Carbon reports ₦112.6 million PAT and 2.2 million active customers

Carbon reported a profit after tax of ₦112.6 million in its 2019 financial result. Carbon also revealed that it has 2,272,997 active customers.

Carbon, a digital bank popular for its loan service, reported a profit after tax of ₦112.6 million in its 2019 financial result.

The neobank has now made its financial results for two consecutive years public. Both the 2018 and 2019 financial statements were audited by KPMG. This culture of transparency is laudable and worthy of emulation. Carbon is the operating brand of One Finance and Investments Limited (AKA OneFi). It was formerly known as Paylater.

Carbon said, "We're releasing our financial statements because we prioritize a culture of transparency and accountability at Carbon. Our customers trust us with their money, so it's only right we show them how we're doing as well as our plans".

According to the 2019 financial results, Carbon recorded a 60% increase in its total operating income. From a total operating income of ₦3.6 billion in 2018 to ₦5.7 billion in 2019. But its expenses also surged by the same proportion. From total expenses of ₦3.4 billion in 2018 to ₦5.5 billion in 2019.

Unsurprisingly, Carbon tax expense for the financial year ended December 2019 was ₦110.5 million. This represents a 5,615% increase from the preceding year. As a result, the profit after tax (PAT) dipped by 23%. From a PAT of ₦147.2 million in 2018 to ₦112.6 million in 2019.

Carbon also revealed that it has 2,272,997 (0r 2.2 million) active customers. Of whom 69.9% (or 1,589,766) are male and 30% (or 683,231) are female.

These are good numbers for an eight-year-old startup. Considering the fact it reported a loss of ₦111.2 million in 2017.

But the veracity of these numbers is dependent on the corporate governance of Carbon. Both the 2018 and 2019 financial results are unaudited and have no accompanying notes. A representative of the company said, "Maybe next year", our financial statement would have notes.

Why is it important for the financial statement to have notes? Financial statement notes are an integral part of the overall picture. The notes further explain the numbers in the financial statement and the accounting policies used to prepare it. The notes help people to interpret the financial statements.

However, the absence of financial statement notes does not seem to bother people. Even stakeholders in the tech ecosystem. "At least they are profitable", James Agada, Founder of Ixzdore Laboratories, said. "And they have always published their numbers. Which other 'startup' [does] the same?"

Startups are quick to throw numbers around to signal growth. And since they are private companies, they are only responsible to their board of directors and investors. Hence, the need for corporate governance.

Last month, OPay revealed that it has “five million uses and processes over 60% of mobile money transaction in Nigeria”. And Agada quipped, "PayStack processes over 60% of payments. OPay does the same for mobile money. Paga does the same. Nigeria must be very big".

Similarly, SafeBoda — a ride-hailing company operating in Ibadan — gave a cryptic report of growth. The Country Manager of SafeBoda, Babajide Duroshola, said, "65.77% growth in June vs the previous month".

In response, Olumide Olusanya, Founder of Gloopro said, "This is a vanity metric. Some people had 10,000% month-on-month growth in June. It means nada".

Other highlights of Carbon’s 2019 financial result

Carbon said it disbursed ₦23 billion worth of loans in 2019, representing 666.6% increase from the ₦3 billion disbursed in 2017. ₦13 billion worth of loans were disbursed in 2018.

The workforce of the digital bank also more than doubled in the year under review. As of December 2019, there are 144 "humans of Carbon" compared to 57 people working in the company in 2018.

Last year, Carbon introduced free bill payments and cheaper transfers. And as a result, the volume of transactions on Carbon increased from over 574,000 in 2018 to 5.5 million in 2019. The transactions were worth ₦3 billion and ₦51 billion, respectively.

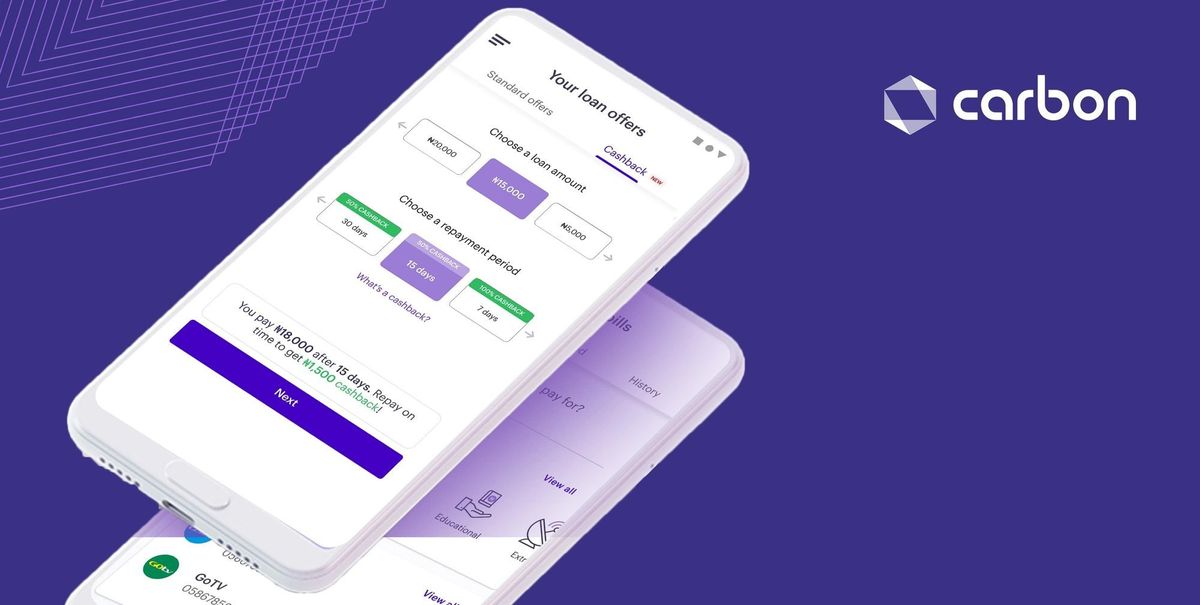

According to the report, Carbon released a Cashback feature last year. Within the first three months of launch, over 93,000 customers have repaid their loan on time. And over ₦130 million have been disbursed to them.

Carbon also expanded its operations to East Africa in 2019 by launching in Kenya.

Carbon’s 2020 so far

In response to the coronavirus pandemic, Carbon introduced loan rescheduling. It has rescheduled 9,016 loans so far. "This is far below what we expected", Chijioke Dozie, CEO of Carbon, said. "But we’ll continue to support all [our customers] who need assistance".

Carbon has also partnered with AXA Mansard to give customers health benefits. Eligible customers receive ₦20,000 to cover hospital expenses. It has served 5,673 people so far.

Other features launched by Carbon are:

- Free transfers. Carbon now offers free 30 interbank transfers every month.

- Periodic automated investment plans. Carbon users can now save fixed amount daily, weekly or monthly.

- Carbon Express: This allows users to carry out any transaction from any app, using Carbon’s custom keyboard.

Later this year, Carbon will be introducing small- and medium-sized enterprises account. It will also roll out a reward programme and virtual and physical debit cards.