... or, have we? Tell us, what should our next 'O' be? We might just have it developed. 😉 pic.twitter.com/VQATBawrlz

— OPay (@OPay_NG) November 20, 2019

In line with that thought, OPay is currently reviewing the business model of OBus to increase the number of third-party buses on its platform. Also, following a courtesy visit to the Lagos state Chairman of National Union of Road Transport Workers (NURTW), Alhaji Musiliu Akinsanya (AKA MC Oluomo), last month, OPay has signed a Memorandum of Understanding with the union to ensure smooth running of their operations.

> **Related:** [PlentyWaka: A safe, comfortable and affordable bus hailing service](https://www.benjamindada.com/farmcrowdys-plentywaka-crowdyvest)Hard to imagine western businesses ‘partnering’ with Oluomo in this way. Shrugs

— tyro (@DoubleEph) November 20, 2019

While this will boost the prospect of OBus as NURTW members can put their buses on OPay's platform, the impact of the partnership on ORide operations, whose drivers are constantly harassed by louts and hoodlums, called "agberos" remains to be seen. Because these agberos often parade themselves not as members of NURTW but the Road Transport Employers' Association Of Nigeria (RTEAN) and the Amalgamation of Commercial Tricycles and Motorcycles Owners, Repairers Association of Nigeria (ACOMORAN).

Can't keep up with my mentions but this is reciept issued by the Agberos representing the Motorcycle union. pic.twitter.com/x1RusFBmBY

— Olamide Egbayelo (@olamideyelo) July 17, 2019

Earlier this month, OPay raised $120 million (₦43.5 billion) from its Series B funding round. Investors that participated in its Series A funding six months ago, where it raised $50 million (₦18.1 billion), also participated in the round; these include Sequoia Capital China, GSR Ventures, Meituan-Dianping, Source Code Capital, IDG Capital. Other investors are Softbank Ventures Asia, Redpoint China, Dragon Ball Capital and Bertelsmann Asia Investment.

With this new funding, OPay can finance its ride-hailing business in Nigeria and expand to other African markets, namely Ghana and South Africa.

OPay will facilitate the people in Nigeria, Ghana, South Africa, Kenya and other African countries with the best fintech ecosystem that Africa has ever seen, paired with the inclusion of daily use services such as transportation and delivery. The capital raised will be allocated to African countries where local regulation is supportive of scientific and technological entrepreneurship in the fintech space.

Zhou said, "We see ourselves as a key contributor to expanding financial inclusion in Africa, and helping local businesses and workforces to thrive from opportunities created by new, digital business models."