VC funding in Nigeria plunges 92.1% in Q1 2023

Venture capital (VC) funding in the Nigerian tech startup ecosystem declined by 92.1% in Q1 2023 compared to the same period in 2022.

Venture capital (VC) funding in the Nigerian tech startup ecosystem declined by 92.1% in Q1 2023 compared to the same time in 2022. Last month, we told you that funding announcements have slowed in Africa, with early- and growth-stage funds retracting their steps due to the "tightening" economy.

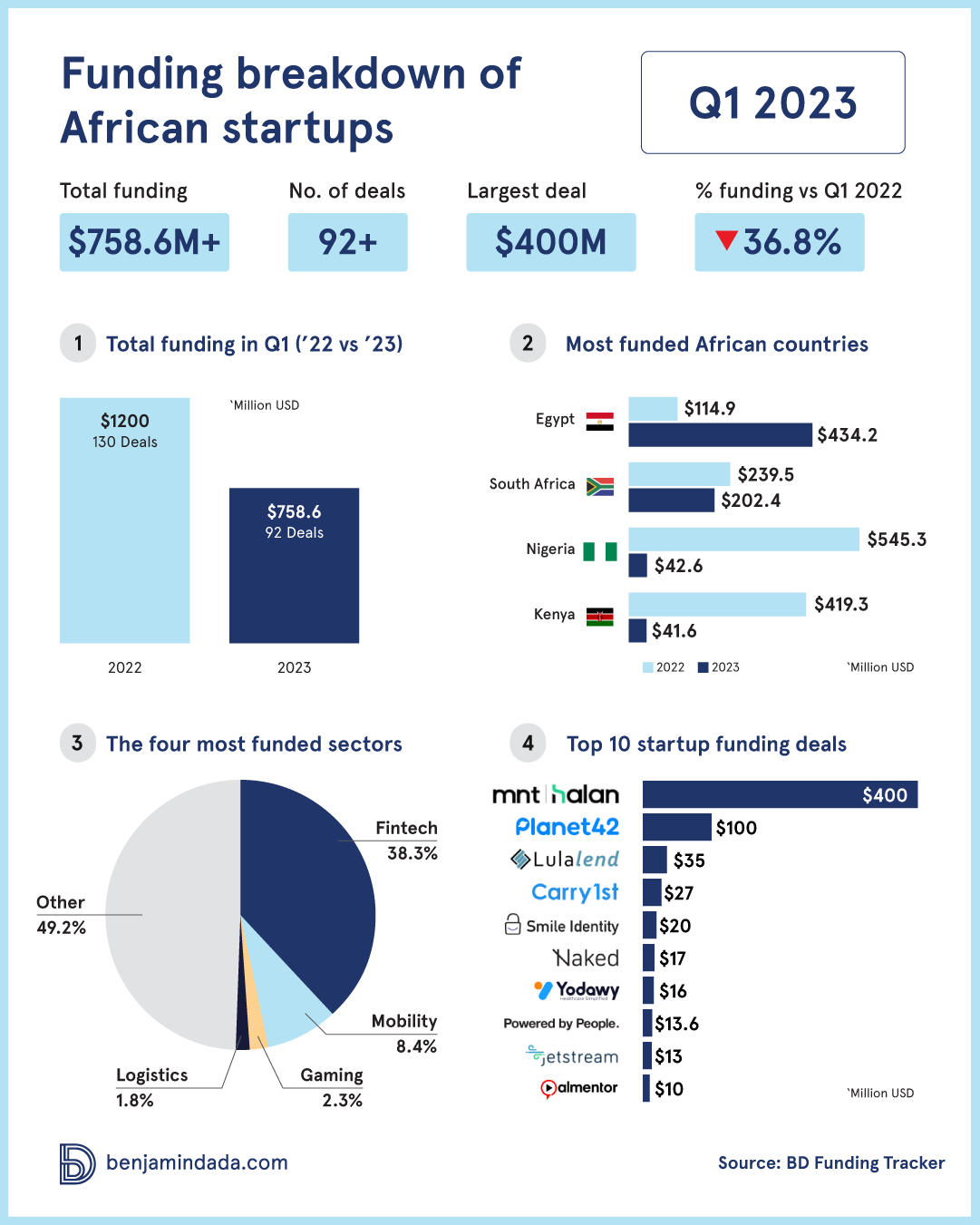

Last year, Nigerian startups led African VC funding in Q1 with $545.3 million. However, startups based in the country secured only $42.6 million between January and March this year across 32 deals, according to BD Funding Tracker.

That is 5.6% of $758.6 million—the total amount raised by African tech startups within the period under review; Nigeria dropped two spots from its top position within the Big Four countries.

Earlier this year, Bruce Nsereko-Lule, a general partner at Seedstars Africa Ventures, said that African startups will find fundraising challenging due to the global economic slowdown trickling due to inflationary pressures and tightening monetary policy. "Investors on the continent will maintain a judicious approach to investment," he said.

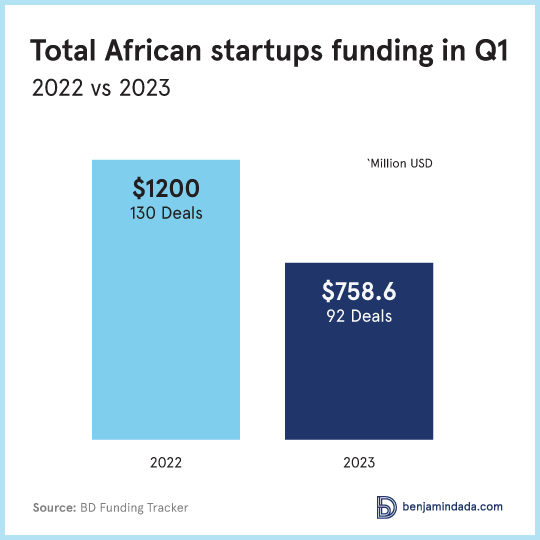

Compared to Q1 2022, funding for African tech startups plunged by 36.8%, and the number of deals also dropped to 92 from 130, a 29.2% decrease. From its bottom position within the Big Four in Q1 2022, Egypt grew by 277.8%, becoming the most funded country on the continent last quarter—raising 57.2% of the total funding, followed by South Africa, Nigeria and Kenya.

"Outside of the market correction we’ve had over the last 12 months, the fundamentals of many leading African tech startups are at levels that would ordinarily command a unicorn valuation," Zachariah George, Managing Partner at Launch Africa Ventures, told Benjamindada.com. "Nonetheless, they’re delaying their next raises until the market gets better instead of raising at flat or down rounds caused by macro-economic market correction despite better fundamentals. So yes, there will be more unicorns in Africa, but mainly when the market has improved."

Despite the dominance of The Big Four, Zachariah, whose VC firm is arguably the most active investor on the continent, says, "I believe some of the markets worth investors’ attention include: Senegal, Côte D’Ivoire, Morocco, Tunisia, Ghana, Uganda, Tanzania, DRC, and Ethiopia. These countries have massive addressable markets."

However, Peter Oriaifo, Principal at Oui Capital argues that "in uncertain times, investors will seek to de-risk an already risky investment by concentrating capital in markets where the revenue opportunity is exponentially large," adding that "capital will concentrate further on the big four markets—Egypt, Kenya, South Africa, and Nigeria."

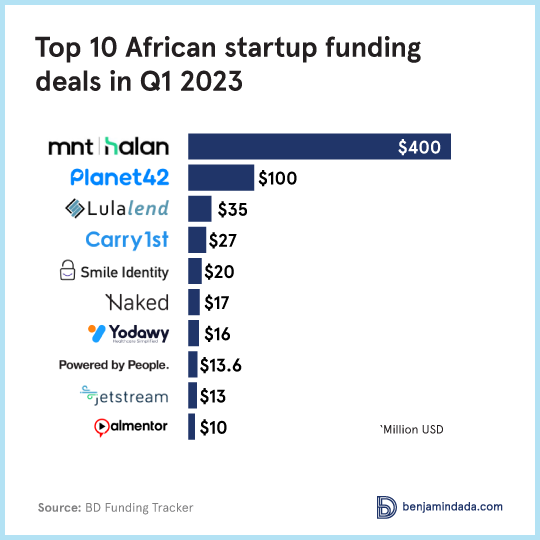

Four of the top 10 major deals in the quarter were from South Africa, three from Egypt and one each from Nigeria, Kenya and Ghana.

Until September 2021, Tabby was operating in the Middle East only—Saudi Arabia, UAE and Kuwait—it expanded into Egypt but shuttered its operations within six months of operations.

RapidDeploy's $34 million growth fund is also omitted for the same reason. Although founded in South Africa, its primary market is the United States.

Related Article: How is BD Funding Tracker curated?

Amidst the funding slowdown, investors are still bullish on fintech. The sector remained the most funded by the number of deals, raising 60.6% of the total deals across 22 deals.

The decline in VC funding last quarter will likely impact the overall funding at the end of 2023. Why? Last year, the VC funding in Q1 comprised almost half the total funding raised by African tech startups in 2022.

"It is always hard to compare quarters year on year when you are in a turbulent time, and we have definitely seen some unexpected developments since last year. A retreat of some international funds and major losses for international LPs (that remain a large source of funds for African VCs than domestic LPs) has indeed affected sentiment around investing—with several VCs delaying final close on new funds and slowing down their investments towards the end of 2022 and the start of 2023," Mark Kleyner, co-founder of Dream VC told Benjamindada.com.

African-focused VC funds that we tracked in Q1 2023

According to BD Funding Tracker, African-focused VC funds raised at least $1.4 billion in Q1 2023, including Nigeria's $618 million iDICE fund and the $377 million Vantage Capital's mezzanine fund.

On Tuesday (April 4, 2023), a Nigerian shared mobility startup, Shuttlers, announced that it has raised $4 million in equity funding led by Verod-Kepple. This leading investment firm launched a $43 million pan-African fund to invest in early-stage startups on the continent.

However, as Nsereko-Lule said, investors are more likely to maintain a judicious approach to investment in the coming months.

"Multiple new VC funds have been raised and they will start to deploy as we move into the next quarters," Kleyner added.

During #BDTalks last week, Ventures Platforms' General Partner, Dr Dotun Olowoporoku, while encouraging founders to pitch their ideas to the VC firm, he said, "Amidst the economic downturn, investors are still backing entrepreneurs who are building stellar products." Late last month, Ventures Platforms led a $1 million seed investment into Fez Delivery, a Nigerian last-mile logistics startup.

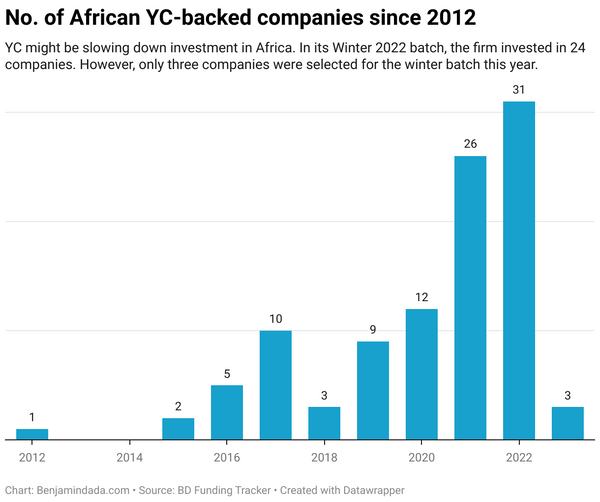

Conversely, some funds that invest in the continent, including South Africa's largest early-stage VC fund of approximately $77 million, Naspers Foundry Fund and Y Combinator's $700 million fund, shuttered last quarter. YC's investment in Africa also slowed down last quarter compared to previous years.

Our next article will explore mergers and acquisitions in Q1 2023.