BD Insider 178: Moniepoint enters Nigerian retail banking market

The fintech company is rolling out a consumer app and debit card that will enable personal banking transactions.

It’s official! CcHUB co-founder and CEO Bosun Tijani is now Nigeria’s communications, innovation, and digital economy minister. His ministerial portfolio was announced on Wednesday by the Nigerian government.

In his new role, Tijani will drive policies enabling the ICT sector’s growth; the sector accounted for 17.47% of the country’s GDP in the first quarter of this year. “I look forward to working with all stakeholders to raise the level of productivity across our economy through the smart application of technology,” Tijani said.

Across Africa, CcHUB which was founded in 2010 has a network of more than 1100 startups that can trace their roots to the hub’s innovation-focused programs and interventions, more than 7,300 direct jobs created by its portfolio companies, over 35,000 indirect jobs have been created by portfolio companies through their value chain, more than $10,000,000 invested in direct startups by CcHUB and over $150 million in external funding attracted by the startups in their portfolio.

Although Tijani has made a significant impact in the Nigerian tech ecosystem, the telecom industry sees him as an “outsider”.

“Someone with a telecom background primarily would have been fine as everything rides on it really and if its needs are not met other services will suffer,” an operator told BusinessDay. “[However], it is good to have someone who speaks the communication language albeit from a user perspective.”

We will continue to bring you coverage of his activities in the ministry.

Still in the Midweek Brief, we bring you news about:

- Moniepoint’s expansion into retail banking

- the journey to profitability at Jumia

Also, we curated a few opportunities that you might find relevant.

Let’s dive in!

📰 The Midweek Brief

#1. Moniepoint expands to provide retail banking in Nigeria

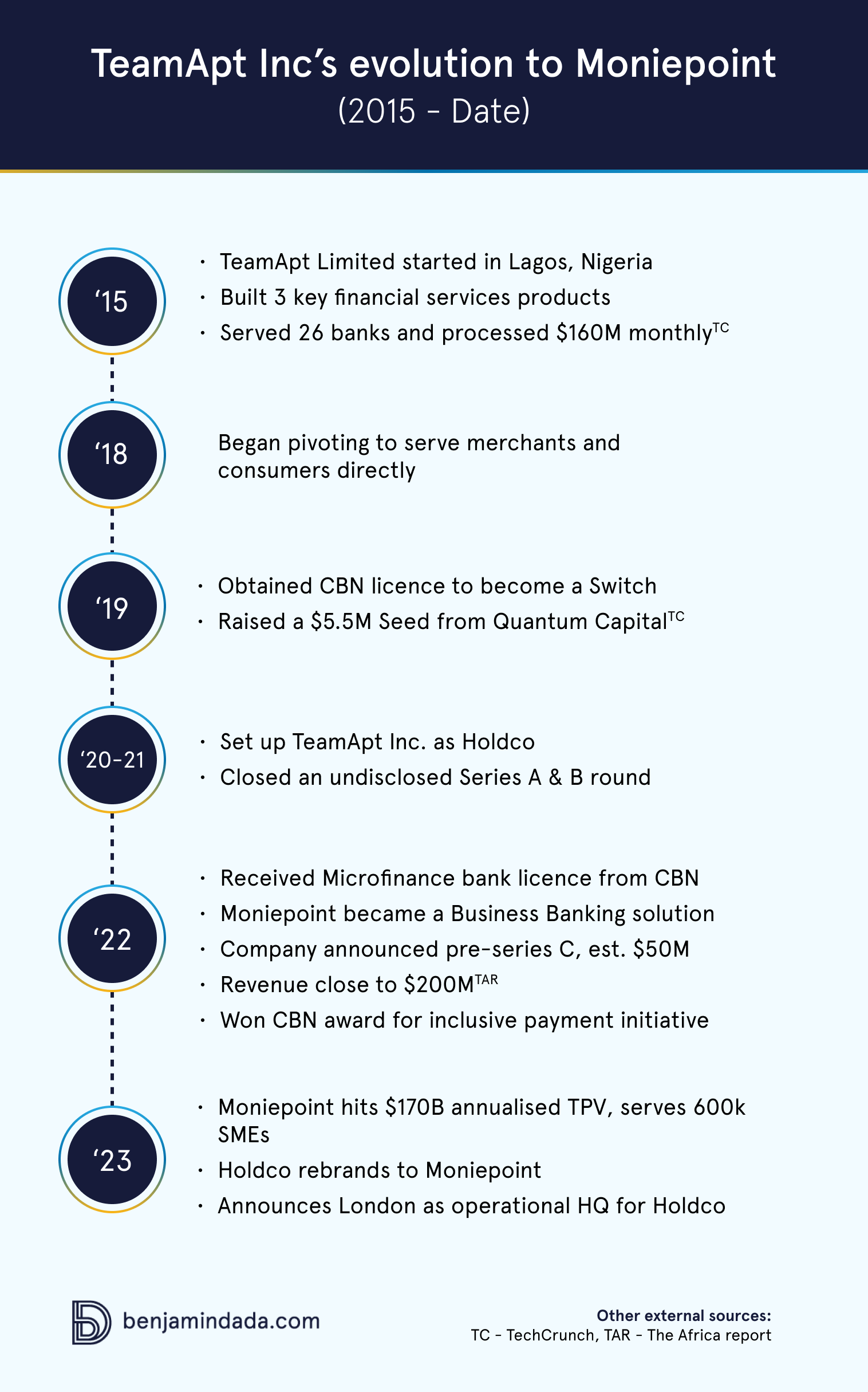

The news: After eight years of operating a B2B model, Nigerian fintech, Moniepoint wants to start offering retail banking services in the country, with the launch of a consumer app and debit card.

The app will enable users to make transfers, pay bills and buy airtime, while its debit cards can be used at ATMs, POS terminals, and online. These debit cards will be issued through global payment processors, including Mastercard and Verve.

Know more: Outside of its business banking stronghold, Moniepoint will be competing against existing retail banking providers like Chinese-owned fintechs, Opay and Palmpay, these two are currently the most downloaded finance apps on Google Playstore in Nigeria.

Moniepoint maintains that “[It is] positioned to do it right”. “We currently have 800,000 terminals actively used daily across the country, and assuming there are 120 million adults in Nigeria, the ratio is 150:1. We can leverage this to make payments and banking better,” Ope Adeyemi, Moniepoint’s senior vice president for channels and sales tools, told TechCabal.

Aligning with its sponsorship of this year’s season of Big Brother Naija reality TV show, the Moniepoint personal banking app will also feature various games. These games will see users earn points with each transaction and compete in pursuit of grand prizes of millions of Naira each week.

#2. Jumia cuts losses amid dwindling revenue.

The news: Africa’s e-commerce leader, Jumia has released its Q2 2023 earnings report showing significant progress on its drive towards reducing losses. However, that progress was cancelled out by the worsening macroeconomic environment in the markets where they operate which saw reduced orders by customers.

Why it matters: The report shows that operating losses have slowed down to a four-year low of $23.3 million, decreasing 66% compared to the $67.7 million in losses in Q2 of 2022. The progress was made possible by cost-cutting measures in advertising and sales which saw the company’s advertising expense reduced to $5.8 million, a 78% decrease compared to last year.

However, the company is still not profitable. Rising inflation across Nigeria, Egypt, and Ghana has seen a reduction in the purchasing power of the company's customers, which has in turn affected revenue. This quarter the company only recorded 6.5 million orders from 2.4 million active customers, a 36% decrease from last year. Leading to a reduction in revenue from $57.3 million to $48.5 million, a 15% decrease from last year.

Know more: Profitability has been Jumia’s north star since it went public in 2019, but that growth metric has managed to elude the e-commerce company. In Q4 of 2022, Jumia’s co-founders resigned from the company as part of a larger streamlining effort to focus on profitability that reduced its headcount by 20%, affecting 900 roles across 11 markets.

The fruits of those cost-cutting measures are beginning to show but the challenging operating environment will mean Jumia has to work much more harder.

💼 Opportunities

While we patiently await the gods of “unbelievable liquidity” to answer our prayers, here are some opportunities to set you on a path to at least achieve believable liquidity.

- Job Vacancy: Brass, a Nigerian fintech company, is hiring for several roles across its sales department. Shoot your shot.

- Startup Accelerator: Applications have been opened for the Startup Wise Guys SaaS acceleration Africa program. Selected startups will receive up to €100,000 investment for equity with a follow-on possibility. The deadline to apply is September 7, 2023.

- Event: This year's Africa Startup Festival is set to in Lagos on November 11. It is an annual event that celebrates and supports entrepreneurship and innovation in Africa. Reserve a seat.

🗞️ ICYMI—In case you missed it

- Amazon launches AWS Skills Centre in South Africa: Amazon has launched the first AWS Skills Centre based outside of the US, in South Africa, to deliver free training for learners in the region.

- Olumide Balogun is Google’s new director for West Africa: Google has appointed Olumide Balogun, its former head of consumer apps for Sub-Saharan Africa, as Director for West Africa.

- African countries rank lowest on the AI readiness index globally: According to a report by Oxford Insights, African countries rank lowest on the AI readiness index globally. However, Mauritius, South Africa, and Seychelles are leading the drive.

- How to secure your investments as an angel investor: When Stripe acquired Paystack, some Angel investors confessed to making nearly 20x on their investment. Yet, a single mistake in their investment process could have wiped out any potential gain, Levi Cee writes.

You’ve come to the end of the Midweek Brief.

Do you want more like this?

Click below.