Aboki Africa closes pre-seed round led by Mono's CEO Abdul Hassan

Aboki Africa has raised an undisclosed amount in a pre-seed round led by Mono's CEO, Abdul Hassan, alongside Niche Capital Limited, Ingressive Capital, and other strategic investors.

Aboki Africa, a fast-growing Nigerian fintech startup, has raised an undisclosed amount in a pre-seed round led by Mono's CEO, Abdul Hassan, alongside Niche Capital Limited, Ingressive Capital, and other strategic investors.

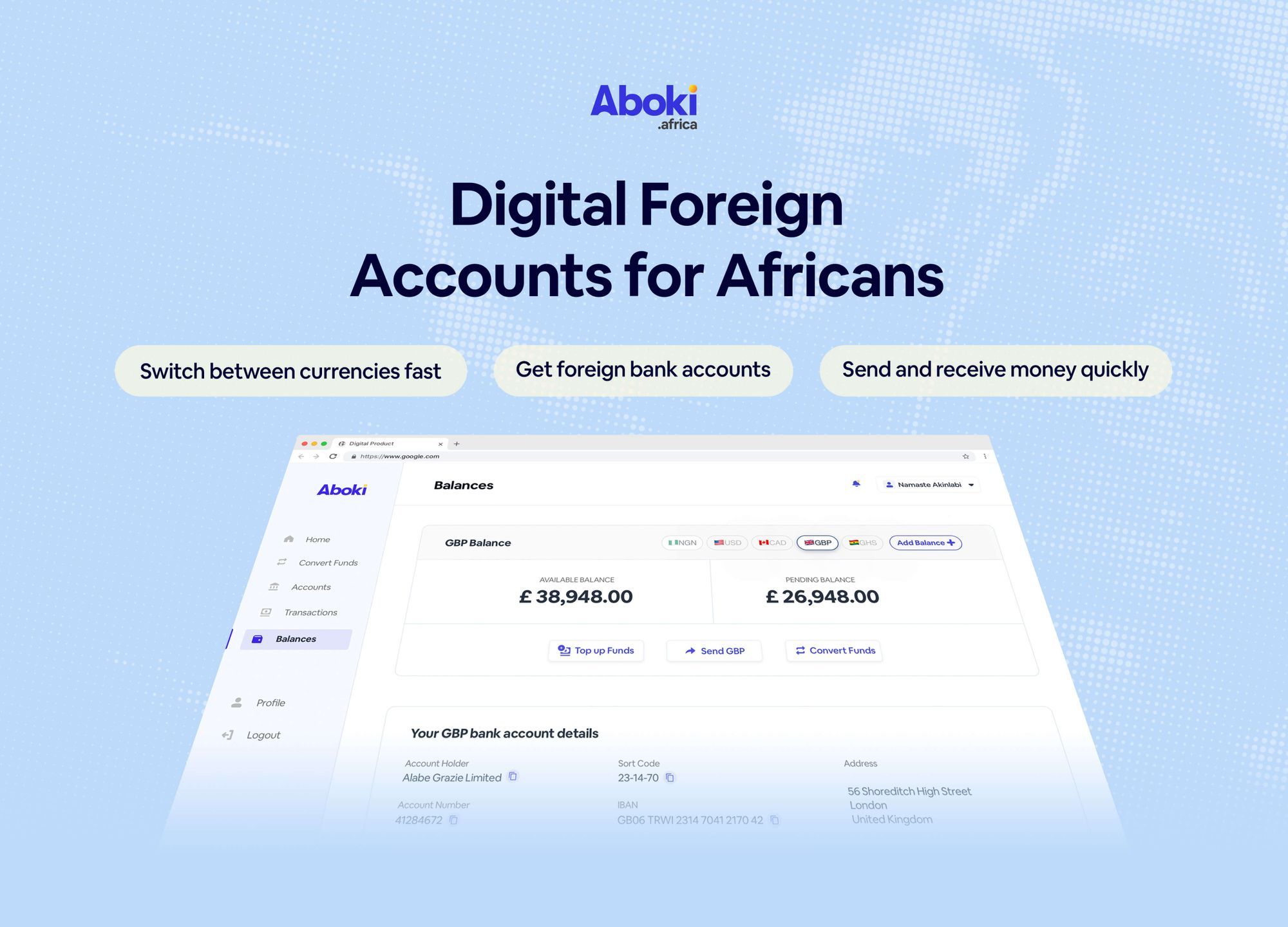

Aboki Africa provides foreign accounts for Africans. Co-founders of Aboki Africa, Idorenyin Obong and Femi Aghedo, describes it as the easiest way to send and receive international payments without restrictions. It currently offers British Pound (GBP) and Euro (EUR) foreign accounts to customers, and plans to add United States Dollar (USD) accounts soon.

When Idorenyin and Femi launched Aboki Africa in June 2020, the mission was to simplify the currency exchange process for Africans, starting with their home country — Nigeria. However, they have since expanded the scope of their mission to incorporate other international payment-related processes. As Idorenyin puts it, "We are building the TransferWise for Africa".

Aboki Africa allows its growing customer base to create foreign bank accounts and get their own IBAN (international bank account number) as well as transfer money to anywhere in the world from their account.

"We built Aboki Africa out of necessity. I've had personal experiences with the pain points we are trying to alleviate", Femi said. "People who work and do business remotely should not have to jump through hoops to receive payments. We are fixing that".

With the pre-seed funding, Aboki Africa will focus on scaling its products and expand its core team to reach more Africans in need of their services.

About the investors

Abdul Hassan is one of the prominent founders funding founders in Nigeria. Before launching Mono with his co-founder Prakar Singh, Abdul worked with Paystack and Oyapay.

We celebrate you, Abdul Hassan (@ijbkid) CEO of @mono_hq

— Benjamindada.com, tech blog (@dadabenblog) November 3, 2021

for your investment in the ecosystem. pic.twitter.com/0jN7GCB5OD

Ingressive Capital is a $10 million venture capital fund targeting pre-seed and seed-stage tech-enabled businesses in Nigeria, Kenya, Ghana and Egypt

"Ingressive’s investment in Aboki Africa further cements our belief that technology will help us lift African out of poverty and create numerous opportunities for the youths as well as freelancers, importers and exporters, traders, manufacturers, etc. to easily exchange forex as well as seamlessly create foreign accounts to collect payments", Ingressive's VP of Fund Operation, Uwem Uwemakpan, said.