Nigerian CBN governor Cardoso's debut MPC meeting scheduled for February

Olayemi Cardoso is scheduled to chair his first monetary policy meeting as the CBN governor in February, as indicated by a tentative calendar released by the Bank.

The Central Bank of Nigeria (CBN) has published its 2024 Monetary Policy Committee (MPC) meeting calendar, starting in February. Olayemi Cardoso, who took office as the CBN governor in September last year, has not conducted any MPC meetings, having deferred at least two since assuming the role.

Amidst criticism from investors and financial analysts, particularly during economic challenges like inflation, Naira devaluation, and FX shortages, Cardoso defended the postponement in a keynote address at the 58th Annual Dinner of the Chartered Institute of Bankers of Nigeria in Lagos last year, stating that, "the Central Bank of Nigeria Act 2007 requires that the meeting of the Monetary Policy Committee of the bank be held at least four times a year, and the Bank has satisfied this requirement for 2023."

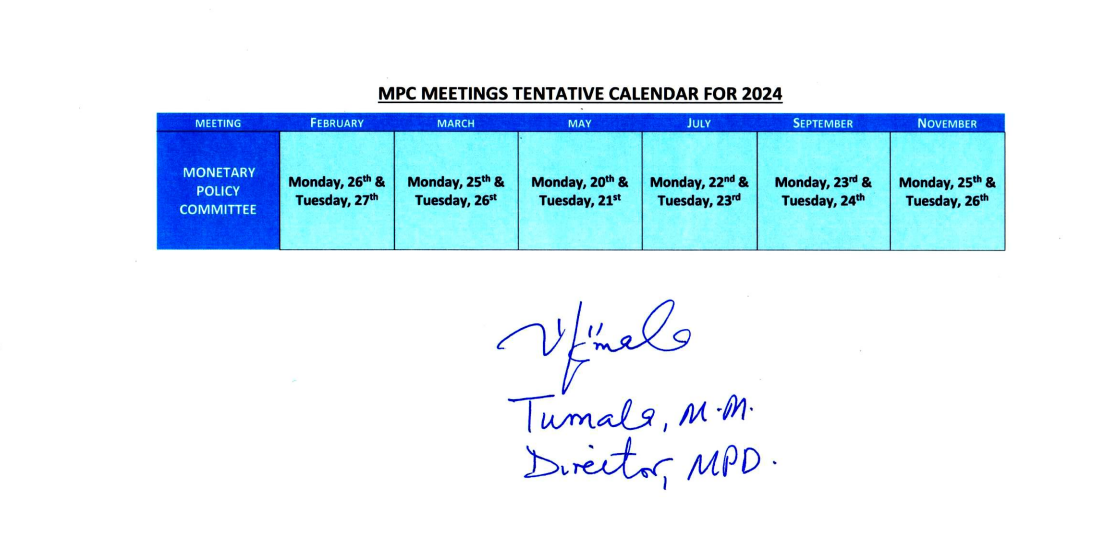

This year, the tentative schedule for MPC meetings shows that the CBN has set dates for six months: February, March, May, July, September, and November.

"The lack of a monetary policy meeting is, on the face of it, not a big deal. But the truth is that investors like certainty. A clear sense of a plan and what’s being done to tackle problems would help international investors and foreign businesses put off by fears that currency fluctuations would make it hard for them to repatriate their profits," Alexis Akwagyiram, managing editor of Semafor Africa, said.

As the top policymaking body of the CBN, the MPC reviews economic conditions, sets policy stance for the short to medium term, regularly assesses the monetary policy framework, and communicates decisions to maintain transparency and credibility in the transmission mechanism of monetary policy.

After the postponement of the MPC meeting in November last year, Cardoso said that "[the CBN] has critically reviewed the effectiveness of the central bank’s monetary policy tools and have spent time fixing the transmission mechanism to ensure the decisions of MPC meetings result in desired objectives".

On Monday, the National Bureau of Statistics announced, that the country's annual inflation rate rose to 28.92% in December 2023 from 28.20 per cent in November with food prices a key contributor. "While absolute inflation is still rising, the declining rate of growth indicates progress," Cardoso said.

Cardoso's upcoming MPC meeting next month might lead investors to expect a rise in interest rates. This move will counter the growing inflation.

This is a developing story