Foodledoodle, cloud kitchen by the founders of HotelOnline launch in Kenya

Foodledoodle, the first cloud kitchen in Kenya, has been launched by Achieng Butler, erstwhile Senior Vice President of Airtel Money and the co-founders of HotelOnline, Havar Bauck and Endre Opdal.

Foodledoodle, the first cloud kitchen in Kenya, has been launched by co-founders of HotelOnline Havar Bauck and Endre Opdal, and Achieng Butler, erstwhile Senior Vice President of Airtel Money.

Foodledoodle is a virtual restaurant (AKA ghost restaurant) that will house many delivery-only food brands. The first of such brands is Chickadoodle which launched today, June 17, 2020.

Cloud kitchen has been trending up in food delivery service since 2010. In the last two years, two notable cloud kitchens were launched in South Africa. In 2018, a consortium of restaurateurs and chefs launched Darth Kitchens. And three months ago, Larry Hodes — a veteran restaurateur — launched The Dark Kitchen in Johannesburg.

A cloud kitchen could be a delivery-only brand added to the in-house offering of an existing restaurant, a virtual restaurant that houses many delivery-only food brands, or a co-working space or shared kitchen for many delivery-only food brands.

Both The Dark Kitchen and Darth Kitchens are virtual restaurants accessible online via their website or an app. They have no physical infrastructure for people to be "seated and served". Like Foodledoodle, Darth Kitchens house five delivery-only food brands. But Bauck explained that Foodledoodle is different.

"Foodledoodle is different from other cloud kitchens in that we operate on a light capital expenditure model", Bauck said. "We lease idle kitchen capacity from hotels for our food production. This makes our model uniquely agile and scalable".

Foodledoodle currently partners with small, local hotels in Kenya to use their idle kitchen capacity to produce food for delivery. But it is looking to engage bigger hotels.

Explaining the relationship between Foodledoodle and Chickadoodle, Bauck told benjamindada.com: "Chicakadoodle is a prototype of a multi-brand pan-African operation. We are launching Chickadoodle as part of a multi-brand operation, under one brand [Foodledoodle]. Each brand [like Chickadoodle] will be a standalone entity with its own website and social media profile, and each brand will cover one specific food type".

Chickadoodle covers only chicken meals. From today, residents of Kileleshwa, Kilimani and Lavington areas of Nairobi, Kenya, can order "sumptuous chicken meals from Chickadoodle" through its website and Uber Eats. Soon, Chickadoodle will be available on Jumia Food and Glovo too.

Envisioning a successful launch in Nairobi, Kenya, this year, Foodledoole will be expanding to West Africa in 2021 with more delivery-only food brands. "We are raising money to expand to the main markets in Africa", Bauck said.

Foodledoodle, a fish in a big river of cloud kitchens

The global cloud kitchen market is expected to reach $2.63 trillion by 2026. The growth levers are the rising adoption of food delivery platforms, low cost of implementation, and the increase in the standard of living and urbanisation.

Similarly, in its S-1 filing, Uber valued the global food delivery market at $795 billion. With 19 million monthly active users, Uber Eats is the most popular food delivery app outside China. It recorded $7.9 billion gross bookings in 2018, which is about one per cent of the total market value.

The global pandemic and restriction on movement have somewhat been a boon to food delivery service. Bike-hailing startups such as Gokada in Nigeria have pivoted into food delivery service and logistics.

According to the Kenya Food Index, on-demand deliveries are expected to grow by 50% this year. On-demand deliveries of non-restaurant items such as groceries, pharma products, alcohol, cosmetics, giftings and flowers will drive the strong growth.

The Index, which was launched by Jumia Food, also show that Kenyans prefer chicken as the most popular cuisine for delivery. Pizza and burgers in second and third place, respectively. This means Chickadoodle chicken menu will resonate with Kenyans.

Bauck revealed that one of the most popular items during the testing phase of Chickadoodle has been West African-style chicken in peanut sauce. "Other popular items are chicken wraps, ginger chicken, and premium chicken avocado burger", Bauck said. "We also have some of the most popular bitings like chicken samosas and chicken wings".

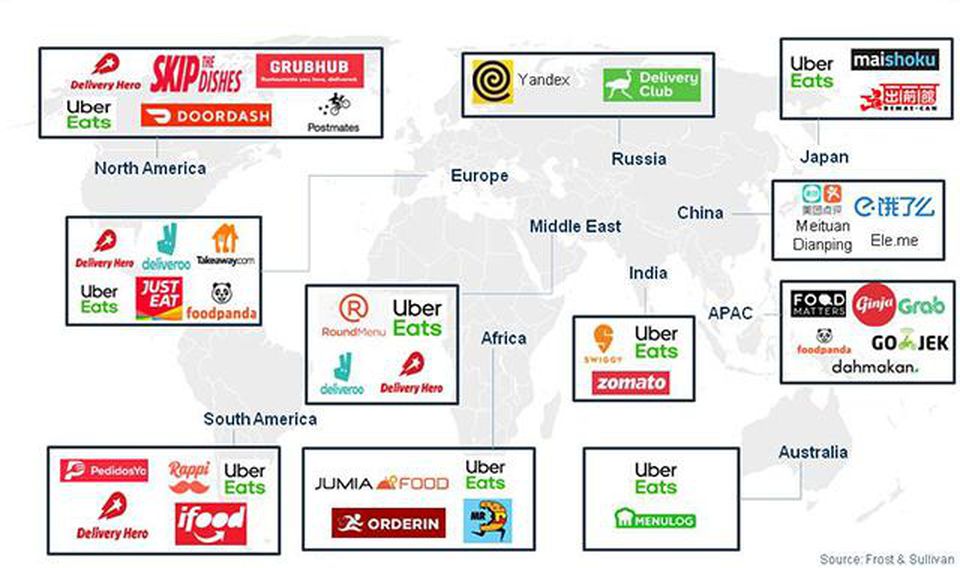

Bauck is bullish on the food delivery service in Africa. And despite being not so popular, he believes cloud kitchens will also thrive on the continent. "Across the continent, online and app-driven food delivery services are flourishing, with international players such as Uber Eats and Glovo targeting the continent aggressively", Bauck said.

Glovo is a five-year-old Spanish on-demand courier service that purchases, picks up, and delivers products ordered through its mobile app. Glovo entered the African market in 2018, and its most popular offering is food delivery.

"We have also noticed Bolt hiring aggressively across Africa to launch food delivery service [Bolt Food], so the battle keeps intensifying", Bauck added. "There is also Jumia Food in some markets, and a plethora of local and regional players, like GoFood in Nigeria, Yum and Ayazona in Kenya, Yamee in Botswana and Tanzania, and dozens more across the continent".

"Eventually, there will be a consolidation", Bauck continued. "[But before then] I think we will see even more players emerge. Look for instance what happened in Rwanda. Once Jumia Food exited, their former employees immediately created Vuba Vuba. There is a strong appetite for delivery services, both among entrepreneurs and investors, and that means we are in for an even fiercer battle to deliver food to people's homes and offices".

The change in consumer habits, particularly that of millennials, and their desire for varieties create "a vast opportunity for players who can bring novelty and quality to the market", Bauck concluded.

Cloud kitchen is a hot trend and considered the future of restaurant and food delivery. Travis Kalanick, Founder and former CEO of Uber, is one of the big players in cloud kitchens. His investment fund, 10100, has invested up to $150 million in City Storage Systems—a holding company for CloudKitchens and CloudRetail.

Andreessen Horowitz of a16z also invested in a cloud kitchen startup, Virtual Kitchen Co. GV, formerly Google Ventures, led the $10 million Series A funding in Kitchen United, a cloud kitchen which operates the shared kitchen or co-working space for restaurants model.

Foodledoodle Founders: Who are they?

Many people may remember Havar Bauck from Marek Zmysłowski's fracas with the Interpol and investors HotelOga. Bauck, a Norwegian entrepreneur, set the record straight that his company did not merge with Marek’s HotelOga.

In 2014, Havar Bauck and Endre Opdal founded Savanna Sunrise Ltd, which became the leading online marketing partner for hotels in Eastern and Central Africa.

With over 10 years of cumulative experience between Bauck and Opdal working in the leisure and hospitality industry in Africa, it explains why Foodledoodle is partnering with hotels to use their idle kitchen capacity. Savannah currently trades as HotelOnline.

Bauck is also the Chairman of Cloud9xp—an online marketplace and booking service for leisure experiences in Kenya. Last year, Bauck orchestrated the merger of Cloud9xp with another travel startup, HeartBeat Adventures.

Since she left Airtel Africa, Achieng Butler has served as the Chief Marketing Officer at Danone, a food production company, and the African Leadership University. Butler is currently an adjunct lecturer at the United States International University of Africa and the CEO of Digital Odyssey, a branding and marketing agency.