Takeaways from Kippa's Nigeria MSME Report 2022

Kippa, a Nigerian fintech startup has released a 2022 report on Micro, Small and Medium Enterprises (MSMEs) in Nigeria.

Kippa, a Nigerian fintech startup has released a 2022 report on Micro, Small and Medium Enterprises (MSMEs) in Nigeria.

MSMEs are the backbone of the African economy; however, they face compounding challenges which make building and solving for this segment particularly unique. African MSMEs also experience inadequate support from government institutions making private owned companies the order of the day for business management, credit provision and advisory services relevant to SMEs.

Founded in June 2021, Kippa's goal is to help Nigerian businesses be more sustainable by solving the accounting and bookkeeping challenges. Its mobile app allows users to record sales and expenses, create and send invoices, manage inventory, recover debts and track the profit of their business per time. Since its launch, Kippa has served about 500,000 merchants.

In November 2021, the fintech raised a $3.2 million pre-seed fund in a round led by Target Global to enable small businesses in Africa. Recently, Kippa appointed its co-founder, Duke Ekezie-Joseph as President to meet the demands of a rapidly growing customer base following the launch of new digital products.

The state of MSME in Nigeria

As of 2020, Nigeria's Small and Medium Enterprises Development Agency estimates that there are approximately 39.6 million MSMEs in Nigeria with a population of 200 million. Compared to other countries with higher populations, such as the United States with 30 million MSMEs, India with 42 million MSMEs, China with 38 million MSMEs, and Indonesia with 64 million MSMEs, it is clear that Nigeria and Africa have significantly more entrepreneurs than these other regions.

Tagged; "Fuel for Africa's next billion businesses", Kippa's report provides insights into the operations of small and medium-sized businesses in Nigeria and Africa, the unique business environment, the challenges encountered, and the role of technology.

MSMEs in Nigeria by their numbers

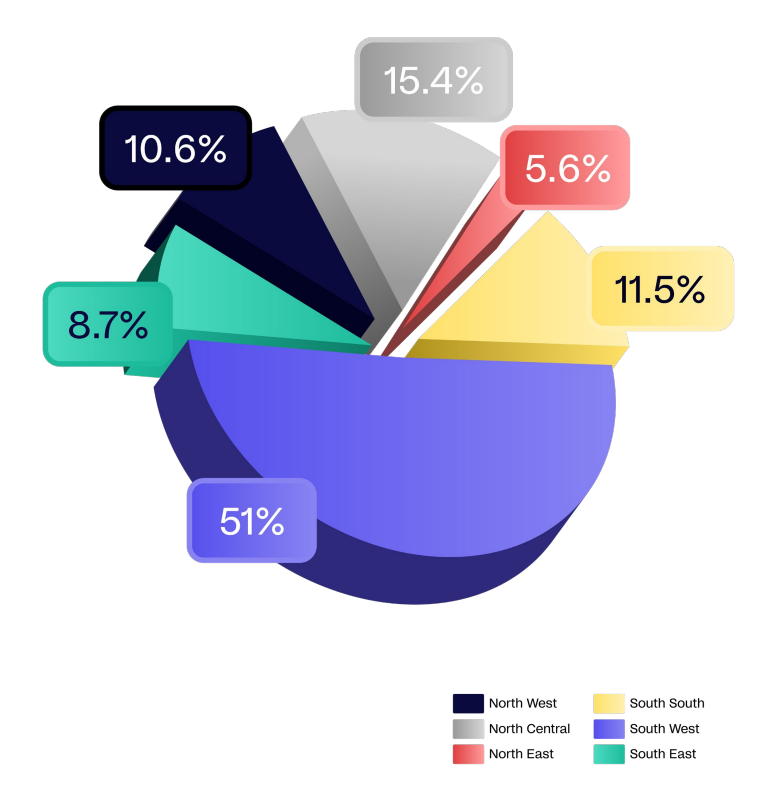

According to the report, the South-West dominates the Nigerian SMEs in distribution, with 51% of the 20,000 MSMEs surveyed operating from the South-West. Upon even further investigation, Kippa discovered that half of Nigerian SMEs use a Business-To-Customer model where they provide either products or services to direct consumers with apparel, food/restaurants, and grocery stores leading the way in business categories with the most merchants.

Another unexpected turn in the report shows that the most significant impediment to MSMEs’ growth is not a lack of capital; instead, it is a lack of the skills necessary to manage a successful firm, as well as a lack of process, corporate structure, and business acumen.

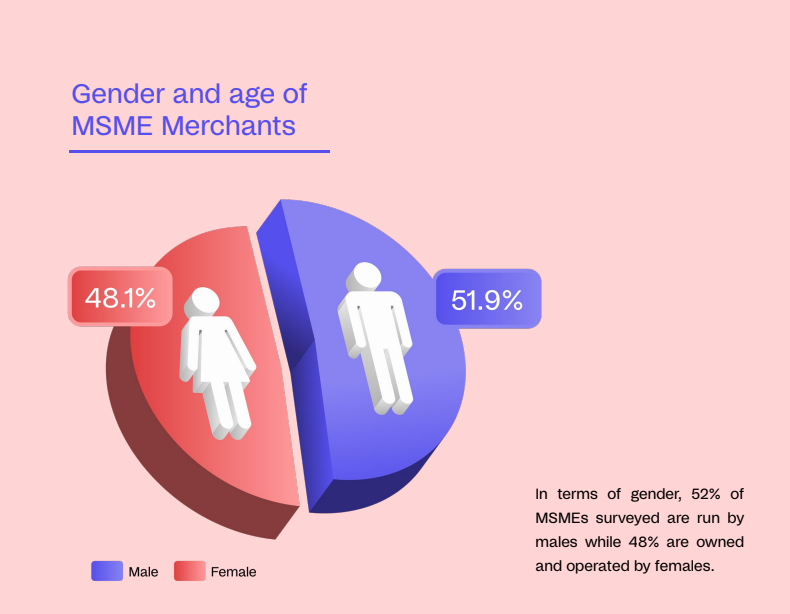

The Kippa MSMEs report also revealed that the majority of SME owners in Nigeria are between the ages of 20 and 50 and have some literacy level, suggesting that many SME owners can use technology to help their businesses grow. Also highlighted is the gender distribution of MSMEs, with 52% owned and operated by males and 48% by females.

Within nine months of operation, Kippa merchants have recorded over $3 billion in transactions showing the financial capabilities of MSMEs within Nigeria. Seasonal periods like the end of the year are also peak periods for merchants. Our customers logged clothing/apparel, retail/grocery stores, food vendors/restaurants and pharmacies dominating sales during peak periods. After speaking to merchants, the report concluded that consumers are more inspired to buy more groceries, upgrade their electronics and lighting, purchase new devices towards the end of the year, and begin the new year with a new resolution.

With Nigerian MSMEs, cash is King

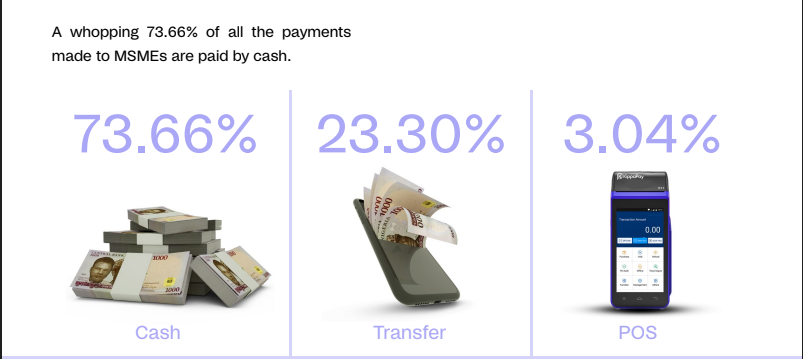

According to Kippa, cash is used in 73% of all transactions with MSMEs. This is not unique to Nigeria; the same behaviour can be seen across Africa. Cash was the most popular payment option in online retail in Morocco, Egypt, and Kenya in 2021, accounting for 74%, 60%, and 40% of the total, respectively as reported by Statistica.

"Consumers prefer cash when they can because of the irregularity and unpredictability of digital payment options; no one wants to be stuck in a store after a shopping trip or a night of fine dining when their cards or bank transfers fail," Kippa stated in the report.

Related Article: The state of the $1.5 trillion B2B payment market in Africa

Meanwhile, clothing & Apparel accounts for 40% of the total MSMEs in Nigeria, this is followed by the food and restaurant businesses (13%) and retail/grocery stores (6%).