Lemonade Finance raises $725k pre-seed financing to change cross-border financial services for Africans abroad.

Lemonade solves a problem that Africans in the diaspora face: sending and receiving money from their home countries in efficient, affordable, and fast ways.

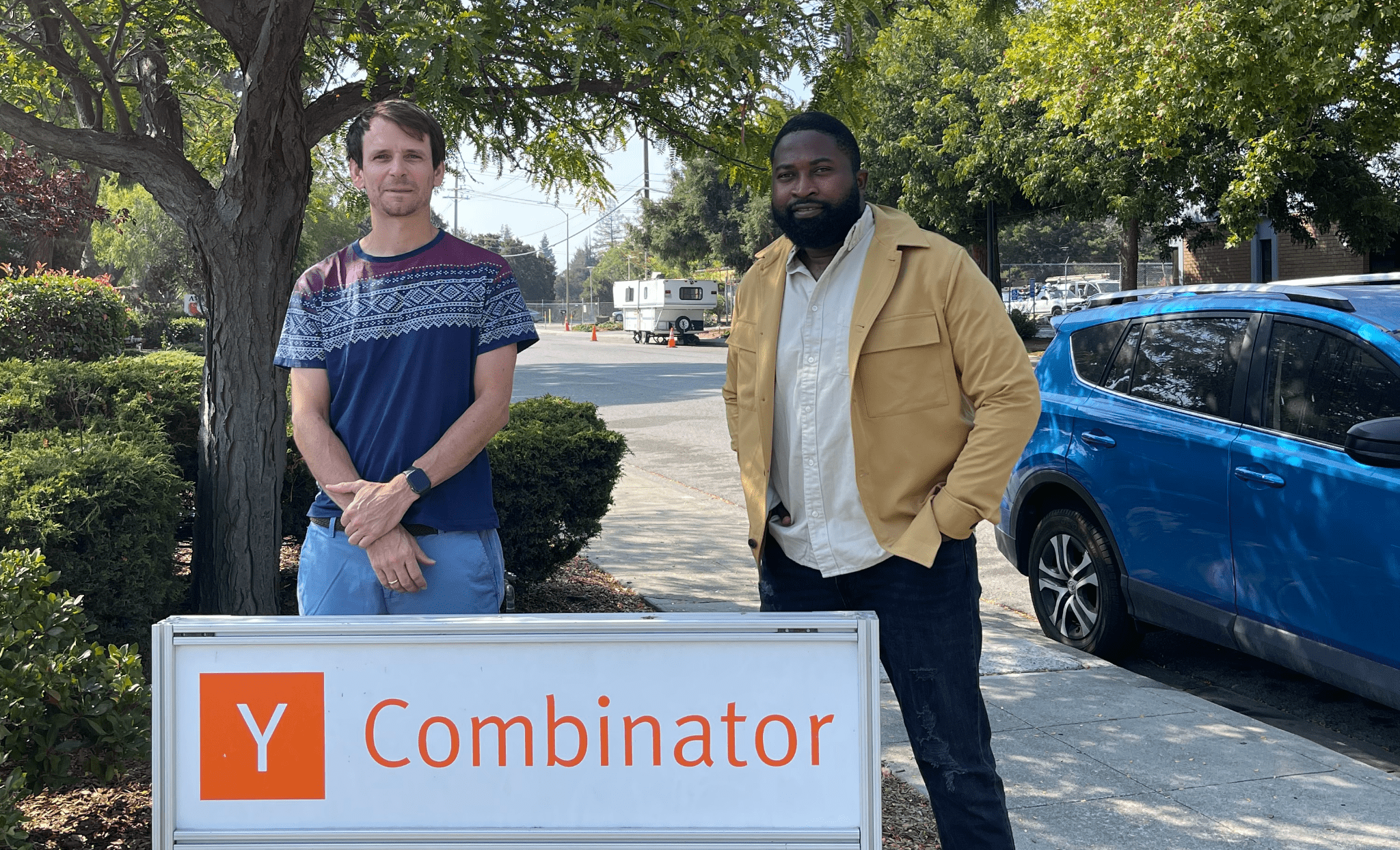

Lemonade Finance, a startup that allows Africans abroad to send and receive money from home, has raised $725k in pre-seed funding. The American startup accelerator, YCombinator, and Venture Capital firms, Microtraction, Ventures Platform, and Acuity Venture Partners funded the pre-seed round along with involvement from several other individual investors.

Lemonade solves a problem that Africans in the diaspora face: sending and receiving money from their home countries in efficient, affordable, and fast ways. The existing remittance options, some of which are led by big players, are not nimble enough. For instance, many Africans abroad own businesses back home and need to hold money in two currencies. They also need to move such funds quickly, sometimes for needs and purposes that are urgent.

This is where Lemonade differentiates itself, with an app that lets users hold their balances in the currencies that matter to them. A Nigerian user of Lemonade in the U.K can hold the Pound Sterling and the Nigerian Naira, easily converting one to the other. Users can also transfer the money back and forth from Nigeria without needing to wait days.

The startup’s co-founders, Ridwan Olalere and Rian Cochran say that this flexibility is intentional and has been at the core of the team’s thinking in building the app. Ridwan told (whatever publication), “Before Lemonade, international money transfers that should take minutes took days.

Those are hours of stress and anxiety for you and your family while your money is stuck in transit. It also makes it difficult for many Africans abroad, who own businesses, to keep those ventures running. The Lemonade app solves all that, with great rates and instant transfers across borders; it’s a game-changer for the African diaspora.”

That promise of efficiency resonates with users in Canada. With proven service, Lemonade Finance is also setting its sights on Africans in the U.K, who also need to jump through hoops to send and receive money from home. There are also reports of an expansion to Ghana, although the timeline remains unknown.

Away from funding, two of the company’s investors, Microtraction and Ventures Platform, say they’re confident of the critical nature of Lemonade’s solution. According to Dayo Koleowo, Managing Partner at Microtraction, “Lemonade’s solution is very timely. As a multi-currency financial service provider, they make it easy for the African diaspora to send and receive money from their new country of residence, which is remarkable. We believe Rian and Ridwan have the technical and financial know-how to provide the number 1 cross-border Neobank for Africans in diaspora.”

Kayode Oyewole, a partner at Ventures Platform, said, "We are excited to back Ridwan, Rian and the Lemonade team, who have built a compelling financial product to serve the more than 100 million African diaspora, who today have limited access to great financial products. The founders are rockstars with deep experience building and scaling products to reach millions of users."