African startup equity funding plummets by 43% in 2023

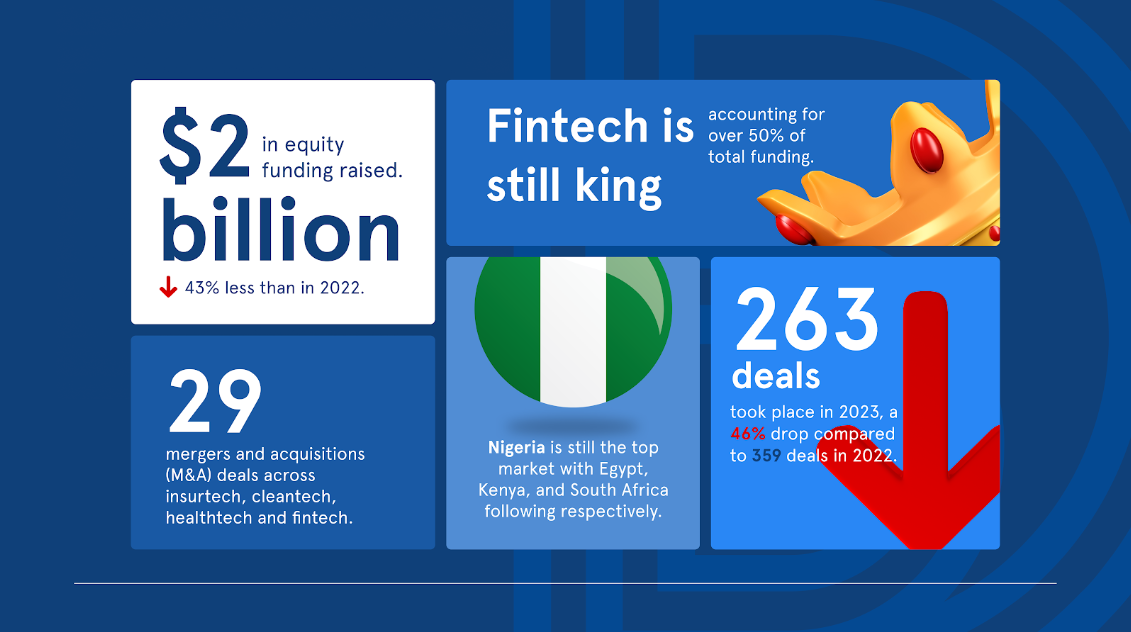

Per BD Funding Tracker, African startups raised $2 billion in equity funding across 263 deals in 2023, marking a 43% decline from last year.

In 2023, African startups raised $2 billion in equity funding across 263 deals, marking a 43% decline from the $3.3 billion raised in 2022, according to the BD Funding Tracker. Additionally, the number of deals also dropped by 46%.

The Big Four markets—Nigeria, Egypt, Kenya and South Africa–retained their position as top tech investment destinations in Africa; securing 88% of the total equity funding amount last year. Meanwhile, a $40 million Series B round from Nuru, a cleantech startup based in the Democratic Republic of Congo (DRC) helped DRC displace Ghana from its former position as the fifth most funded market.

As total funding figures decreased year-on-year, fintech's share of funding increased from 30% in 2022 to 50% in 2023. Cleantech, mobility, and the e-commerce sectors followed, indicating continued investor interest. However, emerging sectors like AI show promising signs of future growth, hinting at a forthcoming boom.

Efayomi Carr, principal at Flourish told Bendada.com that "while AI has already demonstrated its transformative impact on startups in established markets like the US, its influence is anticipated to grow significantly within the African context [going forward]."

Related Article: BioNTech’s InstaDeep picks Rwanda as AI research hub in Africa

Inside the top five funding rounds

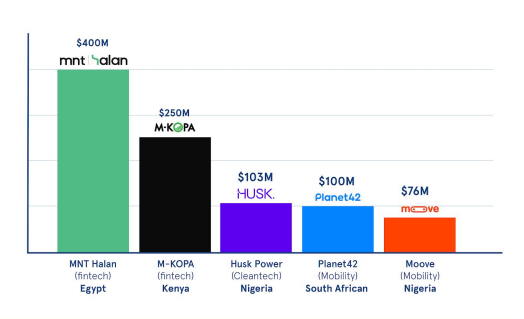

Overall, African startups saw a reduction in equity capital last year, with the top five funding rounds making up 40% of the total amount raised. As a result, the remaining 219 disclosed rounds had to vie for $1.2 billion.

The top rounds were secured by MNT Halan, M-KOPA, Husk Power, Planet42, and Moove. Fintech startups predominantly led the list, followed by mobility and cleantech; the major markets were also well-represented in the mix.

Aside from these top rounds, most of which remained undisclosed except for Husk Power's Series D, the bulk of funds raised last year stemmed from pre-seed, seed, pre-series A, Series A, and Series B rounds. However, as anticipated, there has been a decline in the number of deals per round.

Additionally, the average ticket size has plummeted. Take Seed and Series A rounds, for instance, as they signify the initial set of institutional rounds and are widespread across the continent. Per BD Funding Tracker, there was a 27.78% decrease in the average Seed round size from $3.6 million (105 deals) in 2022 to $2.6 million (46 deals) in 2023. The Series A round size dipped from $14.5 million (30 deals) in 2022 to $11.9 million (15 deals) in 2023, marking a 17.93% decline.

2023: The year of M&A

Lexi Novitske, General Partner at Norrsken22, forecasted that "We will see a lot of consolidation across sectors [in 2023], but especially in fintech," and her prediction materialised. We monitored around 29 mergers and acquisitions last year, with BioNTech's $680 million acquisition of InstaDeep being the largest deal. However, the pricing of most deals remained undisclosed.

The number of deals in the fintech space accounted for more than one-third of the total M&A activity in 2023.

Introducing Bendada.com's inaugural State of Startup VC Funding in Africa Report

In our inaugural report on the state of startup VC funding in Africa, we explored some of the trends from last year and also provided insights and recommendations for investors and entreprenuers.