Flutterwave becomes Endeavor's first investee in Nigeria with a $35 million Series B round

Flutterwave has raised $35 million in a Series B round. The money will be spent on technology and business development to increase Flutterwave's market share across the nine African countries it currently operates.

Flutterwave has closed a $35 million Series B round led by Greycroft and e.ventures.

CRE Venture Capital, Fidelity National Information Services (FIS)—an American financial services provider, Visa, Green Visor Capital and Endeavor Catalyst participated in the Series B round. Flutterwave becomes Endeavor's first investee in Nigeria.

With this Series B round of $35 million (₦12.6 billion), Flutterwave has now raised over $55 million (₦19.9 billion) within four years. And with the participation of Endeavor Catalyst in the round, Flutterwave becomes Endeavor's first investee in Nigeria.

Endeavor Catalyst is the venture capital fund of Endeavor—a non-profit organisation on a mission to drive economic development through high-impact entrepreneurship. Endeavour Nigeria, launched in 2018, is the sixth outfit of Endeavor in Africa.

With over $110 million (₦39.8 billion) capital under its management, Endeavor Catalyst supports Endeavor Entrepreneurs with their equity financing rounds. In 2019, Olugbenga 'GB' Agboola (CEO of Flutterwave), Ife Orioke (CCO of Flutterwave), Kene Okwuosa (CEO of Filmhouse Cinemas) and Moses Babatope (Co-founder of FilmOne) became Endeavor Entrepreneurs.

We’re excited to be part of Flutterwave's growth story, with GB and Ife as active Endeavor Entrepreneurs, and with Endeavor Catalyst’s investment in Flutterwave’s Series B—our venture capital fund’s first investment in Nigeria. Catalyst is just one of the ways that Endeavor supports high-impact entrepreneurs across 38+ under-served markets. We look forward to supporting even more Endeavor Entrepreneur-led companies in our ecosystem.

Endeavor Entrepreneurs also have access to a network of mentors, and investors, and they are supported in raising capital, expanding into new markets and hiring talents.

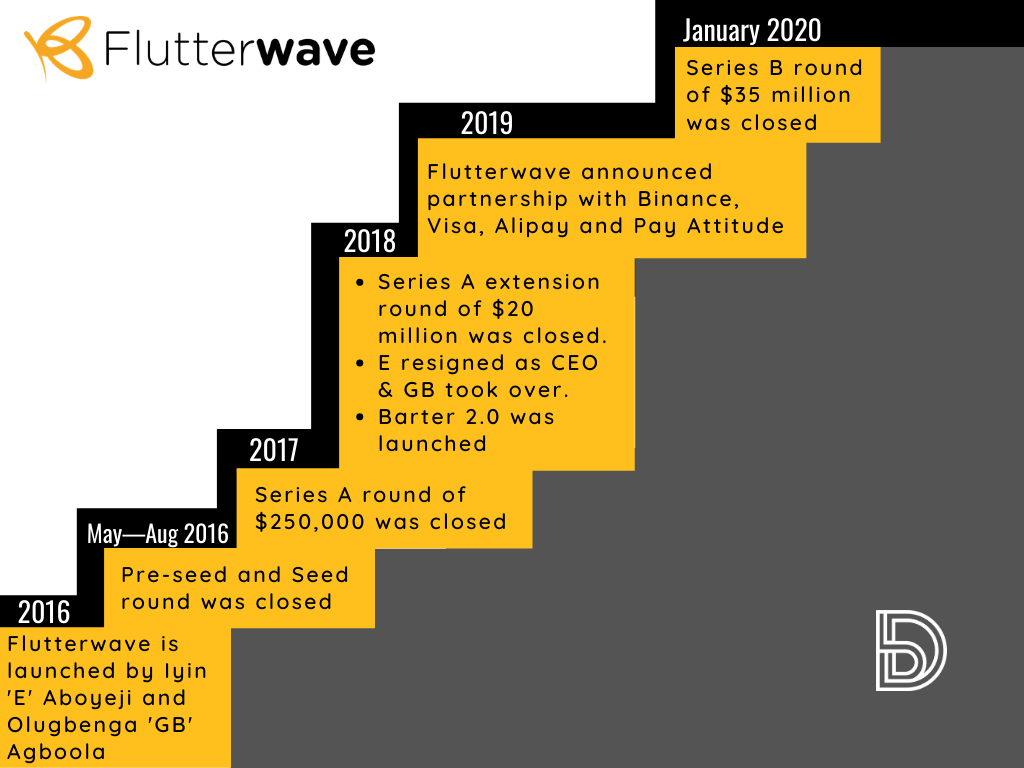

Flutterwave is a Nigerian fintech startup launched in 2016 by ex-bankers, entrepreneurs and engineers. It allows individuals and businesses to make and receive payments worldwide.

Related Article: Flutterwave says goodbye to co-founder Iyin, welcomes Visa CEO on Board

Everyday we get a little closer to our goal. Soon, when you make payments to your favourite airlines and on entertainment platforms, you'll be paying through Flutterwave.

The Series B funding round also comes with a partnership Worldpay—an American payment processing company acquired by FIS last year for $43 billion. GB explained that, with this partnership, any Worldpay merchant in Europe or the United States will be able to accept payment from Africans. "If someone goes to pay Netflix with an African card, it just works," GB told TechCrunch.

The partnership with Worldpay joins Flutterwave's expansive strategic partnerships. Flutterwave has partnered with Binance—a cryptocurrency exchange, Visa, Alipay, Pay Attitude and Ripple.

Related Article: What to make of Flutterwave's spree of strategic partnerships

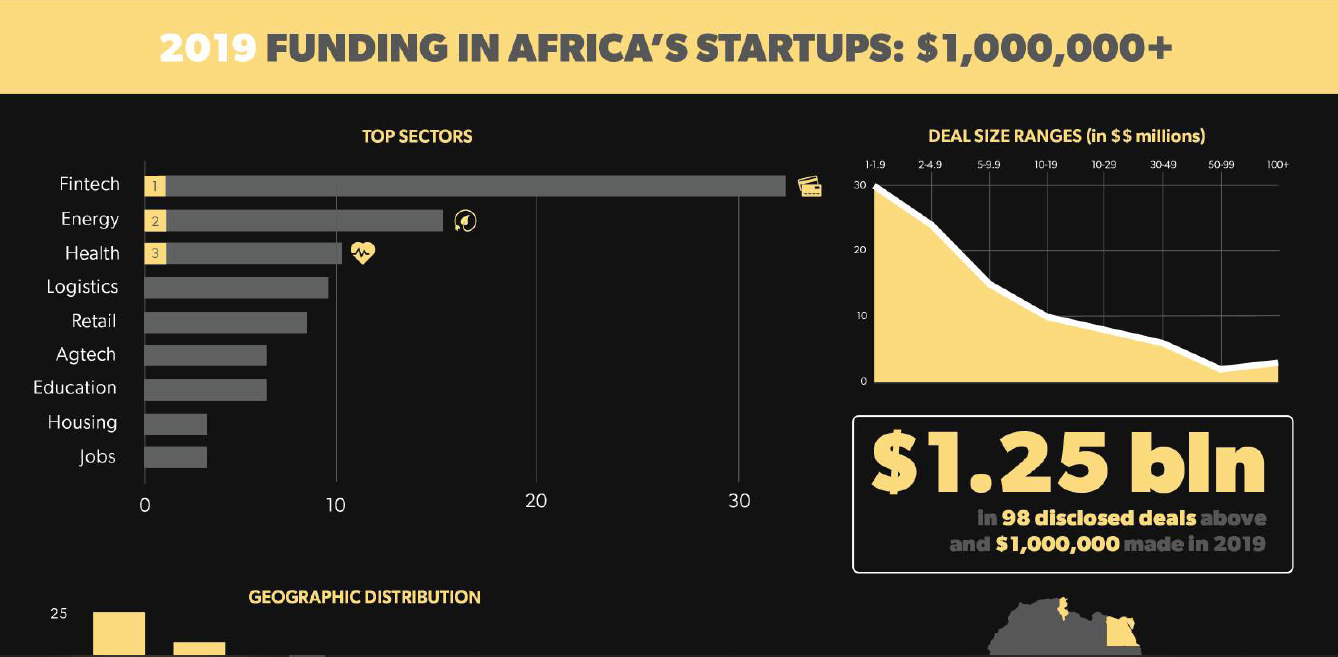

Flutterwave's series B funding is in tandem with the trend identified in the 2019 African startups investment report released by WeeTracker, Disrupt Africa and Briter Bridges. Fintech is the most attractive sector for investment in the African techcosystem. Last year, the most notable deal on the continent was the $200 million (₦72.5 billion) Visa invested in Interswitch—a Nigerian payment processing company priming for IPO later this year.

Going forward, Flutterwave says it will be expanding its array of solutions. "We don't just want to be a payment technology company, we have sector expertise. Education, travel, gaming, e-commerce and fintech companies all use our expertise," GB said.

Our business goes beyond payments. People don't want to just make payments, they want to do something. [So,] if you are a charity that wants to raise money for cancer research in Ghana, or you want to sell online, or you’re Cardi B who wants to do concerts in Africa, we want to be able to set up payments, write the code and create the platform for those needs.

With operations in Cameroon, Ghana, Kenya, Nigeria, Rwanda, Sierra Leone, South Africa, Tanzania and Zambia, Flutterwave solutions include Checkout, Virtual Cards and Invoicing. It plans to launch a Point of Sale (POS) service, payment links, payouts and subscriptions soon.