BD Insider 183: Where does Nigeria’s “$500 million digital economy fund” come from?

Where is the Nigeria’s “$500 million digital economy fund” from? We attempt to answer this question and also provided insights into World Bank’s partnership to roll out digital IDs for Nigerians.

Before we get into today’s letter, let us quickly recap one of the major stories in our last Midweek Brief that had a slight error:

Kenya has the highest TikTok usage rate worldwide for news and other purposes, according to the 2023 Reuters Institute Digital News report.

The social media platform has been accused of creating political tensions in the country due to disinformation and lack of content moderation.

Last week, the CEO of TikTok, Shou Zi Chew met with William Ruto, Kenya’s president and they agreed that both entities would work together to moderate content on the platform. Chew also announced that TikTok will set up an office in Kenya.

This comes a few days after Somalia banned TikTok, Telegram, and online betting website 1XBet to limit the spread of indecent content and propaganda.

Away from how African governments are regulating social media, in today’s letter, we will explore:

- the “$500 million” fund for Nigeria’s digital economy

- World Bank’s partnership to roll out digital IDs for Nigerians

- the new employment rate figure in Nigeria

And other noteworthy information like:

- Last week’s African tech startup deals

- opportunities, interesting reads, and more

#1. Understanding the “$500 million” fund for Nigeria's digital economy

The news: Last week, Bosun Tijani, Nigeria’s minister for communication, innovation, and digital economy announced that the government has acquired access to financing for a local innovation funding program.

“So we’ve got access to about half a billion dollars to start local funding. This funding is aimed at propelling innovation and entrepreneurship within Nigeria’s thriving digital sector,” Tijani said at a luncheon organised in his honour by the World Bank.

The “$500 million” fund, according to Tolu Ogunlesi, a former digital media aide to former President, Muhammadu Buhari, is part of the Investment in Digital and Creative Enterprises (iDICE) programme, a $618 million fund that was launched in March, before the inauguration of the current administration.

For context, this is the "Investment in Digital and Creative Enterprises" programme - iDICE - launched by former VP Osinbajo in March 2023.

— Tolu Ogunlesi (@toluogunlesi) August 26, 2023

Financing from @AfDB_Group @isdb_group @AFD_en @BOINigeria etc.

Now at implementation stage: https://t.co/jhAaQmtslK https://t.co/fyJZTEqlAV pic.twitter.com/Mb2PSuzD9K

At the time, the government said that iDICE intends to support about 451 technology startups, 226 creative enterprises, and 75 enterprise support organisations.

Know more: The iDICE fund comprises of the following:

- $170 million from the African Development Bank (AfDB) and

- $116 million (€100 million) from the French Government through its development agency—Agence Française de Développement.

- $70 million from the Islamic Development Bank, subject to approval from its board

- $45 million from the Bank of Industry, representing the Federal Government of Nigeria. The BoI's fund will come as loans to qualifying startups

- $217 million mobilised from other institutional and private investors by an independently-managed venture capital fund tagged DICE fund.

Since the funds, especially the one from the Islamic Bank and other institutional and private investors were unavailable at the time of the launch. Only $500 million, as announced by Tijani may be currently available.

This quote by the digital economy minister makes it more explicit: “The government is not just going to put half a billion and that's it; it can bring more investors on board,” he said.

Embed financial services with SeerBit Alpha

Say goodbye to developmental stress and hassles, and launch your Fintech products faster when you build with SeerBit Alpha.

This is partner content. Contact: hello[at]benjamindada[dot]com

#2. World Bank to support roll-out of digital national IDs for Nigerians

The news: Shubham Chaudhuri, World Bank country director for Nigeria, says the multilateral lender is collaborating with the Nigerian government to ensure the successful rollout and registration of digital national IDs for all Nigerians.

According to Chaudhuri, the partnership has set a target to provide digital IDs for at least 148 million people by the middle of next year.

Why it matters: Nigeria’s first attempt at e-ID cards was in 2014. About 15% of Nigerians have both an e-ID card and a National Identity Number (NIN) while around 30% have a NIN (66 million) but not an e-ID card, according to a report by VerifyMe.

Meanwhile, more than 100 million Nigerians, a little less than half the population, do not have any form of recognised ID, including other non-NIN IDs, the report says.

According to the National Identity Management Commission, “the National e-ID is a strong tool for institutions offering services to their customers, like the “Know Your Customer” (KYC) tool for banks and other financial institutions”.

It will also enable transparency in sharing various dividends of democracy that often go to ghost personalities.

A view from India: Aadhaar is arguably the largest biometric identification scheme globally, with 1,289 billion people enrolled as of March 2021. With Aadhaar, each resident—of 18 years and above—in India is issued their unique national identification number, the 12-digit Aadhaar number.

“Because of Aadhaar, many have gained access to public services they had long been entitled to. Banks and mobile phone companies have enrolled poor people who previously had been seen as too risky and cost-prohibitive to be viable customers,” according to a 2020 research by K. Sudhir and Shyam Sunder, faculty members at Yale.

#3. Why Nigeria’s unemployment figure dropped to 4.1%

The data: About four months after the National Bureau of Statistics (NBS) announced that it would change how it calculates the unemployment rate, NBS last week pegged the rate at 4.1% in Q1 2023.

The new methodology now classifies those employed in Nigeria as those working for at least one hour a week, as against the 20-hour-a-week parameter previously used to determine that the unemployment rate was 33.3% in Q4 2020.

It also defines unemployed as someone who is not employed at all and is actively searching for a job.

The controversy: The new data has come under heavy criticism since it was released. Some experts say that the number does not reflect the true number of jobless people in the country, especially with the economic downturn which has led to layoffs even in the tech ecosystem.

According to Akintunde Ogunsola, an Abuja-based financial analyst, “the true unemployment rate in Nigeria might be more than the 33% recorded in 2020 when the NBS last released the labour data”.

Several commentators have advised that the methodology should be revised to better reflect the reality of the Nigerian labour market. However, the NBS said that “the revised data aligns with the rates in other developing countries where work, even if only for a few hours and in low-productivity jobs, is essential to make ends meet, particularly in the absence of any social protection for the unemployed”.

🎙️ BD Talks: Embedded finance: to build or buy

Businesses are faced with a dilemma when they need a financial services infrastructure.

Join us tomorrow as we examine factors to consider when making the decision to either buy of build a financial service infrastructure with experts from Nigerian fintech, Seerbit.

💰 State of Funding in Africa

Gates Foundation has selected 29 African researchers for its inaugural $5 million Grand Challenges fund for AI project targeted towards global health. Each recipient will receive up to $100,000 to advance their research project, for a total of $5 million in grants.

In the first half of this year, funding in the AI sector plunged 98% compared to the same time last year, according to BD Funding Tracker. Funding for the sector has also plummeted globally.

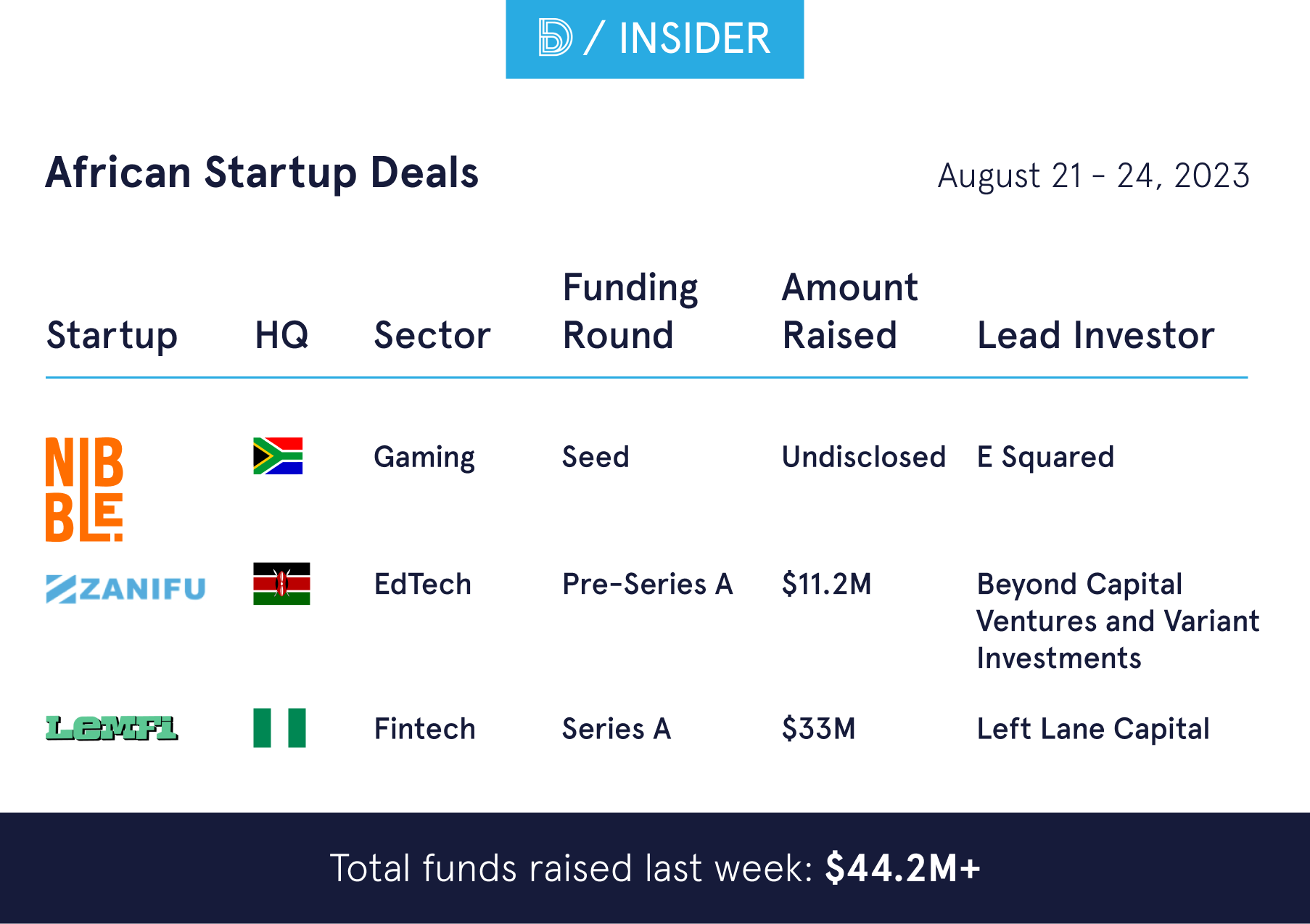

Meanwhile, three African startups raised about $44.2 million last week. Find more details below.

📚 Noteworthy

Here are other important stories in the media:

- Camels or unicorns? Unicorn startups are an alluring dream, but three founders and two investors believe that Camels are a more realistic ambition for Africa's tech ecosystem.

- Nigeria rakes in over ₦2 trillion from Big Tech taxes: Within 15 months, non-resident digital firms paid over ₦2 trillion to the Nigerian government, according to NBS data.

- Detecting anomalies in babies' cries with AI: Experts believe that the sounds of the cries of babies can provide various health-related information, Ubenwa is building a platform for early screening and monitoring of a range of neurological and respiratory conditions affecting infants.

- AI is assuming an increasingly important role in traditional banking: Experts from Kora, Finextra, Binance, Yoco and six other companies share research-based ideas and hard-won lessons and analyse the developing patterns that are driving Africa's fintech evolution.

- Patricia releases PTK whitepaper: In a whitepaper released last week, Patricia outlined the reason, scope and process of rolling out its native token. Here are five main things you should know about PTK.

💼 Opportunities

Jobs

We carefully curate open opportunities in Product & Design, Data & Engineering, and Admin & Growth every week.

Product & Design

- Wakanow — Senior Product Designer, Lagos

- Interswitch — UI/UX Designer, Lagos

- Dayra — Graphic Designer, Egypt

Data & Engineering

- Flutterwave — Backend Engineer, Lagos

- New Globe — Senior Data Analyst, Lagos

- Carbon — Senior iOS Engineer, Lagos

Admin & Growth

- Nokia — Customer Delivery Manager, Lagos

- Stears — Senior Research Associate, Remote

- Bolt — Sales Manager, Nigeria/South Africa/Kenya

Thanks for reading this edition.

Know someone who might find it useful? Don't hesitate to share.