How Africhange is serving the remittance needs of African Canadians

Africhange enables anyone in Canada to send money to Nigeria, Ghana and Mexico at the best rates, without unnecessary fees.

African countries have a lovely immigration relationship with Canada. And the blockchain-based remittance company Africhange Technologies Limited is making that relationship sweeter.

Africhange was launched in December 2020 to enable anyone in Canada to send money to any African country at the best rates, without unnecessary fees. It started with Nigeria and has now added Ghana and Mexico, with more countries and features in the pipeline. Africhange reported that over 46,000 transactions worth more than $15.3 million were completed on its platform last year.

According to the 2016 Canadian census, 3.5% (or 1,198,540) of the North American country’s population are black — people of full or partial Sub-Saharan African descent who are citizens or permanent residents of Canada. This represents a 26.7% increase from the 945,665 African Canadians reported in the 2011 Household Survey.

But Canada has not always been this welcoming. There was a time when Africans were less than 1% of new immigrants to the country. And even recently, Canada was one of the countries that hastily banned flights from African countries to supposedly slow down the spread of the Omicron virus. According to the Organisation for Economic Cooperation and Development, Canada has "the most elaborate and longest-standing skilled labour migration".

Through their elaborate immigration policy, Canada gets skilled workers who are productive and contribute more to economic activities than they consume, Nonso Obikili, a development coordination officer at the United Nations, said. Surely, more people will join the black population in Canada in the coming years.

And these African immigrants don’t cut ties with their countries of origin, at least not completely. Nonso added that these skilled workers send money to their relatives back home and this remittance is a crucial source of revenue for their home country.

The World Bank reported in 2018 that while Canada received $1.36 billion in remittances, it sent $5.33 billion abroad. And a study conducted by Statistics Canada — the national statistical office of the Canadian government — showed that the total amount sent abroad in 2017 was $5.2 billion. Of that amount, 27.5% went to Southeast Asia and Oceania, 22.6% went to Southern Asia, 11.3% to the Americas, and 9.7% to Sub-Saharan Africa.

So it makes sense that an immigrant-founded company is addressing the remittance needs of Nigerians, Ghanaians, and other African immigrants in Canada. "We understand that remittance sent back home plays an important role, and cutting transaction costs would significantly help recipient families", Africhange explained. "Our goal is to save you money with low-cost international money transfers and competitive currency exchange pricing".

Why you should use Africhange to send money from Canada to Ghana and Nigeria

According to Statistics Canada, sending $200 from Canada abroad would cost you, on average, 9.4% of that amount, while for $1,000 and higher, it’s 1.6%. The World Bank data, however, shows that the average remittance sending costs have steadily declined from 9.7% in 2014 to 7.7% in 2019. This decline in cost corresponds with the proliferation of remittance service providers (RSPs) in the North American country. The number of RSPs have increased from 99 in 2014 to 140 in 2019.

Africhange is one of these 140 RSPs. And it has the best rate compared to other international remittance companies such as Wise, Western Union, WorldRemit, MoneyGram, Ria and Xoom. For instance, if you’re sending $200 to Ghana, Wise charges 2.4%, Western Union charges 4.6%, and WorldRemit charges 6.11%. But Africhange is free.

Serious? Naira dey dip daily for lemonade

— bobbygram ³⁴ (@bobbitwist) September 17, 2021

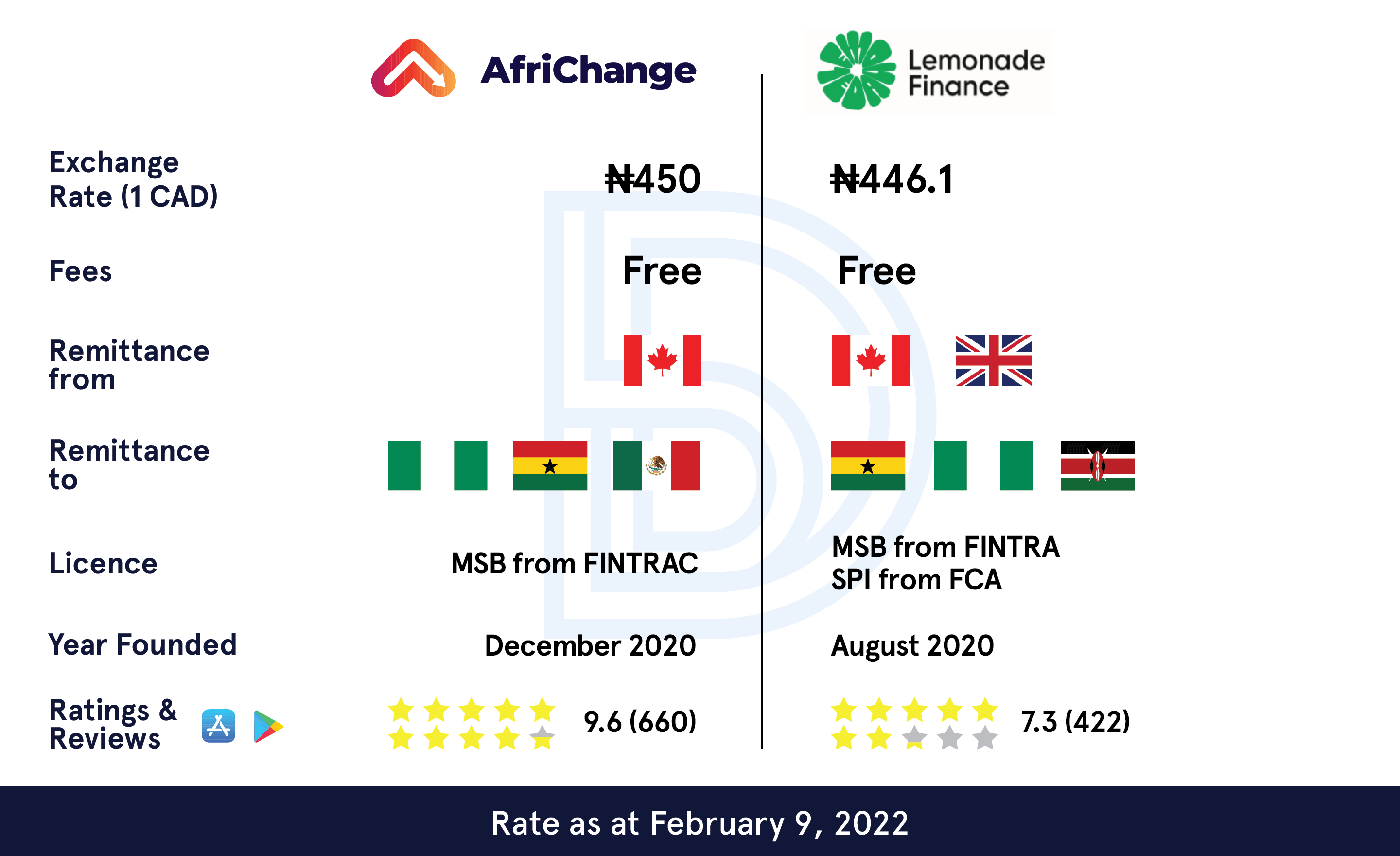

The chart below compares Africhange and Lemonade using seven parameters: exchange rate, fee, remittance from, and to, licensing, year founded, and ratings and reviews.

I particularly like Africhange transparency. You can see their exchange rate on their website and anyone can easily check out the app. But Lemonade seems to be secretive. The exchange rate is elusive and I couldn’t even register on their app because I don’t have a Canadian or British phone number (I relied on reports from friends in Canada).

And I'm not the only one with this gripe. The co-founder of CVLoft Funke Onafuye asked how she could receive payments from Ghana on Twitter. Someone replied, "Lemonade Finance has got you". But Funke couldn't even get past the signup page because she's not in the United Kingdom or Canada.

Yet I need to be in UK or Canada to create an account? pic.twitter.com/SPEk41nSqf

— A. Onafuye (@FunkeOnafuye) February 4, 2022

According to Statistics Canada, convenience for the sender and receiver is the most important factor when deciding how to send remittances from Canada. It is closely followed by the reliability of the method and price. Africhange caters for all these factors.