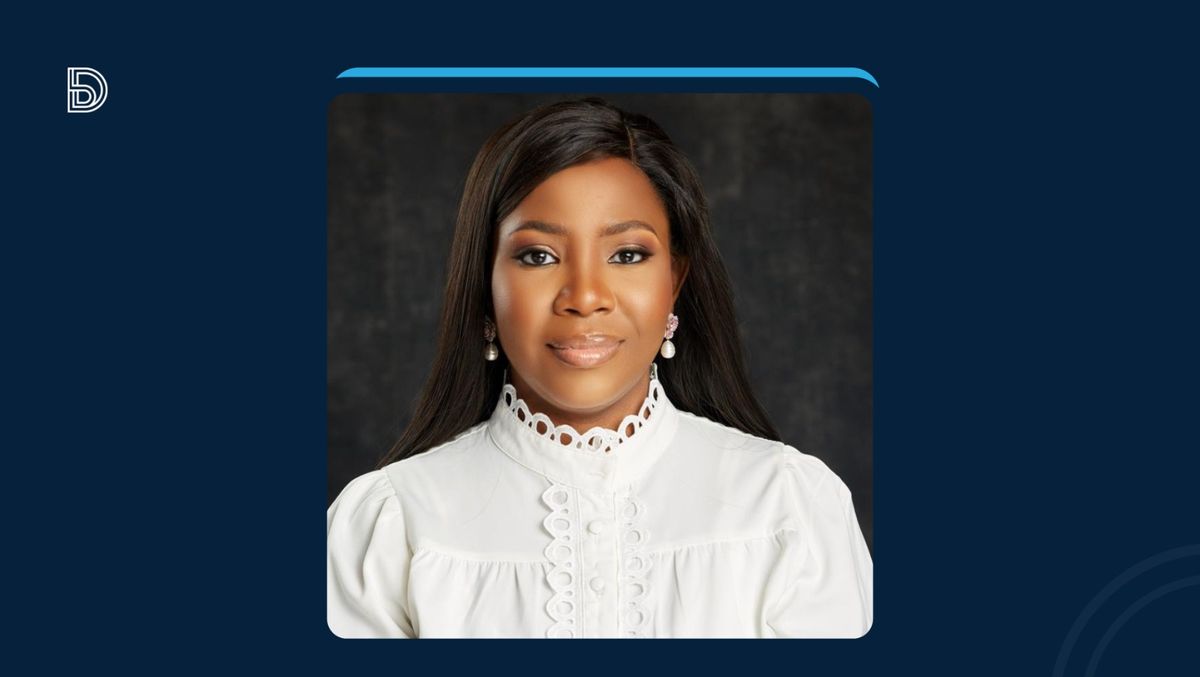

“Equal gender representation should be the norm,” Mayokun Fadeyibi, SVP at Autochek West Africa, says

In this interview, Mayokun Fadeyibi, SVP at Autochek talks about the importance of equal representation and the M&A landscape in Africa.

Across Africa, Science, Technology, Engineering and Mathematics (STEM) related fields are often male-dominated, although this is common globally, the numbers on the continent are very low. In 2010 only one in four engineering students was a woman, according to Polity, an institution that is deepening democracy through access to data.

Hence, scientific work and technological innovation are missing women’s invaluable perspectives and critical contributions. The Equality Equation Report by the World Bank says that gender norms, stereotypes, biases, and sexual harassment are key drivers to the low representation of women in STEM fields.

The implication of this low representation is the lack of STEM female role models for young girls. Amidst this challenge, women like Mayokun Fadeyibi have broken these barriers and are building successful careers in STEM. In 2005, Ms Fadeyibi graduated with first-class honours in mathematics at Tusculum University.

She went on to bag a master's degree in applied mathematics at North Carolina University, and then a doctorate in business analytics at Bentley University in 2013.“While I was studying for my PhD, I was teaching algebra and calculus to undergraduate students at the university. Also, I started to do internships—did one at the UN,” she said.

After studying and working in the United States, in 2015, Ms Fadeyibi returned to Nigeria to take business executive roles at a number of companies in the country, including OLX and Cars45.

In 2020, Mayokun co-founded, Autochek, an automotive technology company making car ownership more accessible and affordable across Africa. She is currently a senior vice president, responsible for the company’s West African operations, which covers Nigeria, Ghana and Cote d'Ivoire.

“I have largely operated in male-dominated sectors without meaning to—from studying maths to working in various industries. However, what has always guided me amidst the bias that exists in these sectors is; showing up—owning your growth and success,” Mayokun told Benjamindada.com. “When you show up with your best foot forward, it is hard for you not to be noticed. Whatever bias that exists can be overcome.”

To address gender bias, Mayokun believes that the girl child should be given the opportunity to education, including STEM-related programmes at an early stage. “It is really about the opportunities that you have, I had the opportunity to go to school. Also, the realisation that maths and science are not only for men,” she added. “Also, conscious efforts around gender diversity in hiring will help in addressing this bias. The tech industry is very performance-driven, it is not about the gender of the individual but the results that they can achieve.”

In the coming months and years, Mayokun wants to see a change in the narratives around, ‘male-dominated industries’. “Equal gender representation in the workplace and schools should become a norm,” she said. “The term ‘male-dominated’ should be retired because it does not exist.”

Influencing over six mergers and acquisitions (M&As) at Autochek

In Africa, Autochek is one of the companies that have consistently leveraged M&As as “a strong part of [its] growth strategy,” she said. Starting out with the acquisition of Cheki Nigeria and Cheki Ghana from their parent company, ROAM Africa in 2020, the automotive tech company again acquired Cheki Kenya and Cheki Uganda to enable its East African expansion in 2021.

After raising about a $13.1 million seed fund from TLcom Capital, 4DX Ventures and other investors, to scale its technology and accelerate expansion across the continent, Autochek acquired KIFAL Auto last year, to drive its expansion into North Africa. The acquisition is arguably the first major expansion of a West Africa-based startup into the region.

Again, to double down its efforts across the continent, the Nigerian company acquired CoinAfrique, a leading platform for classified ads in French-speaking Africa, to accelerate the penetration of its auto financing services in Senegal, Côte d’Ivoire and other Francophone African countries. Per BD Tracker, Autochek has raised $16.5 million (based on disclosed rounds) since it was launched in October 2020.

To execute the aforementioned M&A deals, the company sets up a special project team for every deal. Mayokun Fadeyibi has been part of all these teams, playing an active role.

“The bedrock of M&As is relationship building, so, it is not about looking out for M&As immediately. However, when we spot an opportunity in the course of cultivating this relationship and/or partnership, we can then set up a special project team to focus on reviewing these partnerships for possible M&As,” she said. “At this point, we are looking at the operational synergies between the potential entities; the business models, integrations and how it will look post-acquisition—you need all of these for M&As to be successful.”

M&As are dependent on the strategy of the founder, you should not dive into it because others are doing it. The question is; “how does it fit in your business?”. As much as possible, ensure that it connects with your growth strategy; either product or location expansion. In looking at an M&A, you also need the right legal structure. — Mayokun Fadeyibi

Aside from M&As at Autochek, she worked on the launching of Autochek Financial Services, the company’s fintech arm in 2022. “Our business is mostly about providing financial services in the automotive industry—we facilitate auto-financing for credit penetration across the continent,” she added.

Within two years of the company's existence, it has worked with more than 70 financial institutions and more than 2,000 dealerships to process more than 80,000 car loan applications.

Editor's Note: This article is part of our series for the 2023 women's month.