FrostPay lets you send crypto and receive naira in 3 minutes or less

FrostPay is a new crypto company that allows users to convert their bitcoin to fiat currency in real-time without dealing with untrusted 3rd parties.

FrostPay is a new crypto company that allows users to convert their bitcoin to fiat currency in real-time without dealing with untrusted third-parties.

Interest in bitcoin and cryptocurrencies has spiked in recent times. The events of the last few weeks have once again lent credence to the crypto movement. The EndSARS protests in Nigeria, the world’s most populous black country, moved to crypto donations to avoid government sanctions. Paypal also announced that it would be supporting crypto payments on its platform.

The buzz is reminiscent of the 2017 rally that led to bitcoin briefly touching the $20,000 price point. According to some pundits, it may reach those heights again by the end of the year.

FrostPay founder, Philip Ese, is a close follower of the crypto market. He has been invested in blockchain technology and cryptocurrencies for eight years now. He believes Bitcoin will eventually become mainstream, and all these events are key contributors to it. Every small win contributes towards the eventual growth and acceptance of Bitcoin.

If you take a step back and look at the trends, you’ll see it’s only a matter of time before cryptocurrencies go mainstream.

FrostPay is helping to take crypto mainstream by facilitating seamless transactions using bitcoin. The service converts cryptocurrencies to fiat currency in real-time without dealing with an untrusted third-party.

Philip is not new to building solutions. Before FrostPay, he had made a career out of building digital businesses in the financial services industry. The products he has build cut across banking, insurance, pensions, crypto, and adjacent sectors like healthcare. He has also done some work in Regtech, using AI and machine learning to manage digital identity.

His interest in blockchain technology and cryptocurrencies led him to build FrostPay. He had used a couple of platforms for crypto to fiat transactions and was unsatisfied. But the "Aha!" moment didn’t come until one of his friends needed to send money to someone in Nigeria.

"FrostPay started as a pet project to explore my curiosity around blockchain technologies and cryptocurrencies. Sometimes this year, a friend called me asking how to send money to his friend’s account from another country without having to deal with the 24-72 hour delay that happens with SWIFT. That’s when I started thinking this pet project may have value. That’s how FrostPay became a thing", says Philip Ese

FrostPay’s vision is to connect the world with finance. To achieve this vision, the company is using funds transfer and cross-border remittance as a starting point. Diaspora remittances are a big deal in Nigeria, largely driven by an increasing emigration. Just last year, the country recorded $17.5 billion in remittances, and those were just official figures. Unofficial flows are predicted to be at least half the official figure, giving an estimated total of over $25 billion in diaspora remittances.

The key to gaining a stronghold in the remittance market will be acquiring customers that rely on crypto to do transactions. FrostPay is targeting both retail crypto users and businesses. Everyone who used crypto to settle real-time transactions is welcome to use the service.

Being able to provide users with real-time transaction settlement is a critical part of FrostPay’s offering. Although other platforms that promise on-time settlements, FrostPay is adamant that their service is better.

We see time as our biggest advantage - Philp Ese, Founder of FrostPay Africa

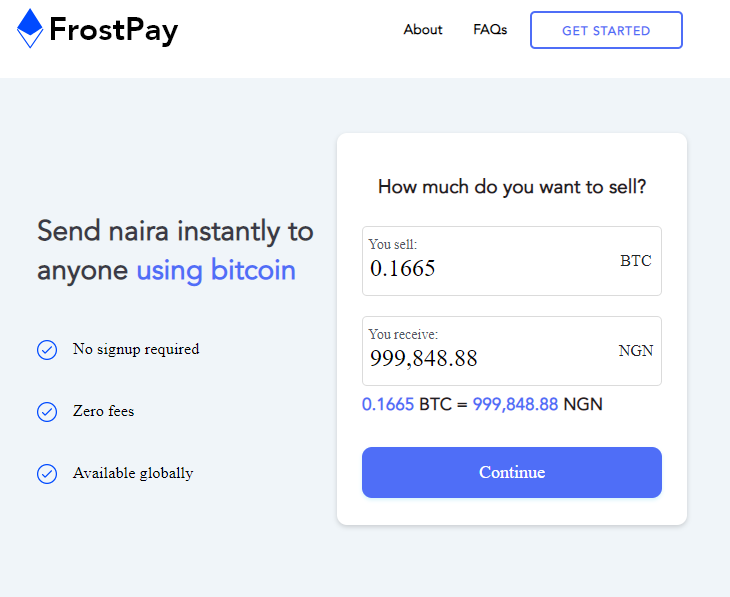

"There’s no reason why moving from Crypto to Fiat and vice versa should take more than a few clicks and 3 minutes or less", Philip says. With FrostPay, you can move funds from your preferred crypto wallet directly to any Nigerian bank account in seconds.

Sending money with FrostPay is straightforward. There’s no sign-up required. On the homepage of the website, you can enter the amount you want to send in BTC. The next screen prompts you to input the account details of the person you’re sending to. After that, the account details are confirmed with you and a QR code is generated for you. If your wallet provider doesn’t allow you to scan QR codes, you can send to a BTC address which is also provided. Your recipient’s account is credited once your BTC deposit is confirmed which usually takes under 180 seconds.

Expansion plans are already afoot, with Philip admitting that there’s much work to be done in the coming months.

Within the next three months, the service will expand to support some of the other popular cryptocurrencies, in addition to Bitcoin. In addition, to cross border real-time crypto-to-Fiat funds transfer, FrostPay intends to launch a full exchange and build out its treasury and settlement features.

There are also plans to have FrostPay as a payment method so people can make purchases using cryptocurrencies. The company also has plans for extending its reach into other countries by partnering with payment aggregator networks.

FrostPay’s future projections are not solely financially motivated, though. The crypto startup wants to engage in grassroots education as a way to drive financial inclusivity. Educating people on cryptocurrencies and blockchain technology is core to their vision. Philip has big dreams for FrostPay’s user education plans.

I think if we achieve even 20% of our plans on this front, it will go a long way in chipping at non-consumption of crypto and crypto-enabled services. - Philip

Right now, the company is starting from the crypto community because it’s a low hanging fruit. Fighting non-consumption of any service is a marathon, not a sprint. There’s an app in the works, but Philip is not too concerned about it. For now, his major concern is helping people complete transactions on time.