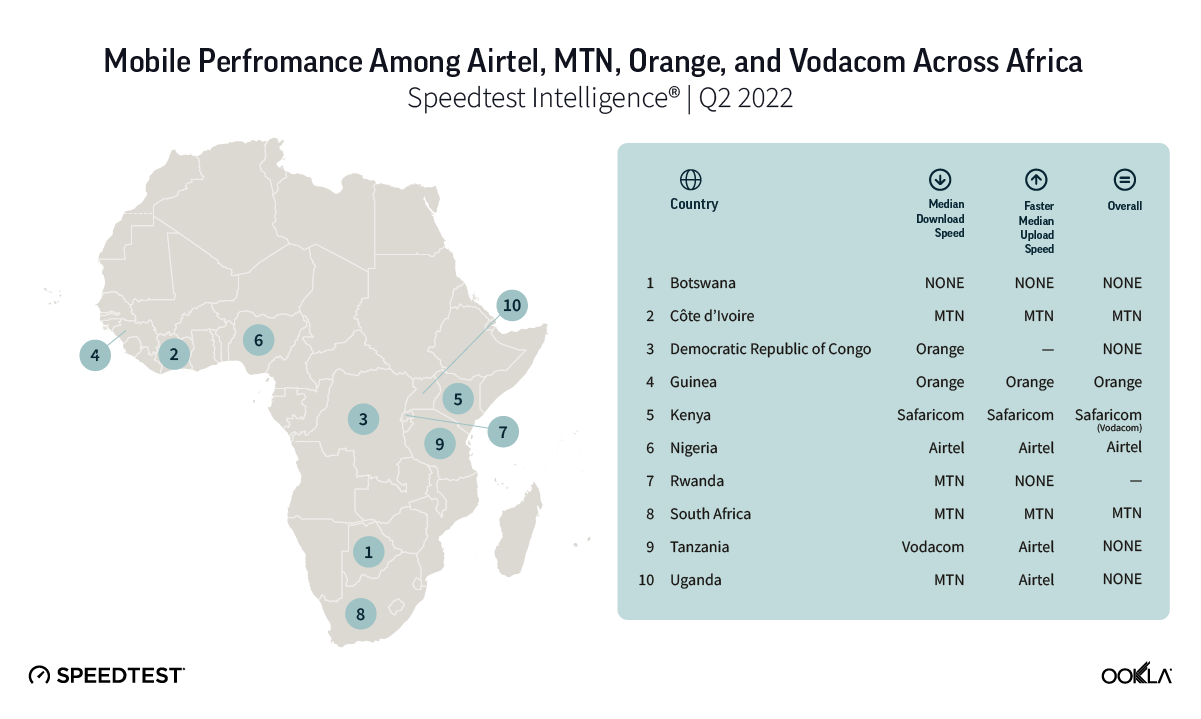

Ookla analysed the mobile performance of African telecoms in Q2 2022, MTN South Africa delivered the fastest median download speed in the region.

As of Q2 2022, MTN Nigeria commanded 38.9% of Nigeria's mobile users, with its 74.1 million subscribers almost double that of Airtel’s 46.0 million, Yet when it comes to mobile performance, Airtel Nigeria was ahead of MTN; in Q2 2022, according to data analysed by Ookla—a global leader in network intelligence and connectivity insights.

Airtel Nigeria recorded a median download speed of 30.35 Mbps and a median upload speed of 10.28 Mbps, both of which topped those of MTN (26.30 Mbps download and 9.13 Mbps upload).

According to the analysis, the aforementioned speeds are set to increase as both companies have invested heavily into network infrastructure, with a combined investment of N208.5 billion ($502 million). The investment translates into an increase in 4G Availability as well. In Q2 2022, MTN had 83.8% 4G availability compared to Airtel's 77.9%.

Outside of Nigeria, MTN outperformed Orange in Côte d’Ivoire and Vodacom in South Africa, both in terms of median download and upload speeds: When it comes to mobile speeds in capital cities, it is not surprising that cities that have 5G networks came top of the list. As such, Johannesburg led the pack, with a median download speed of 66.54 Mbps, ahead of Cape Town at 49.22 Mbps.

Vodacom got ahead of MTN in Johannesburg and was the fastest operator across the 12 cities that Ookla analysed, with a median download speed of 81.36 Mbps in Q2 2022 compared to 73.83 Mbps in Q1 2022. MTN was faster in Cape Town. Taking 5G out of the equation, Orange in Gaborone, the capital city of Botswana, achieved median download speeds of 39.46 Mbps.

While MTN had better download speed in the Democratic Republic of Congo, in Rwanda MTN performed better than Airtel with regards to median download speed. Orange took the top spot in Guinea, Airtel in Nigeria, and Safaricom in Kenya.

In the rest of the countries, the difference in mobile performance was either not statistically significant or there was not a single operator that delivered a better performance both upstream and downstream, Ookla revealed.

The market share of African telecoms

Uganda: MTN’s 53.9% market share in Uganda translates to 16.3 million subscribers as of Q2 2022. Meanwhile, Airtel Uganda had a 45.1% market share (13.6 million).

Rwanda: MTN Rwanda increased its customer base by 1.7% year-on-year (YoY) to 6.6 million as of Q2 2022, expanding its lead in customer market share by 2.7 pp to 65.6%, Airtel controlled the remainder of the market.

Botswana: Mascom (MTN) is the largest operator in Botswana, with 1.8 million subscribers in Q2 2022 and a 42.2% market share. Orange is the second largest operator, ending Q2 2022 with 1.7 million subscribers and 41.2% market share.

Côte d’Ivoire: MTN had a 38.9% subscriber market share in Côte d’Ivoire as of Q2 2022, which equates to 15.8 million subscribers, Orange ended Q2 2022 with 14.6 million subscribers (36.0% market share).

Guinea: Market leader, Orange, which switched on its 4G network in 2019, accounted for 60% of mobile connections in Q2 2022 in Guinea, ahead of MTN (30.8%). According to telecom regulator ARPT, in Q4 2021, Orange held a 69.9% market share of mobile Internet traffic, while MTN held 26.9%.

Kenya: Safaricom is the largest operator in Kenya by a mile, with 67.1% market share (equivalent to 42.7 million connections) ahead of Airtel 25.9% (16.4 million).

Tanzania: Tanzania’s mobile market is served by seven mobile operators, making it one of the most competitive markets in Sub-Saharan Africa. Vodacom ended June 2022 with 15.6 million subscribers, which translated into a 28.8% market share, GSMA Intelligence estimates that Airtel held a 27.4% market share in Q2 2022, equivalent to 14.8 million subscriptions.

Editor's Note: All the data referenced in this article was analysed and shared with Benjamindada.com by Ookla.