Exploring the rumour and benefits of a potential Moniepoint acquisition of Payday

Moniepoint may acquire Payday last valued at $20 million. If the acquisition goes through, both parties could benefit from leveraging each other's infrastructure. Here is our analysis.

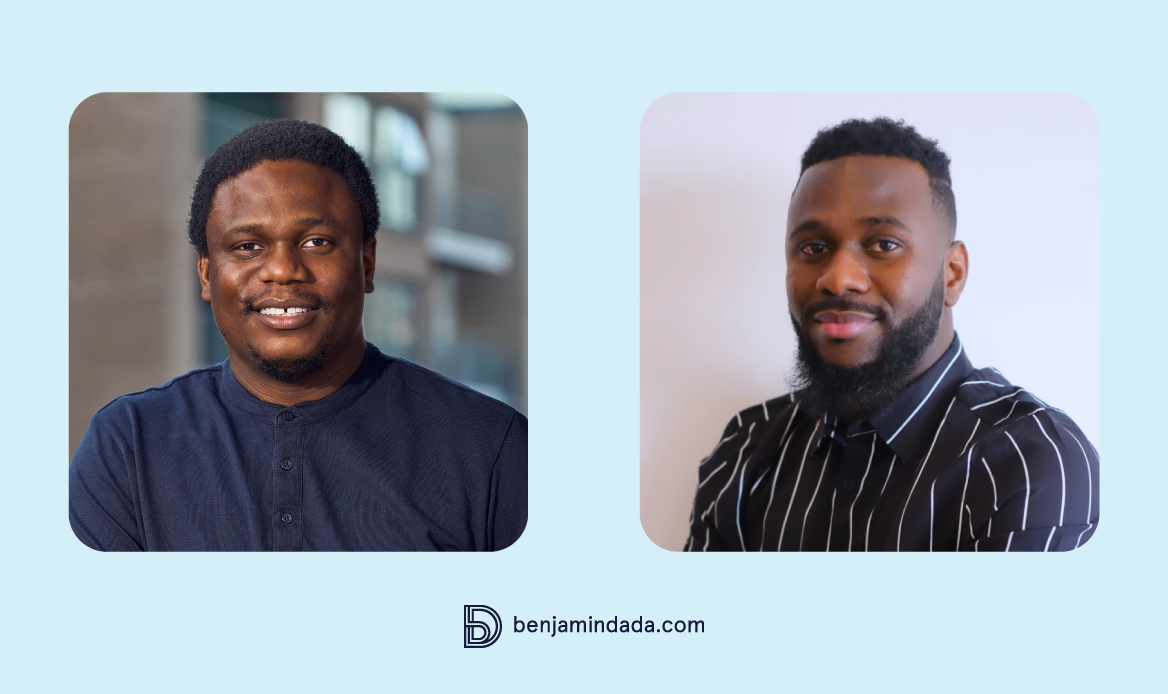

Two days after Payday announced its seed round led by Moniepoint, Weetracker reported that Moniepoint wants to acquire Payday in a cash and equity deal for under $40 million. The acquisition conversations reportedly began during Payday's seed round fundraising cycle.

However, Moniepoint has denied the news of an acquisition, and Payday has declined to comment. This has dampened any premature celebration of a new exit in Nigeria's most prominent tech ecosystem, which has already seen an exit in FairMoney's acquisition of Payforce.

Despite this, the rumoured $40 million acquisition price gives us a sense of Payday's valuation cap. TechCrunch reported that the lower bound was $15 million, so we estimate Payday's value to be around $27.5 million.

What is the reason for the secrecy from both parties, and is there any truth to the acquisition rumour?

Let's dive in and find out.

Five reasons why companies keep potential merger and acquisition news discreet

Proper management of a merger and acquisition (M&A) timing and messaging is necessary to minimise potential negative consequences for both parties involved. Here are five reasons why companies get touchy and defensive about possible acquisition news prematurely getting out:

- Competition and market impact: If news of a potential acquisition is leaked, it can provide competitors with valuable information about the acquiring company's strategy, potential growth areas, and market position. Competitors may try to sabotage the deal through a counteroffer or other tactics, such as launching a competing product or poaching key talent. For example, both Uber and Lyft expressed interest in acquiring Motivate, a bike-sharing firm. When Axios reported on the story, Uber declined to comment, which is standard practice. It's best not to speak about a potential acquisition until there is more certainty.