Understanding how venture funds work

Venture Capital holds a lot of promise, but very few know how it works. This piece will help you understand what goes on before the headlines.

This article is part of a series on venture investments. You can find the first part of the series below:

What is Venture Investments? An explainer, Part 1

You may have heard of Garry Tan’s investment success turning a $300,000 investment in Coinbase to $2.4 billion at IPO. Or how investors smiled to the bank with approximately 1,440% ROI on Paystack’s acquisition by Stripe.

Venture Capital holds a lot of promise, but very few know how it works. This piece will help you understand what goes on before the fanciful headline surface.

The activities of Venture Funds can be split into four broad categories:

- Analysis and Market Research

- Deal Sourcing

- Investment and Portfolio Management, and

- Fundraising

Here is how they work:

Analysis & Market Research

I started my venture capital journey at Ingressive Advisory, a boutique market research entity launched in 2015.

Ingressive conducted market entry trips for top global investors like Micheal Sibeal of Y-Combinator and Silicon Valley technology companies like Figma and GitHub. This was to accelerate the rise of technical skills like product design and programming in Africa.

This Market Research helped to guide opportunities and product adoption in Africa.

“We started leading global investors to Africa before tech was a thing here,” Maya Famodu explains on Forbes. “Back then, questions were less ‘how many Mergers and Acquisition deals have occurred in the African market this year?’ and more ‘do Africans even have internet and electricity?’ It was necessary to not only change the African narrative to focus on its incredible innovations and opportunities but also to sell a future only few imagined.”

The market research trips - like the Tour of Tech in the Summer of 2015-2017- brought together local innovators, regulators, international investors and infrastructure providers like Google, GitHub, New Relic, Intuit, 5OO Startups etc.

Jack Dorsey, the CEO of Twitter, visited Lagos and Accra in 2019 to understand Twitter’s impact in Nigeria and Ghana. This influence helped Nigerian youths get international recognition during the #EndSARS campaign.

#EndSARS 🇳🇬 https://t.co/fcgQIOQYSS

— jack (@jack) October 14, 2020

Another example is Future Africa which rolled out as a community focused on deep conversations about Africa’s future. They published informed opinions about the future (and history) of Africa, e.g. The History of Fintech in Africa, turning them into simplified and engaging content, which generated robust conversations about the collective future editorials on portfolio companies that everyone can participate in.

Companies wondering how they must evolve to continue existing gain actionable intelligence from these insights. Most importantly, the public needs to understand how the future could be built in the public interest.

Deal Sourcing

The first task a VC faces is connecting with start-ups that are looking for funding—a process known in the industry as “generating deal flow.” A fund is as good as its access to a good deal flow.

A recent article by Harvard Business Review on deal sourcing asserts that “30% of deals come from leads from the venture capitalist’s former colleagues or work acquaintances. Other contacts also play a role; 20% of deals come from referrals by other investors, and 8% from referrals by existing portfolio companies. Only 10% result from cold email pitches by company management. However, almost 30% are generated by venture capitalists initiating contact with entrepreneurs.”

Victor Asemota, a top technology ecosystem fore-bearer made a couple of tweets sharing his thoughts on the value of relationships.

I have said it here several times over, it is your friends who make you rich. There is no ”investor vs founder” in the most successful ventures in Africa. It is just friends working with friends. Forget those fancy articles with figures, charts, and terms. Just build friendships.

— Osaretin Victor Asemota (@asemota) February 21, 2021

The methodologies of deal sourcing differs across the markets. Venture Capital companies use data aggregators and research companies, venture scouts and Investor +founder matching frameworks e.g F6s, Pariti.

Investments and Portfolio Management

This serves as both a fund and an angel. As a fund, you optimise ownership and strategically make investments in companies that can give large ROIs. As angels you can invest in at the early stage of the business.

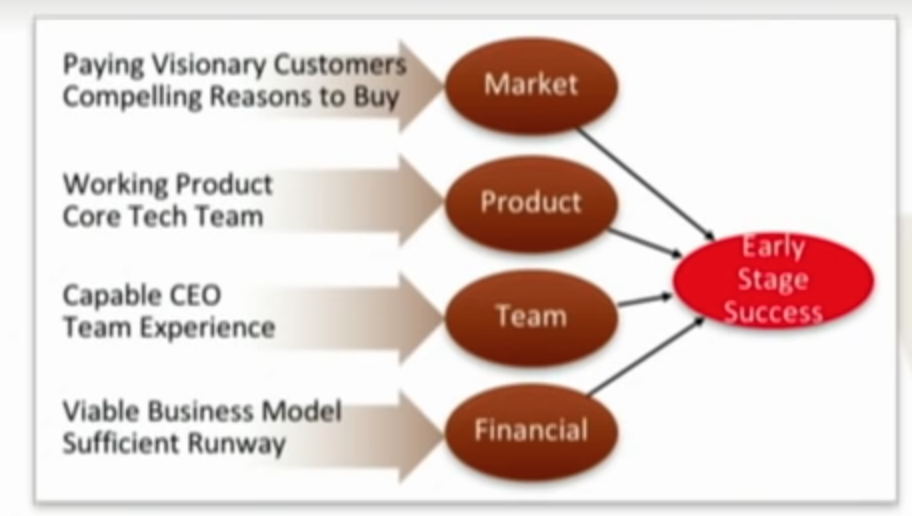

Early-stage investors focus a lot on founders who are adept at problem-solving and can pivot if there is a need aka ‘Painkillers over Vitamins’. Just as the Venture Capital (VC) thesis is to build a winning painkiller, partner with someone who knows the pain.

The main aim of Venture funds is investments and portfolio management

In portfolio management, there are three types of companies; Unicorn, Dragon Eggs and Walking Dead. Investors love Unicorns which are companies valued over a Billion dollars. Dragon Eggs are companies worth between $200M to $500M. We have seen Dragon Eggs exits on the continent (Paystack exit to Stripe and SendWave exit to World Remit)

Fundraising

The most essential themes in Venture Capital are economics and control. The economics of venture capital are mostly tied to the specifics of technical conversions like Pre-money valuation which is the value of a company before investments and post-money valuation is a sum of the pre-money valuation plus the investment amount.

Control in venture capital are tied to the ownership owned by founder and shareholders in a company.

In early stage companies most control is in the hands of the founder who gives a little ownership away for some capital inflow to build the company while in later stages the company reliquences control for growth cheques that can help the company expand and also double down on offerings to a large base of customers.

Eghosa Omoigui the GP at Echo VC spoke about fund economics in a chat setup by CCHub on strengthening the investment pipeline.

Fundraising is the most visible part of a VC/ Tech company relationship because it marks the success of conversations, commitments and acceptance from both parties to establish a solid relationship which could fairly could last between 5-7 years for a successful exit or as limited as 1-2 years if the company fails.

Presently, fundraising is divided into different buckets and it starts by either the venture funds or the entrepreneurs scouting companies that fit criteria.

We can say it is a point where both parties engage companies based on criterias, fund thesis, value add or size of the cheque, stage of the business and a lot of distinct business reasons for either the business and the venture fund.

An essential thing to highlight is that funds invest in business with expectations to retrieve their capital in multiples and that’s an main reason for setting up a venture fund or writing angel cheques. Any other thesis is placed on top of this.

Fundraising can be fast, straightforward and complementary and it can be tedious, complex and long filled with multiple layers of communication, due-diligence and back and forth.

The announcement of a successful round can be the result of conversations that might have lasted between 24 hours to 6 months.