Flutterwave denies money laundering accusations from Kenyan authorities

Flutterwave has denied allegations of money laundering levelled against it by the Kenyan Asset Recovery Agency (ARA).

Flutterwave has denied allegations of money laundering levelled against it by the Kenyan Asset Recovery Agency (ARA). "Claims of financial improprieties involving the company in Kenya are entirely false, and we have the records to verify this." the fintech company stated.

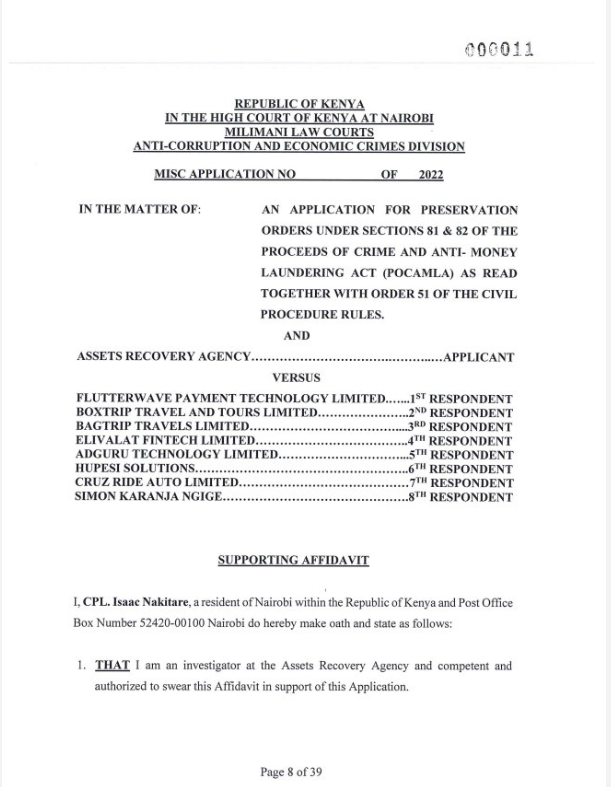

The Agency secured a court order to seize Sh6.2 Billion ($59 million), from 56 accounts belonging to Flutterwave, Boxtrip Travel and Tours Limited, Bagtrip Travel Limited, Elivalat Fintech Limited, Adguru Technology Limited, Hupesi Solutions, Cruz Ride Auto Limited and one Simon Ngige.

"These orders shall subsist for a period of 90 days as provided in section 84 of Proceeds of Crime and Anti-Money Laundering Act," Judge Esther Maina said in a ruling, pending a full hearing later in 7 November 2022.

"We are a financial technology company that maintains the highest regulatory standards in our operations. Our Anti-money laundering (AML) practices and operations are regularly audited by one of the big four firms. We remain proactive in our engagements with regulatory bodies to continue to stay compliant," Yewande Akomolafe-Kalu, Head of Branding and Storytelling at Flutterwave said in a statement.

ARA said that "investigations established that the bank accounts operations had suspicious activities where funds could be received from specific foreign entities which raised suspicion. The funds were then transferred to related accounts as opposed to settlement to merchants". According to ARA, Flutterwave is operating a payment service platform without authorisation from the Central Bank of Kenya (CBK). The Agency also claims there’s little to no record of transactions from customers paying for goods and services.

"Through our financial institution partners, we collect and pay on behalf of merchants and corporate entities. In the process, we earn our fees through a transaction charge, records of which are available and can be verified. As a business, we hold corporate funds to support our operations and provide services to all our customers." Akomolafe-Kalu added.

Flutterwave's operations in Kenya started in 2016. The fintech company's expansion into the East African country was achieved through a partnership with Kenya Commercial Bank (KCB), according to TechCabal. Their first Kenyan client was The Ticket Fairy, a YC-backed company that sells event tickets via card and M-Pesa payments. However, Flutterwave has not publicly declared the licenses that they hold in Kenya.

Olugbenga "GB" Agboola told Peoples Gazette that the bank order is politically motivated. "Why are Nigerian companies in Kenya being targeted by Kenya ARA?" GB said. "This is happening near their election time."

Other allegations against Flutterwave

In April 2022, Clara Wanjiku, an ex-employee at Flutterwave (who was responsible for its expansion into East Africa) claimed that Flutterwave's platform was used to fund an M-Pesa fraud in Kenya in 2019. In this report published by Nairobi News two years ago, Wanjiku claimed that her number was used as the contact person in a fraud that involved Flutterwave allegedly processing payments for non-existent sex parties in Thika, Kenya where participants were extorted.

Clara's allegations were followed by an article by a Nigerian journalist, David Hundeyin, where GB was accused of insider trading. According to Hundeyin, the Flutterwave CEO created a phantom "co-founder" identity to give himself more shares in the company’s early days.

However, in an email to employees on April 20, reported by TechCrunch, GB denied the allegations of impropriety and self-dealing. "The fact that the allegations of financial impropriety, conflict of interest and sexual harassment have been proved false or have already been reported, investigated and addressed by management matters less to me than the reality that these claims may have shaken your confidence in the company," he told Flutterwave workers.

Later in May, an online gambling company, 86fb/86z alleged that "[Flutterwave] maliciously froze our funds and intends to take the funds as their own and extort us by cooperating with the local police". Flutterwave denied the allegations stating that "some merchants were passing transactions on behalf of 86FB/86Z…without approval or authorisation." According to the fintech startup, the merchants involved were suspended from using the platform and all funds due to these merchants were settled.

What's the way forward?

Flutterwave recently employed Oneal Bhambani as its new Chief Financial Officer. An analyst said that "the appointment is so necessary as most of the issues raised in the [aforementioned] scandals were financial and an experienced CFO would have prevented or at least controlled the issues better."

Editor's Note: This is a developing story that will be updated as more details unfold.