Eight notable African tech stories in May 2022

In May 2022, Ethiopia launched its 5G network, Interswitch raised $110 million in investment, and we curated these and other notable stories.

As we commence June, let’s look back on some of the notable stories that broke in the African tech ecosystem in May while we wait for what the last month of Q2 2022 holds.

Ethiopia launched 5G

Ethiopia-owned state-owned operator Ethio Telecom launched a 5G mobile phone service to stay ahead of competition from new entrants in an industry that has been closed to international players. According to Ethio Telecom’s CEO, Frehiwot Tamru, the 5G service has been launched in selected places in Addis Ababa, including Bole International Airport and the Ethio Telecom headquarters.

Ethio Telecom, which has 64 million subscribers across the nation, said in a separate statement that China's Huawei Technologies (HWT.UL) was its equipment supplier for the network worth over cost $40 million.

Currently, about 81 countries across the globe are that are testing or rolling out 5G. Out of these 81 countries. In Africa, 6 countries—South Africa, Kenya, Mauritius, Botswana, Zimbabwe, and Seychelles— aside from Ethiopia have launched 5G. Nigeria will likely be next considering that August is slated for the official rollout since MTN and Mafab have recently acquired their operating licenses.

Interswitch raised $110 million

Interswitch secured a $110 million joint investment from LeapFrog Investments and Tana Africa Capital to scale its digital payment services across the continent. Even though, the actual deal value was not disclosed. TechCrunch reported that it was a $110 million investment— this amount is within the average ticket size of both investors.

In 2019, Interswitch announced its billion-dollar valuation stating that Visa acquired a minority stake. Meanwhile, several media reports claimed that Visa paid $200 million for a 20% stake in Interswitch. The 2019 funding made Interswitch the second African unicorn.

Currently, Interswitch operates two Fintech products: Verve – a debit card scheme that operates across Africa, with over 35 million cards issued since it began operations; as well as Quickteller, a popular multichannel consumer and business payments platform.

Jumia's $47.6 million Q1 2022 revenue

In its Q1 2021 report, Jumia reported that it raised revenue of $47.6 million between January and March— this is 44% more than its revenue in Q1 2021. The report also stated that Jumia had 3.1 million active customers, it also processed 9.3 million orders—the fastest growth rate of the past 9 quarters.

From its Q4 2021 financial report, Jumia said it finished the year with $512.8 million ($117.1 million of cash and cash equivalents and $395.7 million of term deposits and other financial assets). These figures now stand at $421.2 million, $88.7 million and $332.6 million, respectively, as of March 31, 2022.

Autochek’s North Africa expansion

Autochek acquired KIFAL Auto, making it the first major expansion of a West Africa-based startup into North Africa. The acquisition will drive Autochek’s expansion into North Africa.

KIFAL Auto was founded by Nizar Abdallaoui Maane (Essec Paris graduate and former BNP Paribas consultant) in 2019 to transform the automotive experience in Morocco by providing a seamless process for buying and selling used cars, and enabling access to financing, warranties, insurance and other value-added services.

Autochek is building the financial infrastructure to drive the penetration of auto financing across Africa, powered by a data analytics engine that makes it easier for financial institutions to offer credit to consumers. It has existing operations across West and East Africa—Nigeria, Ghana, Ivory Coast, Kenya and Uganda, a partner-led retail footprint in over 1,500 dealer and workshop locations, and more than 70 banking partners including Access Bank, Ecobank, UBA, Bank of Africa and NCBA Bank.

Uber completed one billion rides in Africa

Uber announced that it has completed a billion rides across its African routes, which is over 10 billion kilometres in distance. Uber made its debut arrival in Africa with South Africa as its first market in 2013.

Currently, Uber is present in Nigeria, Ghana, Egypt, Kenya, Tanzania, Uganda and Ivory Coast and it has created over 6 million economic opportunities in over 50 cities across sub-Saharan Africa. Within 2021, Uber expanded to over 30 cities across its major African markets; twenty-one in South Africa, four cities each in Kenya and Nigeria, and two in Ghana.

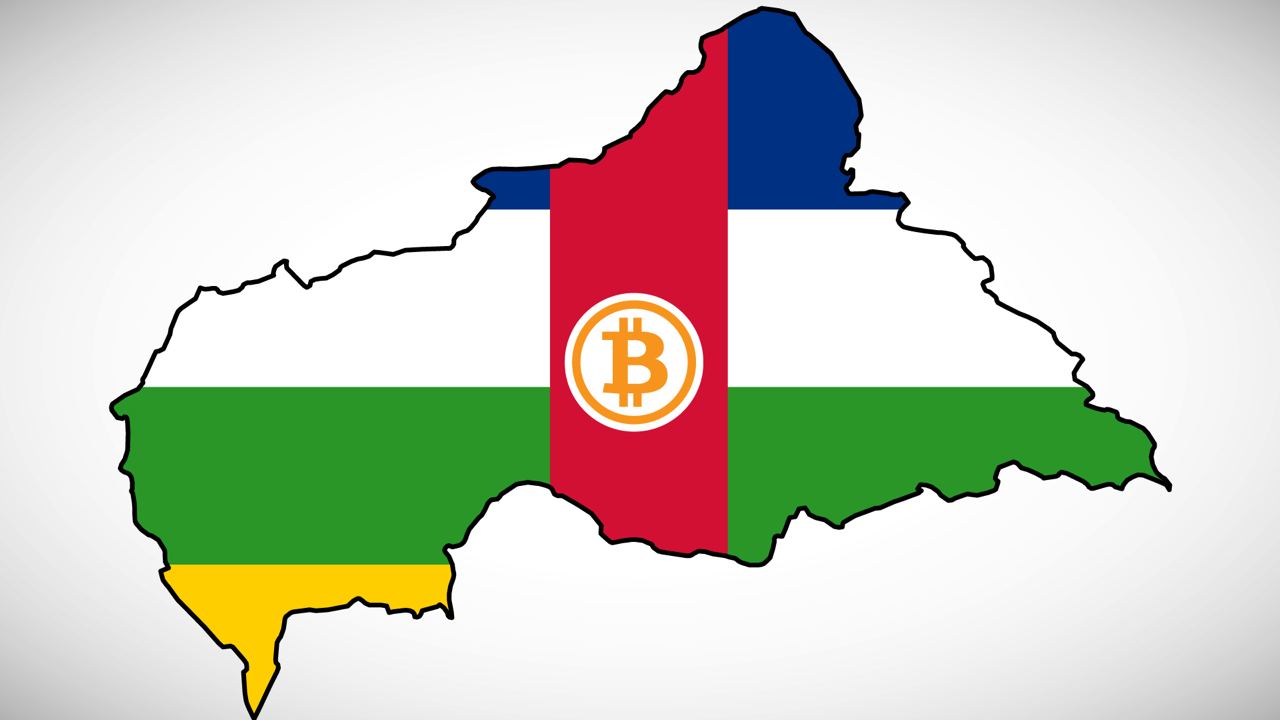

Central African Republic plan to build a crypto hub

Central African Republic, CAR has announced its plan to create a “crypto economic zone” that will enable people to transact using Bitcoin and other cryptocurrencies tax-free—backed by the CAR's "Bitcoin law" which also specifies the establishment of the National Agency for Regulation of Electronic Transactions.

The initiative is tagged “Project Sango”, it intends to attract crypto professionals and enthusiasts to work and live in the country, according to a whitepaper released by CAR. As part of plans to implement the initiative, the nation will establish a Digital National Bank.

This came a month after CAR adopted Bitcoin as legal tender. Making it the first African country and the second country in the world to make the adoption—after El Salvador.

Starlink has been approved in Nigeria and Mozambique

Starlink, the satellite internet service launched by SpaceX, has been approved in Nigeria and Mozambique, Elon Musk tweeted last week. In Nigeria, Starlink has acquired the International Gateway license and Internet Service Provider (ISP) license and will be trading as Starlink Internet Services Nigeria Ltd.

Since the announcement, they have been several arguments as to the affordability of Starlink, especially to average Nigerians and considering that the company targets rural “unconnected” users.

Egypt's Swvl laid off a third of its workers

Following the global economic downturn, several [tech] companies are laying off staff and pausing hiring to minimise expenses—Netflix laid off 2% of its workforce, and Twitter also fired some of its key executives to adapt to the “challenging economy”.

In the most recent move, Swvl announced that it would be laying off 32% of its entire workforce. Swvl’s Chief Financial Officer, (CFO) Youseff Salem, said the layoff intends to “prioritise profitability overgrowth to ensure that Swvl thrives once we are on the other side of this”.

Swvl went public in April via Nasdaq—a Special Purpose Acquisition Vehicle (SPAC) with Queen’s Gambit Growth Capital. This deal landed the company a valuation of $1.5 billion, according to reports the company's value has dropped to $581 million.

“Effective today, May 30, 2022, we are optimizing our operations in some of our markets while reducing our workforce. The reduction follows an extensive evaluation of team redundancy and how this complements our strategy,” Swvl's CEO, Mostafa Kandil stated.