REVIEW: My first impression of FairMoney - digital bank, instant loan app

This review walks you through my impression of the FairMoney loan app. I take you through five phases which are installation, onboarding, loan application.

Fairmoney is a digital bank that makes it easy to apply for a loan and receive it into your bank account in minutes. The features of Fairmoney loan app are quite similar to other instant loan apps save for some stand-out features. The simplicity of the app, instant disbursement of loans with no collateral needed and a flexible repayment plan are fascinating.

This review walks you through my impression of the FairMoney loan app. I take you through five phases which are installation, onboarding, loan application. Then I give my final thoughts on the app.

The download size of the FairMoney banking loan app on Google Play Store is 16 MB. The small download size is good for faster download on prospective users' devices and less internet bandwidth. It has over 5M+ downloads and has a 4.4 rating.

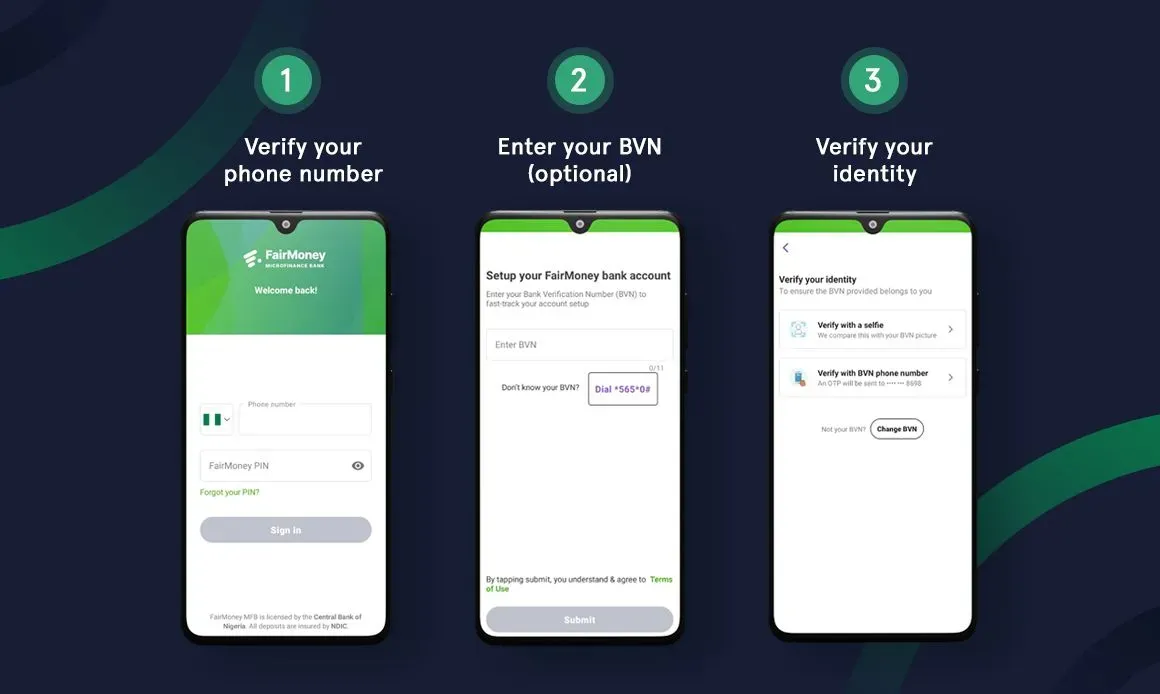

Sign-up and onboarding

Two things stood out while I was signing up on the FairMoney loan app. One, the benefits of the app are thoroughly captured via illustrations. Then, the fact that FairMoney MFB is licensed by the Central Bank of Nigeria and deposits are insured by NDIC. That creates trust in the mind of users. The use of bright colours, friendly user interface and nifty app tricks are also commendable.

In line with the mandatory tiered-KYC requirement of banks and OFIs, sign-up to FairMoney loan app was progressive and comprehensive. Thus, without visiting a bank branch, I was able to open a full-service level 2 bank account.

To begin:

- I entered my phone number

- FairMoney sent my number an OTP

- then, automatically detected the OTP

That way, it was able to verify that I was the holder of the phone number. Verifying phone numbers is the primary means of identifying users and that serves as the user’s account number in their database.

After verifying my number, it asked for my bank account pin which will be used to securely log into my account. Then, I entered my BVN (which is optional, as users can continue without BVN) to fast-track my account setup.

Then, I had to permit the app access to my location and device for identity authentication to enable security. I also took a selfie to verify my identity. Then my account was created. Users who want to raise their account to level 3 need to submit their residential address. These users had access to a daily transaction limit of up to ₦1,000,000. But to do this, the user needs to reach out to customer support through help@fairmoney.ng. I feel this is too much of a hassle, as simply providing a link on the app to submit my address should solve that. As a reward for joining, I was given ₦90.

On the FairMoney loan app, users can take a loan, save, send, and pay bills (airtime, data, electricity, internet, or Cable TV). Using any of these services will help the user build her credit score.

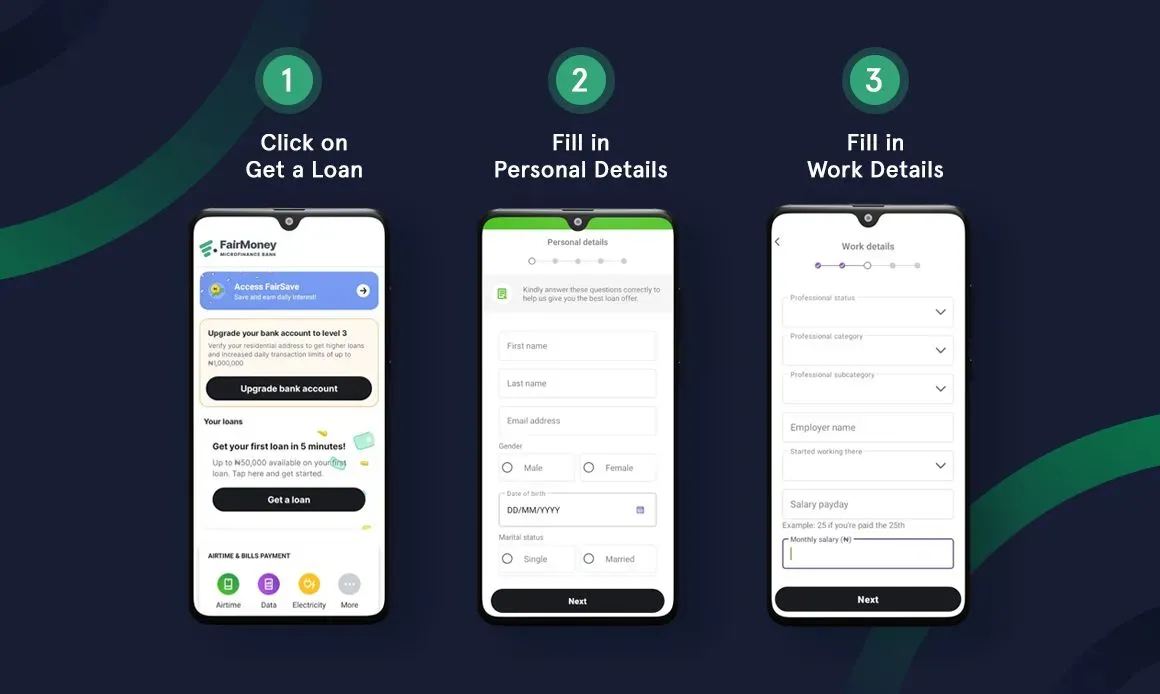

Loan Application

Obtaining a loan from a traditional bank is one of the arduous tasks anyone can do. To get a loan from a commercial bank, I would:

- walk into the bank branch.

- Convince the banking officer that I would not default.

- Provide collateral.

With platforms like FairMoney loan apps, the process is entirely different. I can access loans between ₦1,500 to ₦1,000,000 with repayment periods from 61 days to 18 months at monthly interest rates that range from 2.5% to 30% (APRs from 30% to 260%).

A typical example of a FairMoney loan

Borrow ₦100,000 over 3 months

Interest (total cost of the loan): ₦30,000 (30% rate)

Three monthly repayments: ₦43,333

Total amount payable: ₦130,000

Representative: 120% APR

To get my first loan in 5 minutes, I clicked a button on the home screen. I filled out the form asking for personal details like my first name, last name, email address, gender, date of birth, marital status, highest education, home address, and the state and city I live in.

Next, I entered my work details such as professional status, professional category, employer name, work start day, salary payday, and monthly salary. Then, I filled out my loan details with information like how much I needed, loan purpose, and how I found out about FairMoney.

After these, I had to consent to the terms of the loan which had some conditions:

I could ask for higher loans, get discounts and spread my payment in instalments if I repaid on time. Conversely, late payment attracted automatic debit, higher interest and the defaulter being reported to credit bureaus.

I clicked agree and submitted. Then I gave consent for FairMoney to collect the following information

- Geolocation to make sure I’m in Nigeria.

- Contact list to perform a better risk assessment.

- SMS to validate my income for credit profiling.

- Installed apps to assess my habit of using financial apps.

- Accounts to reach out to me via email.

- Storage to assess my habits and be able to make better credit assessments.

- Calendar to evaluate my application better and provide me with the best offers.

I granted them permission and they began the loan processing. I got feedback on the loan offers available for me within 10 minutes (could have been due to my poor internet connection). I qualified for a loan of ₦35,000. The interest rate was ₦5250 and I was to repay within 2 weeks. After I accepted the loan offer, my account was credited within 6 minutes.

Another thing about FairMoney…

I believe digital credit banks provide slightly better offerings than their competition.

FairMoney’s swiftness to advance the loans. Before digital credit banks like FairMoney came into limelight, I would have to enter a banking hall to apply for a loan. Submit collateral. Then wait for months before the loan is processed. But now, all I have to do is log in to my FairMoney loan app, and apply for a loan. And within 10 minutes I have the money in any bank account of my choice.

There are other features of the FairMoney app I didn’t get to experience. Like saving, sending, and paying bills.

However, I have issues with some things on the app. Whenever I try to log in, I need to verify my phone number and it requires sending an OTP code to my registered phone number. This can take minutes which can be frustrating.

In addition, the issue of granting FairMoney access to my contact list is not good enough. According to FairMoney, they do this to perform a risk assessment. I’m uncomfortable with the notion of revealing my credit history/details to my contacts.

Nevertheless, competition in the credit loan space is increasing. FairMoney has put a strong foot forward in my opinion. For me, their 100 free bank transfer and the flexible payment plan is a winners for me. You can visit FairMoney.io to learn more about what they are building.