Bank of Ghana launches Regulatory and Innovation Sandbox

Bank of Ghana has launched its Regulatory and Innovation Sandbox developed in collaboration with EMTECH Solutions Inc.

Following a successful pilot implementation, Bank of Ghana has launched its Regulatory and Innovation Sandbox developed in collaboration with EMTECH Solutions Inc., a Modern Central Banking Infrastructure provider.

The Regulatory Sandbox is open to all licensed financial institutions—banks, specialized deposit-taking institutions, payment service providers, dedicated electronic money issuers, financial holding companies and other non-bank financial Institutions and unlicensed FinTech startups that have innovative products, services or business models that meet the Regulatory Sandbox requirements.

According to BoG, innovations eligible for the sandbox environment will have to satisfy any of the following broad categories:

- New digital business models are not covered explicitly or implicitly under any current regulation;

- New and immature digital financial service technology; and

- Innovative and disruptive digital financial service products that have the potential of addressing a persistent financial inclusion challenge.

The Regulatory Sandbox Framework, user guide and access link to the platform can be found on the Bank of Ghana website to provide guidance and accessibility to interested licensed and unlicensed financial or non-financial institutions.

Sandboxes can have an important impact on a country's fintech environment—both directly and indirectly. Regulatory sandboxes may open space for improvements in financial inclusion through innovations—for example, biometric ID, alternative credit scoring, e-KYC, blockchain-based remittances, and new business models serving marginalized clients.

This is important because the success of financial inclusion largely hinges on the capacity of the financial sector to innovate. Innovation can address traditional barriers to financial inclusion such as legal.

According to Kwame Oppong, BoG's Director of FinTech and Innovation, "Bank of Ghana through this initiative, affirms its commitment to provide the enabling environment for innovation to promote financial inclusion, and facilitate Ghana's digitization and cash-lite agenda. With support from FSD Africa, we will engage various stakeholders including industry groups, associations and innovation hubs."

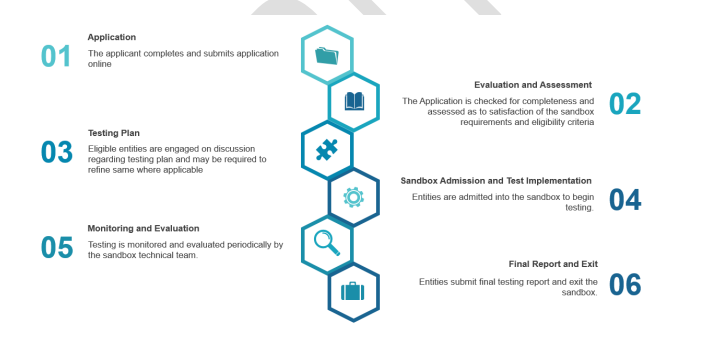

The BoG's Regulatory Sandbox will be operated in a hybrid model thereby fusing the cohort model and the rolling model. According to the whitepaper, the cohort model allows prospective applicants to submit applications during a specific application window.

However, the Bank of Ghana determines the subject matter areas for publication, for which innovative products, services and business models will be admitted into the Regulatory Sandbox subject to the meeting of all applicable requirements.

Meanwhile, the Rolling model allows entities seeking to test innovative products, services and businesses outside the subject areas published for a cohort, to apply at any time. The Rolling model shall be exercised at the discretion of the Bank of Ghana.

Other African Central Banks have also introduced sandbox to drive innovation in their nations. In June, the Bank of Uganda (BoU) hinted that it is open to the idea of crypto firms participating in its regulatory sandbox. The Central Bank of Nigeria (CBN) and Nigeria Interbank Settlement System (NIBSS) in 2021 launched a regulatory sandbox to facilitate digital innovation by financial technology companies in Nigeria