Anchor celebrates record-breaking year with ₦400B ($450M) transaction milestone

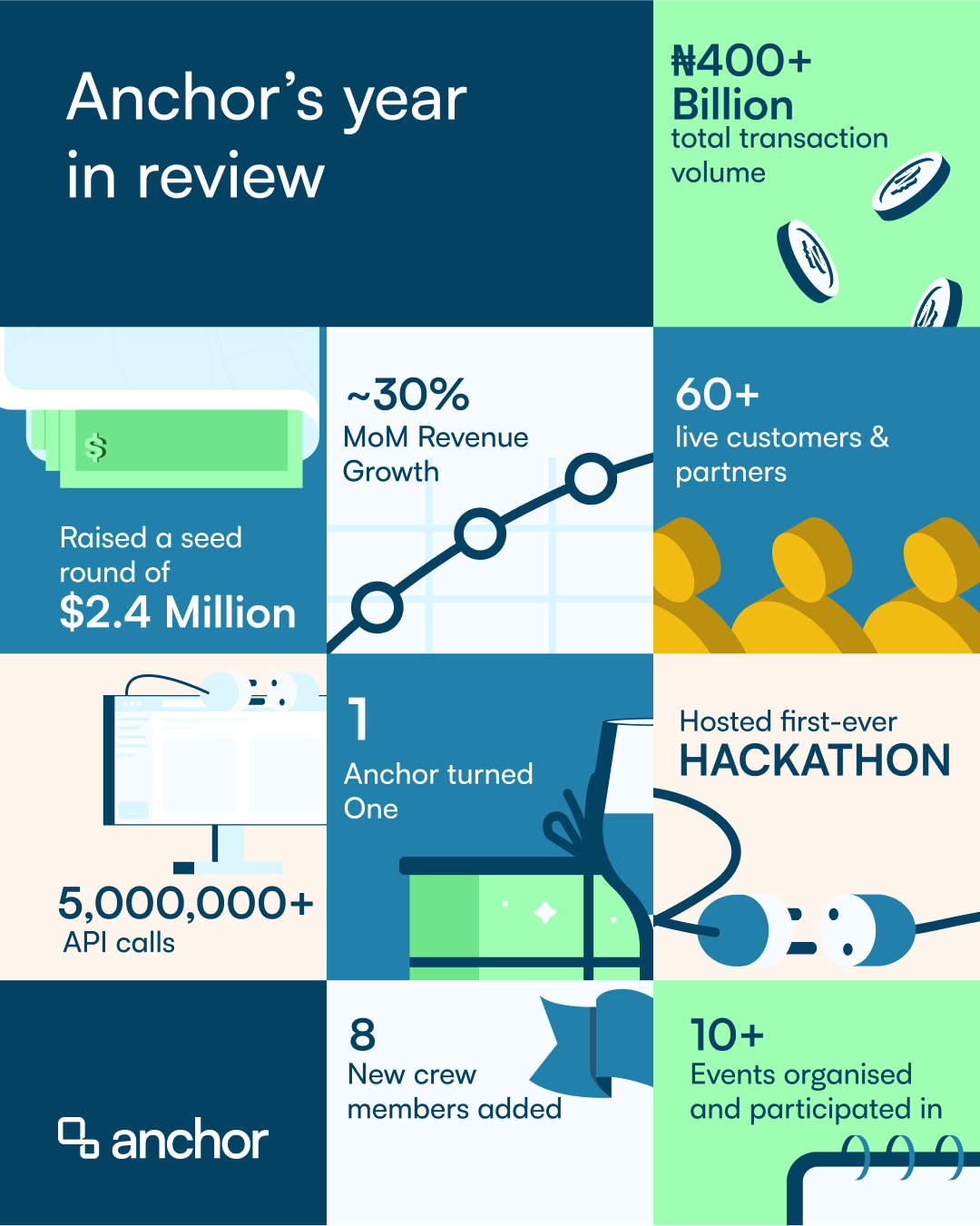

In 2023 Anchor processed over ₦400 Billion ($450 million) in transaction volume enabling 60+ live customers who depend on Anchor's APIs to power services across fintech, HR, logistics, e-commerce and many more industries.

Anchor, a Banking-as-a-service company that makes building compliant fintech products faster, has released an end-of-year review highlighting its key achievements over a year after its launch.

Founded after its CEO, Segun Adeyemi, a seasoned founder, experienced the painful process of obtaining licences, regulatory approvals and closing banking partnerships. Anchor was built to simplify this process for founders in the fintech space looking to launch products.

Currently, Anchor offers several APIs for fintechs allowing them to operate virtual accounts, conduct seamless KYC/KYB, issue virtual cards, set up savings & credit services, offer bill payments and much more.

As captured in its 2023 review, Anchor processed over ₦400 billion (~$450 million) in transaction volume enabling 60+ live customers who depend on Anchor's APIs to power services across fintech, HR, logistics, e-commerce and many more industries.

Anchor also got accepted into the prestigious Visa Accelerator Program joining an elite group of participants who will spend the next year building and scaling their products.

These milestones come after it announced its seed raise of $2.4 million in September 2023.

With more businesses across sectors looking to expand their product offerings to include fintech products, the market is primed for Anchor's continued expansion in 2024.

For now, the team reflects on a truly incredible 2023 in their end-of-year review.

Anchor creates APIs, dashboards and tools that help businesses easily embed, build and launch financial products. The YC-backed banking-as-a-service startup offers simple, well-documented API, dashboard and tools that make it easy to build, embed and launch financial products.

Some of their products include bank accounts, wallets, fund transfers, cards, savings, investments & credit products. With Anchor, a developer can build unique products like a digital bank for women or a savings account for farmers; a retailer can offer its own-branded loyalty cards or HR software.